Dutch and Austrian equities storm ahead of larger markets

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

Two small European stock markets have produced some of the biggest gains in global equities this year, fuelled by companies benefiting from the chip shortage and a recovering oil price.

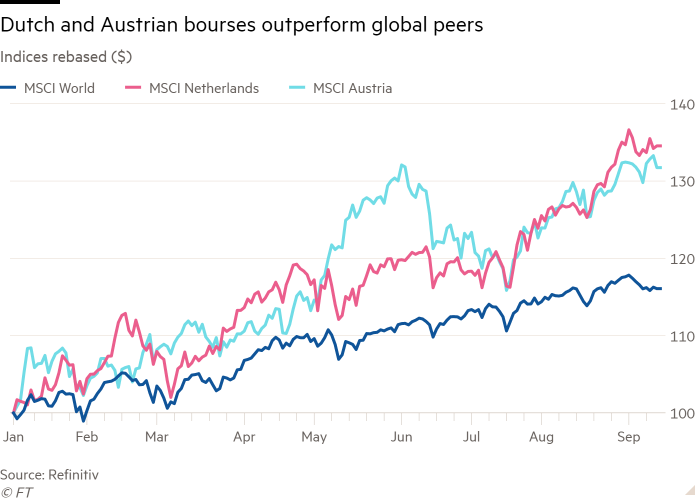

MSCI’s index of Dutch stocks has risen 34 per cent in US dollar terms during 2021, while its equivalent Austrian index has gained 33 per cent, more than double the performance of the broader MSCI World benchmark. Both the Dutch and Austrian markets have shot ahead of the regional MSCI Europe index.

The gains are partly fuelled by investors seeking exposure to Europe’s economic rebound from a short recession last year. But it helps that the Dutch and Austrian bourses are dominated by a handful of companies that have become shareholder favourites this year.

“These index stories are very stock-specific,” said Maarten Geerdink, head of European equities at NN Investment Partners.

Much of the strong performance of the Dutch stock market can be attributed to ASML, a maker of high-end lithographic machines for semiconductor manufacturers that constitutes 40 per cent of the MSCI Netherlands.

Investors expect burgeoning demand for ASML’s products as the US and the EU encourage more domestic chip production, striving to reduce manufacturers’ reliance on long semiconductor supply chains that have been disrupted by coronavirus. ASML’s shares have risen almost 90 per cent so far this year.

“I don’t get any clients saying I want exposure to the Netherlands” said Emmanuel Cau, head of European equities at Barclays. “They come for ASML and end up with a large holding in Holland.”

In Austria, oil and gas group OMV and electricity provider Verbund make up almost 45 per cent of MSCI’s stock index for the country. Shares in OMV have been on a tear, rising 54 per cent during 2021 after more than halving between January and October 2020 because of a slump in global oil prices that has since reversed.

Shares in Verbund are up more than 30 per cent so far this year, contrasting with a drop of 1 per cent across the wider European utilities sector. Verbund says that almost all of the energy it produces comes from renewable sources, and is therefore popular with investors buying into the green energy trend.

Comments