Strong dollar wipes billions off US corporate earnings

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The strong dollar has wiped billions of dollars off the second-quarter sales of US companies, prompting many to cut their guidance for the remainder of the year.

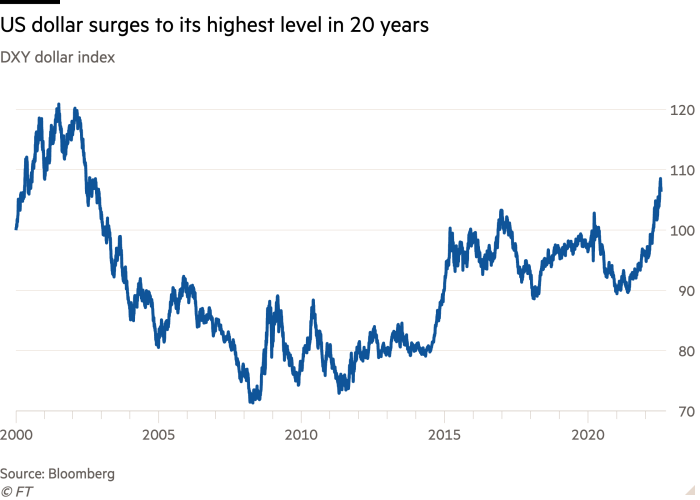

The list of bellwethers stomaching multimillion- or billion-dollar hits has grown by the day after the US currency surged to its highest level in 20 years this month, including IBM, Netflix, Johnson & Johnson and Philip Morris. That group is expected to swell as titans of the technology industry such as Apple and Microsoft — which generate a substantial portion of their business outside of the US — release quarterly results in the coming days.

The currency shock has muddled an earnings period that was being closely studied for signs of a weakening global economy, as high inflation and tighter monetary policy weigh on business and consumer demand. Economic data are already signalling a pullback in activity, as inflation cuts into consumers’ real spending power.

“Even if the rise of the dollar was to stop here, the strengthening we’ve seen over the past 12 months would be enough to prompt further downgrades to earnings estimates just because of the foreign exchange headwinds,” said Max Kettner, a strategist with HSBC.

The dollar has been buoyed by the Federal Reserve, with policymakers in Washington quickly raising interest rates in an effort to cool inflation, which in June hit a 40-year high. They are expected to deliver another jumbo rate rise this week and to continue to tighten policy to restrain demand, lifting interest rates far above their counterparts in Europe and Japan. Higher interest rates typically attract foreign investors, driving up demand for the currency.

But US companies with large businesses abroad suffer as the strong dollar lowers the value of their international sales and makes them less competitive compared with local rivals. A slowdown across Europe and lockdowns in China designed to contain the spread of Covid-19 cases are also proving a thorn for US companies with large foreign operations as demand slackens.

Last week, IBM warned that the strengthening of the greenback could reduce its revenues this year by $3.5bn, including by about $900mn in the second quarter. Johnson & Johnson cut its guidance as the maker of Listerine mouthwash warned that the rapid rise in the dollar could shave $4bn off its sales this year. The currency drag on cigarette manufacturer Philip Morris eclipsed $500mn in the quarter; streaming network Netflix, whose shows include drama Stranger Things, estimated it took a $339mn sales hit between April and June because of the strong dollar.

They join a long list of companies that had already raised the issue before the dollar surged to parity against the euro, including Microsoft, Salesforce and Medtronic.

“The velocity of the strengthening is the sharpest that we’ve seen in over a decade,” said James Kavanaugh, IBM’s chief financial officer, on the company’s earnings call. “All the currencies we hedge, over half of them are down double digits against the US dollar this year. So it’s kind of, I would say, unprecedented.”

Kavanaugh said IBM hedged about 35 of the more than 100 currencies it did business in. It was a response, coupled with the large foreign exchange hit, that left some investors “miffed”, according to Diane Jaffee, TCW senior portfolio manager. IBM shares fell 5 per cent following its results, even as the company eclipsed Wall Street expectations.

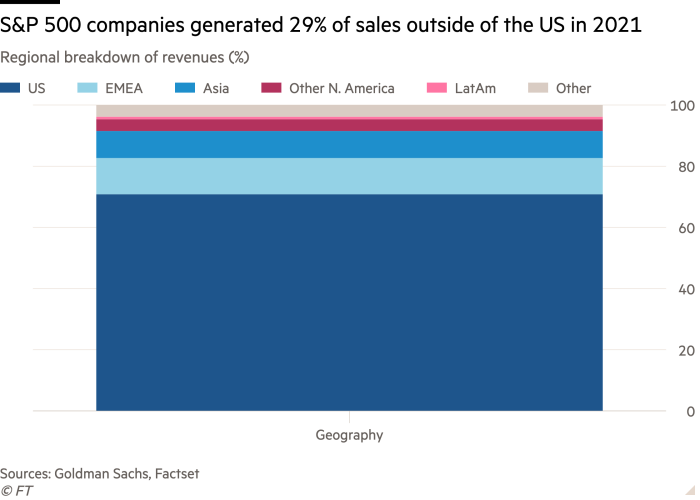

Big Tech is acutely exposed to the dollar given the industry’s overseas footprint. Goldman Sachs estimated that 59 per cent of sales for tech companies in the S&P were generated outside of the US. That is far above the average US large-cap publicly traded company; the S&P 500 groups as a whole made 29 per cent of their $14tn of revenues in 2021 abroad.

“Some companies are struggling a little more than others with the dollar,” said Jaffee. “Even though valuations have come down quite a bit in the technology sector we still want to be very . . . judicious because of the concerns of foreign exchange rates and that impacting tech companies even more than others.”

The returns have shown investors are favouring shares of companies with primarily US businesses. Goldman’s index of US companies with large international exposures has fallen more than twice as much this year compared with its domestic counterpart, down 19.6 per cent versus 9.1 per cent, respectively.

For now, earnings for the second quarter remain strong — overall they are expected to have increased by 10 per cent from a year before. But, that figure may have been closer to 12 per cent were it not for the effect of a strong dollar, estimated Jonathan Golub, head of US equities strategy at Credit Suisse. He said that every 8 to 10 per cent increase in the dollar index cut roughly 1 per cent off S&P 500 earnings.

“Earnings are coming in great, but just imagine how much better they would be if the dollar wasn’t so strong,” said Golub.

The effects of the dollar on earnings often lag behind the actual shift in the currency, so a strong dollar may be cited for several quarters to come even if the dollar appreciation slows. Karl Schamotta, chief market strategist at Corpay, expects the dollar to peak now, given many investors are betting that the Fed will have to temper its aggressive pace of rate increases as the US economy cools.

“The big run-up in the US dollar, especially relative to euro and yen, has had a major lagging impact on earnings that we’re likely to see over a couple of quarters,” said Schamotta.

Comments