Fears of both high inflation and low rates vex the wealthy

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

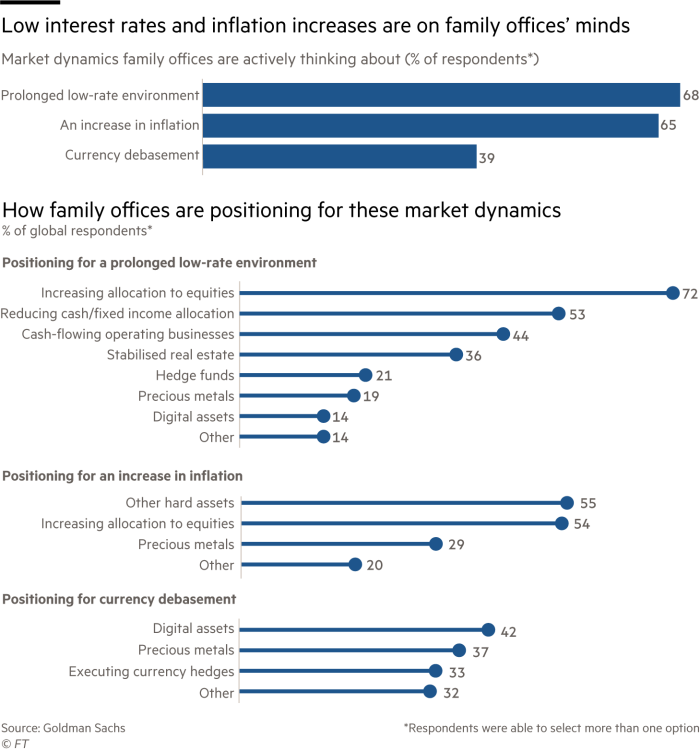

Are the rich worried about inflation? Or about persistently low interest rates? The answer is both. In a Goldman Sachs survey of family offices, two-thirds of respondents said they were looking closely at inflation. And the same share said they had their eyes on ultra-low rates.

You might conclude that the wealthy — and their investment managers — are uncertain about the future, just like the rest of us. Or that they are just being cautious, making sure that they are ready for a range of monetary scenarios.

But where the rich stand out from less well-off investors is in the range of investments they can access, especially in private markets. So, family offices that are particularly concerned about inflation risks are piling into hard assets, notably real estate. It is a sector where the rich often feel comfortable, not least because many have dealt in property already, as buyers of homes and offices for themselves and their families. Or as Goldman’s report, published this summer, puts it: “We see family offices exhibiting a more hands-on approach, particularly if they have ample experience in owning and operating real estate.”

Meanwhile, family offices more focused on the low-rate environment are investing in operating businesses, where profits and cash flow are less dependent on financial markets than portfolio investments.

More broadly, family offices invest a much bigger portion of their portfolios in alternative — that is, unlisted — investments: fully 45 per cent on average in the Goldman survey of 150 family offices around the world. Among less-rich investors, even 20 per cent is seen as a high figure. For ordinary retail savers, the levels are negligible.

This disparity is one reason why the ultra-wealthy have seen their investments rise faster in recent years — including during the pandemic — than even the averagely rich, as price rises for these assets have outstripped public markets.

A bigger risk appetite is part of the story. If you don’t rely on your savings for a pension, it’s easier to take a few gambles, though nobody wants to lose money, as was discovered by those clients of Credit Suisse whose money was advanced to the failed supply chain finance company Greensill Capital. Another factor is the high threshold needed for many kinds of private equity, private debt and venture capital investment. If the minimum is $100,000 or more, and you need to make several such investments to spread your risk, then only the very rich can participate. Wealth managers would naturally add that their advice also plays a valuable role in sourcing the best opportunities and smartly executing deals. There are doubtless brilliant investment managers around but track records are hard to judge as the publicly available data is rarely sufficiently robust.

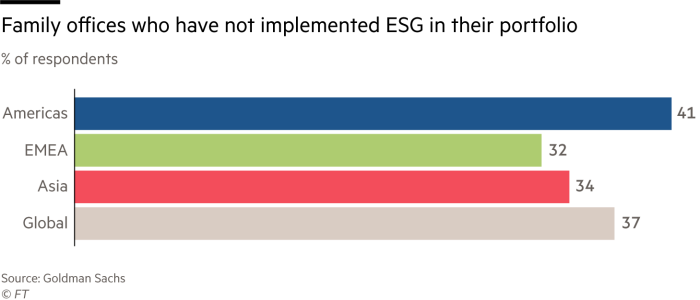

At the same time, many family offices are taking account of ESG (environmental, social and governance) issues, though they vary widely as to how far they apply these concerns. While 60 per cent of survey respondents said they were extremely or moderately focused on ESG in their investment strategy, that still left 40 per cent who were not, with 19 per cent saying they were “not at all focused on ESG”.

Plenty of work to be done there by ESG lobbies and by the many wealth managers who boast of their commitment to the cause.

Finally, the rich seem as uncertain as the rest of us about cryptocurrencies. Only about 15 per cent of those polled reported crypto exposure. Still, with many wealthy investors worried about currency debasement given the flood of central bank liquidity, nearly half of respondents indicated they may be interested in crypto in future.

Among those with doubts, the most common reason was a view that they “are not a good store of value”. In this debate, it seems, the very rich are little different from the rest of us.

This article is part of FT Wealth, a section providing in-depth coverage of philanthropy, entrepreneurs, family offices, as well as alternative and impact investment

Comments