Ark-related funds to launch in Europe

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Retail investors in Europe will for the first time be able to bet on — or against — star US investment manager Cathie Wood, as products based on three of her best-known funds launch on Euronext and the London Stock Exchange.

London-based Leverage Shares, which packages up exchange traded products tracking various international stocks for a European investor base, will from Tuesday offer products reflecting the high-profile Ark funds. The products will follow the funds one-for-one, or enable users to amplify returns from Wood’s gains or losses, in US dollars, euros or sterling.

Professionals can already bet against Ark using derivatives, but these launches will mark the second time in just over a month that investors have gained the opportunity to bet against Ark using an ETP, and come as many of Ark’s funds are suffering unprecedented pressure with many of their holdings having slid into a bear market.

Oktay Kavrak, product strategist at Leverage Shares, said the leveraged and inverse versions of the funds would “enable investors to make directional trades and express their convictions, whether they are supportive of a stock or ETF, or whether they believe it is over-hyped”.

Ark Invest did not reply to requests for comment on the launch of the products, which will be traded under tickers with similar names to its own.

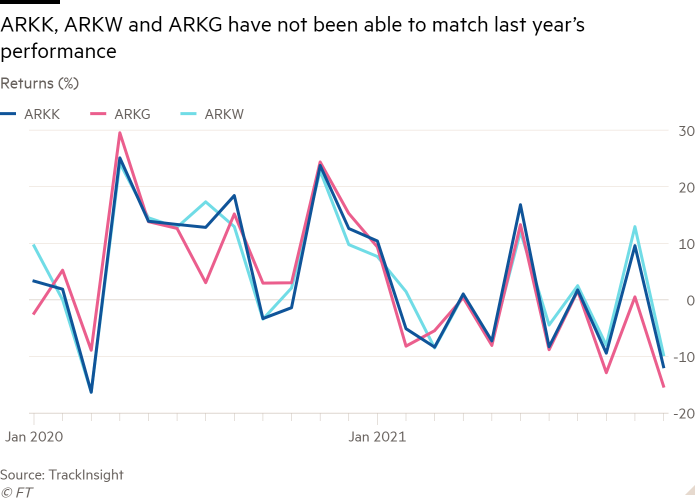

Ark has shot to prominence in the US with large bets on hot tech-focused stocks. But its strategy has stumbled as the potential for US interest rate rises dents the appeal of some of these often unprofitable companies.

Some investors have questioned Wood’s strategy, leading to the launch of these new products and of Tuttle Capital Management’s Short Innovation ETF, traded under the ticker SARK. Short interest in the flagship ARKK ETF has shot up to 17 per cent of its shares.

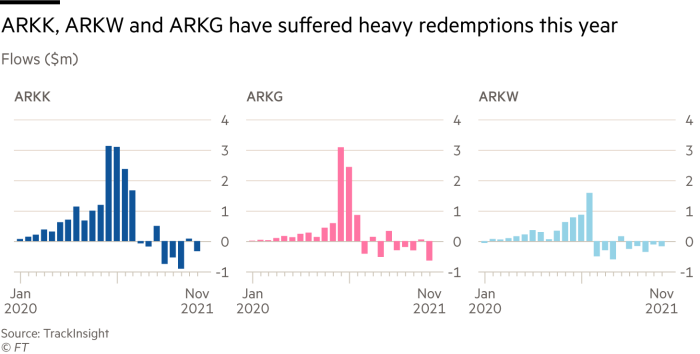

Goldman Sachs research at the end of November showed that five of Ark Invest’s six active ETFs were among the top 10 thematic ETFs globally for outflows since the market high in mid-February. Genomics-focused ARKG was worst hit with $2.1bn in outflows since February, while the Next Generation Internet fund was ranked second with $2bn.

“The Ark ETFs have had some pretty chunky outflows,” said Peter Sleep, senior portfolio manager at 7 Investment Management. But, he added, the detailed process of getting products approved by regulators can mean that investors’ interest wanes by the time they launch. “I think that might be the case here.”

“I also wonder whether ARKK has a following in Europe,” Sleep added.

The launches are among 42 ETPs that Leverage Shares intends to list on the London Stock Exchange on Tuesday, a single-day record for the LSE, surpassing the prior record of 28 set by the same issuer last year.

Others due to launch include long and short versions of blue-chip healthcare, airline and financial stocks, such as Moderna, Airbus and Berkshire Hathaway.

Sleep at 7IM added that some investors may not fully understand the potential for leveraged and inverse products to magnify losses. “I would say that they are products only for pure intraday speculation,” he said.

The new tracker ETPs will invest in physical shares in the US-listed ETFs and will charge fees of 0.35 per cent a year on top of the 0.75 per cent already levied on the Ark ETFs.

Additional reporting by Steve Johnson

Click here to visit the ETF Hub

Comments