Is this time different for Japanese government bonds?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is a former global head of asset allocation at a fund manager

Time and time again, betting against Japanese government bonds has cost traders untold fortunes.

The pay-off for going short on JGBs has always looked tempting and risks asymmetric. Potential losses appear limited given that yields, which move inversely to prices, cannot go too far into negative territory. At the same time, returns could be large as yields can rise a lot. This opportunity has almost always proved a delusion. Forecasts for inflation and bond yields in Japan to rise from long depressed levels have consistently proved misplaced.

But with the return of inflation in the country, higher bond yields around the world, and new leadership at the Bank of Japan, is this time different? One reason to believe so is that yields are now being held down by the BoJ’s policy of capping government borrowing costs through massive bond purchases.

This policy, known as Yield Curve Control, is incompatible with any central bank’s ultimate economic objectives. These involve getting firms and households to change their savings and borrowing behaviour, anchoring inflation expectations in positive territory — that sort of thing.

To do this, interest rates need to be free to adjust to economic conditions, the opposite of pegged yields under YCC. There will be moments when a static bond yield curve happens to deliver something consistent with inflation targets, but these will be transitory. Achieving the central bank’s ultimate objectives can only mean breaking the peg when the time comes to prevent inflation overshooting targets.

We’ve seen this film before. In 1942 the US Federal Reserve implemented its own version of YCC during the second world war, abandoning it only in 1951. Until then a 2.5 per cent yield ceiling remained in place for long-term Treasuries, with progressively lower caps for shorter-term bonds. More recently, the Reserve Bank of Australia had a brief affair with yield curve targeting during the Covid-19 pandemic. Rather than targeting the entire curve, the RBA’s policy between March 2020 and November 2021 was to keep the three-year government bond pinned to a 0.25 per cent yield — later reduced to 0.1 per cent.

The experiences of the two central banks are similar in many ways. When expectations began to shift, the yield targets became ultimately unsustainable. In both cases, the central banks struggled to extricate themselves from a policy no longer appropriate for their economies and increasingly tested by twitchy bond traders.

But there are important differences too, the most relevant of which concern the manner of policy exit. The Fed sought to defend its peg for several quarters, and in so doing outsourced the creation of its reserves to the whims of investor demand. When investors sold bonds, the Fed had to buy them to maintain the yield peg. To buy these bonds, the Fed created fresh bank reserves. As such, in committing to a peg, the central bank passed control over the volume of reserves to private actors in the bond market. This made for bad monetary policy, exacerbating inflation and it led to an institutional crisis. By contrast, the RBA’s defence of its targets crumbled relatively quickly. When the RBA changed tack, three-year bonds yielded more than seven times their target rate despite the central bank having bought 60 per cent of the bonds in question.

Are there lessons for Japan? Bond traders are probing the BoJ’s commitment, and the JGB market is increasingly broken and dominated by the central bank’s holdings. Today policy rates in Japan are negative, although markets are pricing in expectations for them to rise a full 0.15 percentage points by year-end, and progressively thereafter. The market may be wrong, but it is betting that the decades-long battle against deflation is over and the YCC policy no longer appropriate.

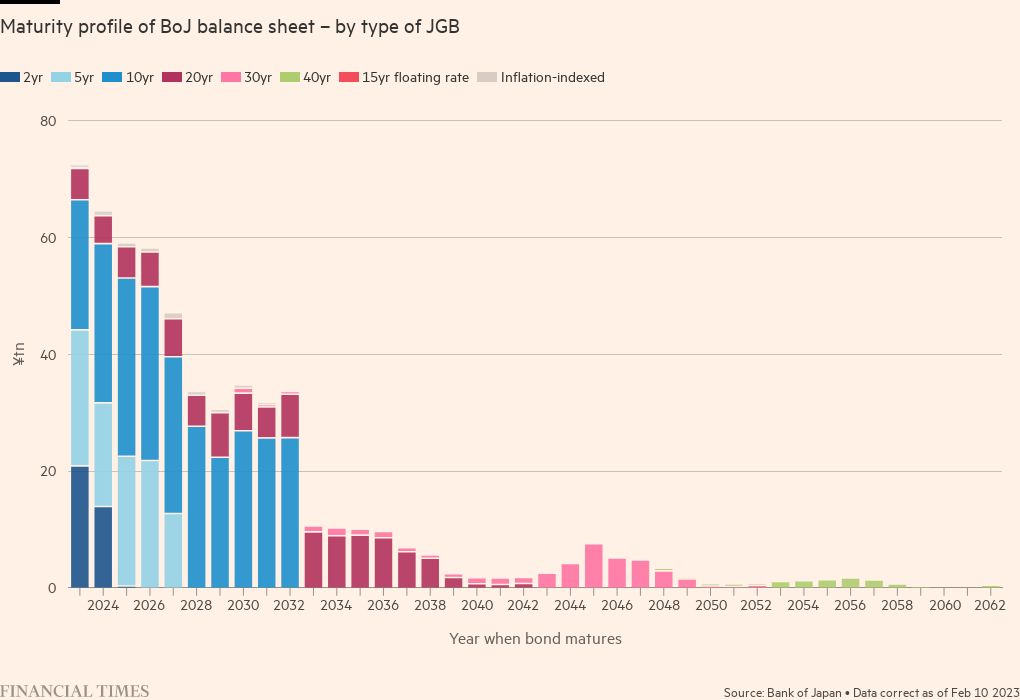

The financial stability risks of a break higher in JGB yields may lean more towards “slow burn” than “market chaos” — with the biggest impact perhaps felt in further diminishing Japanese demand for overseas government bonds. Yes, there will be paper losses for the BoJ as rates rise. But these are unlikely to translate into realised losses under the BoJ’s accounting rules, given their treatment of bonds held to maturity. And the maturity profile of the BoJ’s portfolio is surprisingly short, giving it flexibility to respond to conditions by adjusting its balance sheet by deciding whether and how to reinvest proceeds from maturing bonds. But the BoJ should never have adopted YCC in the first place. Its unravelling was inevitable.

Tony Yates contributed to this column

Comments