How China may keep subverting sovereign debt workouts

Simply sign up to the Global Economy myFT Digest -- delivered directly to your inbox.

This article is an on-site version of our Trade Secrets newsletter. Sign up here to get the newsletter sent straight to your inbox every Monday

Welcome to Trade Secrets. Now that the global banking crisis is definitely over, no worries there, we can go back to looking at cheerier subjects. Today I’m asking if the rash of sovereign debt crises involving China as a creditor are going to get fixed soon, and whether a non-binding declaration attached to an EU trade deal will be the thing that single-handedly solves global warming and deforestation in the Amazon. Obviously the answers are no and no, but at least there are moves in the right direction. Charted waters is on the state of China’s trade recovery.

Get in touch. Email me at alan.beattie@ft.com

Sri Lanka’s insolvency, Beijing’s blockage

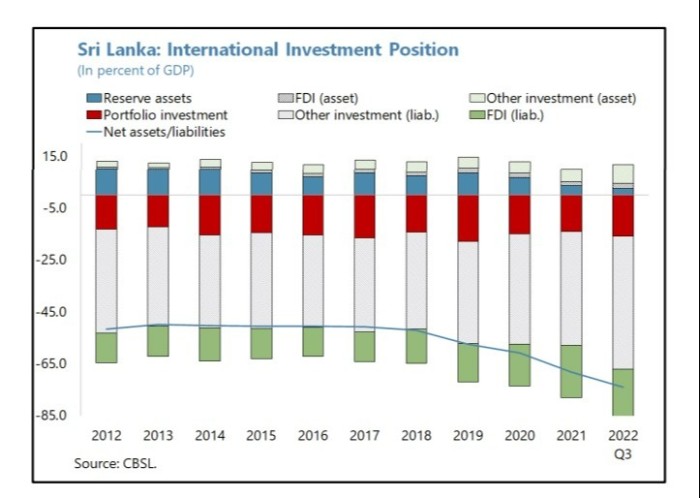

Good news for the multiple emerging market countries in the novel and uncertain position of trying to exit from a crushing sovereign debt crisis with China as a major official creditor. Well, goodish news. Maybe. Last week the IMF decided it had enough assurances from the creditors to push ahead with a rescue loan for Sri Lanka and duly authorised a $3bn extended fund facility. Sri Lanka’s external position has been weakening for years (see this chart from the IMF) and it’s been in limbo waiting for the IMF deal for months after it defaulted on its sovereign debt nearly a year ago.

China, as in the other test case of Zambia, has declined to have its lending to Sri Lanka written down as though it were a rich-country Paris Club creditor. Instead, it’s tried to insist that its lending is development finance on a similar basis to World Bank loans, a move the rich creditors have blocked. This has delayed the IMF rescue: for fairly obvious moral hazard reasons the fund has rules limiting its lending to countries in arrears to other creditors. China has now given assurances in principle it will participate in a writedown, but details tbc.

Traditionally, the rich countries holding defaulted sovereign bonds were also those who essentially ran the IMF. This led to obvious accusations that the fund was being used as their debt collector during restructurings, but at least there could be a coherent collective creditor position about debt sustainability.

That’s notably absent here. China is a rich bilateral creditor acting like a developing country. (There was a different but also obvious mismatch in incentives, by the way, when the Europe-dominated IMF started bailing out EU governments in 2010 during the eurozone sovereign debt crisis.)

As I’ve noted before, although Beijing has made a big deal in the past about taking its place at the top table of global governance, it’s also been keen not to take too much responsibility for running unpopular institutions like the fund. China’s unwillingness to take a writedown is making an IMF-led rescue harder. It’s also a pretty big signal to other EMs in the future: be careful of borrowing from China, if you don’t want to end up in a mess like this.

Can the EU’s Amazon plan deliver?

If you want a test of making trade — and specifically trade deals — compatible with saving the environment, buying Brazilian exports while safeguarding the Amazon is a good one. We’re about to see whether an old-school light-touch approach has enough credibility to get a deal over the line, let alone actually make a difference if it’s in place.

The EU took nearly twenty years to negotiate a trade deal with Brazil and the three other members of Mercosur. It was signed in 2019 and has since been trying to overcome objections from European environmentalists (and European beef farmers wearing hastily printed “I ♥ Rainforests” T-shirts) to get ratified. Last week Friends of the Earth got hold of a “joint instrument” side letter to the Mercosur deal that the EU had drafted to try to placate critics. Brussels prudently waited until Luiz Inácio Lula da Silva had taken over the Brazilian presidency to propose it, given his predecessor Jair Bolsonaro’s unconstructive view that Emmanuel Macron had a “colonialist mentality” over saving the Amazon.

But since new and substantive commitments would mean reopening the agreement and enduring years more talks, the letter is “interpretative guidance” of existing environmental provisions in the deal rather than anything new and binding. Environmental campaigners are obviously strongly sceptical about the instrument, and there’s an interesting statement here from trade and climate experts saying it’s unfortunate those provisions aren’t subject to dispute settlement with sanctions.

The instrument is negotiated and non-binding. It’s in sharp contrast to the EU’s new deforestation regulation, which aims to block the sale in the European single market of products blamed for the clearing of trees for agriculture and takes a very different approach of unilateral coercion/autonomous conditionality (delete au choix). Even Lula’s administration might balk at having its commitments to halt deforestation enforced from Brussels via EU diktat.

As trade-sceptic environmentalists would put it, it’s warm words versus binding rules; as some developing countries might say, it’s partnership against neocolonialism. I’ll keep an eye on who wins.

Charted waters

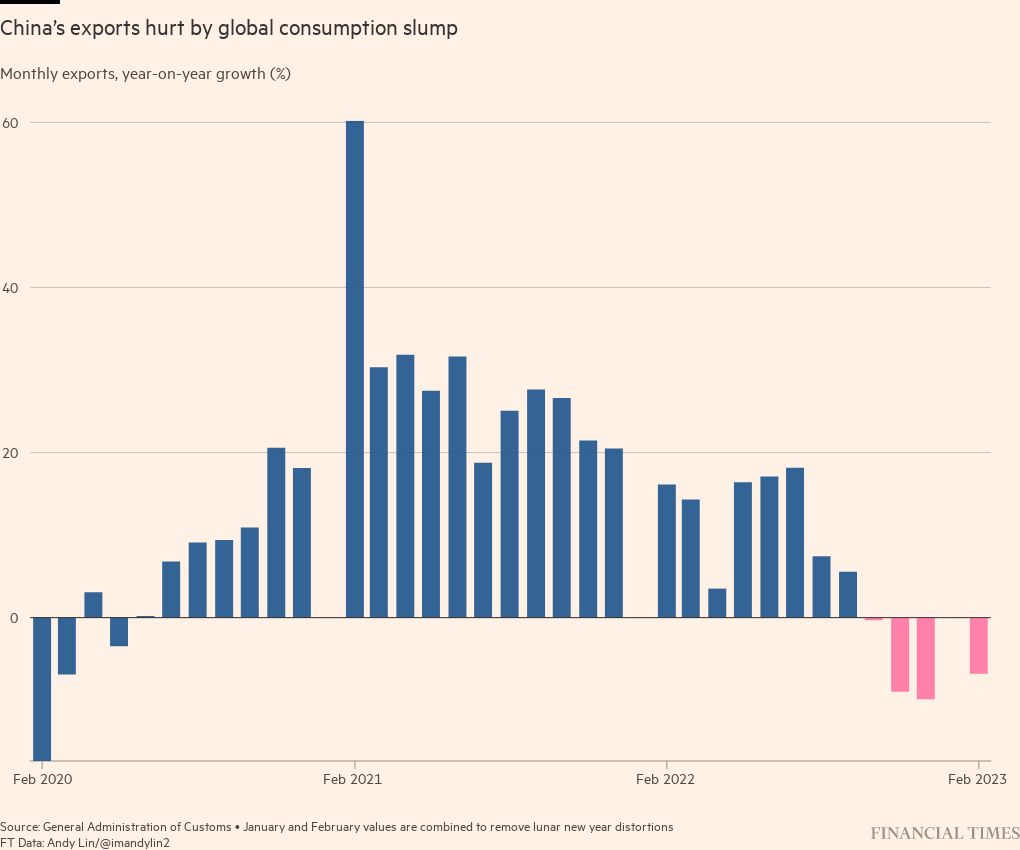

China’s economic recovery — or rather the lack of it — is news today, following a warning from someone who should know, the head of AP Møller-Maersk, the world’s second-largest container shipping group.

Fortunately, we have a chart to help give a little more context.

At the heart of China’s problem is the ever rising tension with the US over trade, pushing manufacturers to relocate production to other countries. This has hit exports, the driver of Chinese economic growth through the pandemic, with exports declining in dollar terms for five consecutive months since last October.

Despite his warning about the current malaise, Vincent Clerc, the new chief executive of Maersk, expresses some optimism that they will recover, despite the US clampdown. He blames China’s current economic problems on the lack of spending by Chinese consumers, “stunned” by the pandemic clampdowns. Of course, Maersk must hope that the real problem is not a long-term drop in Chinese exports and the subsequent hit on shipping firms. Jonathan Moules

Trade links

Adam Posen from the Peterson Institute is right as usual, arguing in Foreign Policy magazine that industrial policy can work but economic isolationism generally doesn’t, and Eswar Prasad from Cornell University ditto in the same publication about the effects of the retreat from globalisation on low-income countries. (See also earlier this month FP’s interview with USTR Katherine Tai on the same issues.)

Presumably acting on the principle that if you don’t ask you don’t get, no matter how improbable the request, Bloomberg reports that the US wants an exemption from the EU’s carbon border levy by virtue of its proposed “green steel” club of low-carbon manufacturers.

Russia has adopted the Chinese renminbi as one of its main currencies for foreign reserves and trade transactions. The move was forced by US sanctions related to the Ukraine war and hence evidence of the dollar’s dominance rather than weakness as a global currency, whatever you may read elsewhere.

The monthly trade indicator produced by the Kiel Institute think-tank shows global goods trade still weak, and low freight volumes continuing rapidly to reduce congestion in cargo shipping.

David Henig of the European Centre for International Political Economy argues that for UK trade policy to live up to its Global Britain ambitions it needs to grow up and get real (my words, not his), while my colleague Peter Foster in the FT’s excellent Britain After Brexit newsletter says Rishi Sunak’s government is ignoring trade as a policy objective.

Rich countries are increasingly overstating their official development assistance by counting spending as aid that really isn’t, say two senior fellows at the Center for Global Development, who propose an independent assessment to hold governments to account.

Trade Secrets is edited by Jonathan Moules

Comments