Wall Street stocks climb further on strong corporate earnings

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

Stock markets rose on both sides of the Atlantic on Wednesday, as a number of strong earnings figures captured investor attention away from the rapid spread of the Delta Covid-19 variant.

Wall Street’s blue-chip S&P 500 index gained 0.8 per cent in New York, climbing for a second day to reverse the entirety of Monday’s sharp drop. The gains were led by economically sensitive industries, including energy and materials groups, bank stocks, big industrials goods companies and airlines.

The tech-focused Nasdaq Composite rose 0.9 per cent, while the Russell 2000 index of small-cap companies advanced 1.8 per cent.

Several strong earning results helped lift investor sentiment on Wednesday, with Coca-Cola raising its full-year sales and profit forecasts as it anticipated surging demand from reopened restaurants and stadiums. Ad group Interpublic and telecom conglomerate Verizon also beat consensus estimates set by analysts.

Tancredi Cordero, head of investment advisory boutique Kuros Associates, said many of his clients were still buying equities “because the alternatives are poor”. Government bonds, he said, provided “a lot of volatility for not much of a return”.

US government debt sold off on Wednesday, taking the yield on the benchmark 10-year Treasury 0.07 percentage points higher to 1.29 per cent. The 10-year note did, however, remain near its lowest level since late February following a strong rally earlier this week and the losses moderated after an auction of 20-year Treasuries showed there was still “reasonable” investor demand, according to strategists with BMO Capital Markets.

Against this backdrop of growing confidence in earnings, Deutsche Bank strategists warned that company bosses may be overly optimistic about pent-up lockdown savings flowing in to corporate coffers.

“Many corporates have pencilled in a strong rebound in earnings this year backed by forecasts of robust pent-up demand. Yet so far there is little evidence of the spending surge that so many expect,” Deutsche’s Olga Cotaga and Luke Templeman wrote in a research note.

“Many people see their recent savings as windfall gains instead of income and, psychologically, this makes them harder to spend.”

Other analysts cautioned that the highly transmissible Delta strain of coronavirus could cause economic stagflation by denting growth and exacerbating price rises caused by jammed-up global supply chains.

“If the virus begins to spread rapidly again, that would curtail economic growth and prolong the inflationary supply chain disruptions that have affected so many industries, including semiconductors and housing,” said Nancy Davis, founder of Quadratic Capital Management.

In the US, the seven-day rolling average for new coronavirus cases in the country has more than doubled from several weeks ago, according to Johns Hopkins University.

In Europe, more positive company results lifted bourses. UK clothing retailer Next raised its earnings guidance, saying consumers’ lockdown savings were being unleashed.

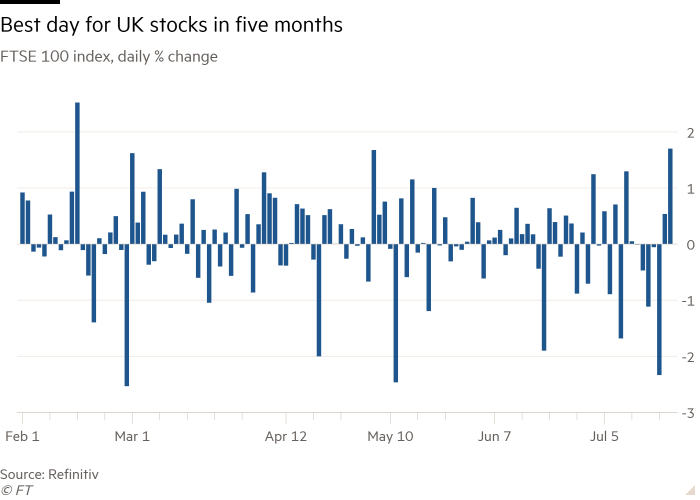

London’s FTSE 100 closed up 1.7 per cent for the benchmark’s best daily performance since mid-February, while the continent-wide Stoxx 600 index rose by the same amount as traders also banked on the ECB increasing its bond-buying plans beyond the end of its €1.85tn pandemic emergency purchase programme at a meeting on Thursday.

Brent crude, the international oil benchmark, gained 4.2 per cent to $72.23 a barrel after shedding almost 7 per cent on Monday, following an agreement by members of producer group Opec+ to raise production by 400,000 barrels a day each month from August.

Unhedged — Markets, finance and strong opinion

Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here to get the newsletter sent straight to your inbox every weekday

Comments