The top FT stories read by the legal world in the coronavirus lockdown

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The FT is reporting on the many ways in which the pandemic has hit the legal sector. Most recently, on how problems with processing evidence during the lockdown have hampered the UK’s biggest bribery and fraud investigations and caused delays.

As the UK extended its furlough scheme, we looked at how some top law firms were keen to avoid state handouts for fear of negative publicity. In the US, after it emerged that founder Elon Musk had stepped in provide personal liability insurance for Tesla’s directors, the FT reported on why the cost of protecting directors from lawsuits is set to spike further because of Covid-19.

The following stories are taken from our Full Disclosure newsletter, sent to FT subscribers in the industry each week, sharing what has been most popular with legal readers on FT.com.

This week legal readers of the FT have been clicking on stories about the battle for consumer refunds and why UK legal powers have fallen short in tackling coronavirus profiteering.

From hand sanitiser priced at £300 to companies refusing to refund hotel bookings or holidays, Covid-19 is triggering a plethora of consumer problems that the UK competition watchdog has pledged to tackle.

The Competition and Markets Authority said it would take on unscrupulous vendors charging crazy sums for personal hygiene products or even basic goods at the start of the outbreak.

But one of its promises has turned out to be a little hollow.

The FT revealed this week that the CMA has been lobbying the government for new time-limited powers to take rogue traders to task after finding current laws insufficient to tackle profiteering and “price gouging”.

Ministers are sounding less than enthused, but stay tuned — this is set to be a battle that affects all of us.

Law firms are planning how to get back to the workplace. What do lawyers want to see before stepping foot in the office again. Face masks for everyone? Better hygiene provision? Contact @katebeioley_FT.

UK watchdog seeks power to tackle coronavirus profiteering

The CMA has asked the UK’s Department for Business, Energy and Industrial Strategy (BEIS) for new emergency powers to tackle unfair price rises, following countries such as France and the US, which have already done so.

“Nicole Kar, competition partner at Linklaters, said the CMA ‘urgently’ needed new tools, adding that the UK currently had ‘no legal weaponry’ to combat ‘Covid-19 price gouging’.”

Court cases resume but backlog persists in England and Wales

New jurors entered London’s Old Bailey for the first time in months last week to resume jury trials amid Covid-19. The pressure to resume trials has placed further strains on the criminal justice system that lawyers say will be hard to fix.

“The mounting backlog in the criminal court system predates the pandemic. At the end of 2019 the backlog of total cases had reached 37,434 — compared with 33,113 a year earlier — and judges were struggling to fix trial dates.”

UK judge rejects Burford LSE claim

Litigation funder Burford’s quest to prove it was the victim of stock price manipulation was stopped in its tracks last week by a UK judge who ruled the London Stock Exchange would not have to hand over confidential trading data.

“In court filings submitted for the hearing in April LSE said it had found ‘no evidence whatsoever’ of share price manipulation and slammed Burford’s claims as ‘completely detached from reality’.

Browder vows to fight Swiss legal co-operation with Russia

Switzerland’s Federal Prosecutor is gearing up to share highly confidential witness statements and testimony about the death of Russian tax adviser Sergei Magnitsky, and the fraud he exposed, with the Kremlin. The controversial move runs counter to Interpol guidance.

“The 2012 US ‘Magnitsky Act’, which [Magnitsky’s colleague William] Browder subsequently lobbied for, is one of Washington’s most powerful weapons against the Kremlin: dozens of high-ranking Russian officials have been sanctioned under its auspices.”

Frequent flyer — the battle for airline refunds

The FT’s Michael Skapinker looks at one of Covid-19’s most common consumer problems: airline refunds. Why is it so hard to get your money back, and what can we do about it?

“How much have we lent? Alexandre de Juniac, director-general of the International Air Transport Association, says we have paid $35bn for flights that cannot now take place.”

Closing argument

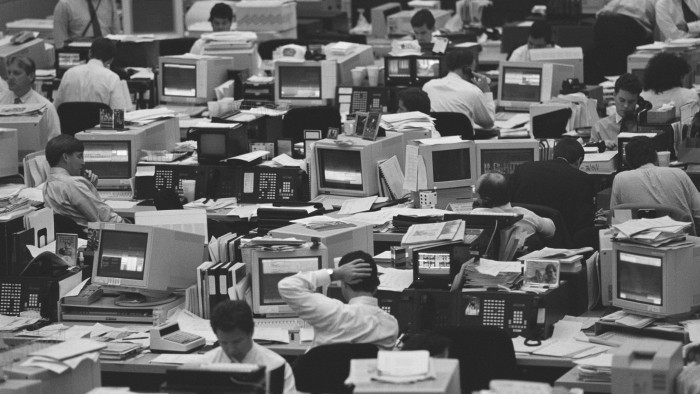

We have lived and worked in them for the best part of a century. We’ve eaten lunch in them, kept our sweaty gym kit in them, and (on Mondays) sometimes dreaded entering them. Until Covid-19, the office was such a mainstay of our lives as to be completely unremarkable. But has the pandemic spelt the end of the “water-cooler century”? The FT’s Henry Mance reports.

“In recent years, it has been hard to imagine a time when the office wasn’t central to our cities and central to our lives. When new ones arrived, we questioned their names: the Gherkin, the Cheesegrater, the Helter-Skelter. We questioned their heights and shapes, their quantity of shower cubicles and their proximity to Pret A Manger. But we rarely questioned their existence.”

Comments