Wall Street predicts that equity bull run will continue

Simply sign up to the Corporate earnings and results myFT Digest -- delivered directly to your inbox.

A robust corporate profits recovery is igniting optimism on Wall Street that US equities will extend their bull run even as investors question whether companies can eclipse a high bar for earnings growth and margins.

The latest quarterly reporting season showed US corporate earnings, revenues and profit margins expanding at their strongest pace since FactSet began tracking these metrics in 2008.

That performance has helped drive US equities to fresh peaks, with the S&P 500 up more than 18 per cent so far this year. The index has roughly doubled from its March 2020 lows, when pandemic lockdowns threw global financial markets into chaos.

“Economic growth is running at the best pace we have seen in decades and that is a tremendous tailwind for earnings,” said Russ Koesterich, portfolio manager of the global allocation fund at BlackRock.

Analysts at Goldman Sachs and Credit Suisse both recently boosted their 12-month projections for the S&P 500 on the back of upward revisions in earnings growth. Wall Street analysts have a target price of 4,949 for the S&P 500 in 12 months’ time, an expected rise of 11 per cent, according to FactSet.

“We’ve been bullish [on] overweight equities globally for some time . . . [but] we’ve been surprised by the strength of earnings and so we needed to reflect that,” said Sharon Bell, equity strategist at Goldman Sachs.

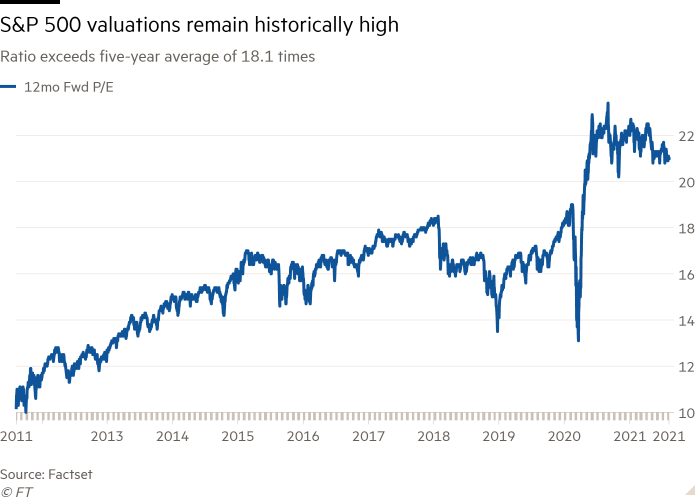

For investors, the story appears more challenging, given that the equity market already reflects plenty of optimism and headline valuations remain historically high.

“It has been a truly spectacular quarter for the S&P and the question is where do you go from here?” said David Kelly, chief global strategist at JPMorgan Asset Management. “It will be hard for companies to sustain that high water mark and valuations in the US still look expensive versus the rest of the world.”

At the start of the year, the S&P 500 was trading at 22.7 times projected profits over the next 12 months. Thanks to earnings growth outpacing gains in the broad market, this measure has moderated to 21.1 times but remains above its average of 18.1 over the past five years.

“Multiples have been generally flat this year and the market has moved higher on stellar earnings growth,” said Koesterich.

The pace of expected earnings growth must be balanced against elevated US equity valuations, said Tim Murray, capital markets strategist in the multi asset team at T Rowe Price. “It means there is less upside when earnings are beating estimates, while there is more downside from disappointing results in the future.”

While the market is not trading at “cheap” headline valuations, Koesterich said many of the big cash flow-generating companies are domiciled in the US and will maintain “healthy revenue growth” as the economy expands above trend — north of 2 per cent — into next year and interest rates remain low.

‘Historic’ earnings season

US corporate earnings have surged in the second quarter of 2021 after the coronavirus crisis severely depressed profits in the same period last year.

Profits of companies listed on America’s blue-chip S&P 500 index have jumped around 90 per cent, when taking into account reported results and estimates for the 10 per cent of companies that have not yet disclosed their figures, FactSet data show. Sales, meanwhile, have lurched higher by around a quarter.

The figures are much better than Wall Street had forecast ahead of the start of earnings season. At the end of March, analysts had pencilled in profit growth of 53 per cent on a 16 per cent increase in revenues.

“Earnings season was pretty historic in terms of what was delivered,” said Kasper Elmgreen, head of equities at Amundi.

Investors are also watching profit margins with this measure for S&P 500 companies rising to a record 13 per cent in the second quarter, up from 12.8 per cent in the prior quarter, and the highest since FactSet began tracking this measure in 2008.

Koesterich said “profit margins held up” during the second-quarter and he cautioned that margin pressure in the coming quarters — whereby companies are unable to pass on rising input costs such as wages — will be a test for equities and high valuations.

“There is nothing transitory about wage inflation,” said Kelly, and efforts by the Federal Reserve to reduce unemployment “will trigger higher wages and pressure corporate margins”.

Another headwind for US corporate earnings is the likelihood of higher taxes paid by companies under the Biden administration.

Earnings “have probably peaked . . . and we will see them slowing in the next few months as the markets start pricing those higher taxes”, said Lale Akoner, senior market strategist at BNY Mellon Investment Management. “I would expect somewhere between October and December to see the market start pricing that in.”

Comments