Time to buy a car? Industry hopes for coronavirus silver lining | Free to read

Simply sign up to the Automobiles myFT Digest -- delivered directly to your inbox.

Rebecca Coleman has not owned a car since 1999. But in early March, as the coronavirus pandemic started to grip New York, she and her wife grew wary of using public transport and bought a Honda from a dealer in Queens via video chat.

“I didn’t want to have a car,” she says, but needed one to visit family outside of the city safely. “Basically, I caved on everything I would never cave on before. I think we both did.”

As carmakers around the world contend with a near total collapse in sales, and months of uncertainty even after they restart their plants, Ms Coleman’s tale offers a slim glimmer of hope to an industry caught in the grip of the pandemic.

For years carmakers nervously watched vehicle ownership rates slide among young people and urbanites, as better public transport and the increasing ubiquity of ride-hailing services chipped away at the appeal of having a private car.

In response, manufacturers from General Motors to Germany’s Daimler poured billions of dollars into new services offering car sharing, taxi services or the option to access vehicles without the hassle of a purchase.

Covid-19 may have turned the tide.

Indications from China, which came out of lockdown as Europe and the Americas were just entering theirs, are of a sharp rise in individual car use as commuters shun public transport.

“In the month following the deep impact of corona in China, there was a pretty major interest shift away from public transportation,” says Jürgen Stackmann, Volkswagen’s brand sales chief.

By the middle of April, congestion in major Chinese cities was back to 90 per cent of pre-lockdown levels, while subway use lingered at just 50 per cent, according to figures from Bernstein.

“We suspect the recent shift among Chinese consumers in favour of private transport will persist as long as fears around Covid-19 linger,” writes Bernstein’s Hong Kong-based auto analyst Robin Zhu.

Sales in the country recovered faster than anyone would have dared to hope, propelled in part by health concerns. Premium brand Volvo reported that sales in China were 20 per cent higher than in 2019, while the whole market in April was 4.4 per cent higher than a year earlier.

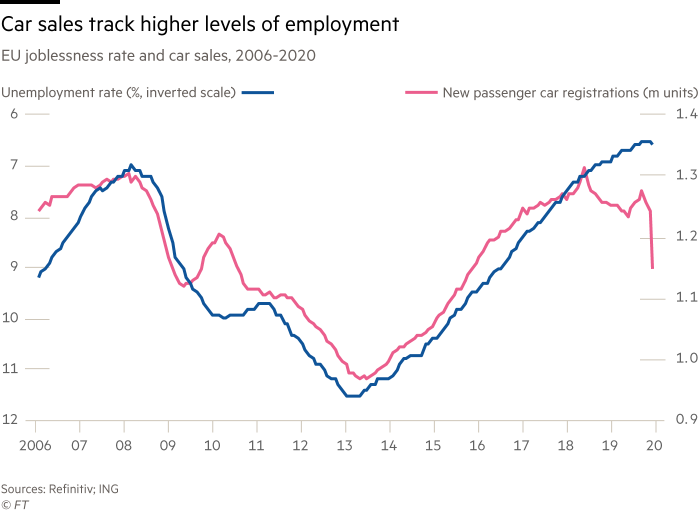

Auto-industry executives are under no illusions about the economic headwinds they face. At the very least, most developed economies are facing a sharp recession; at worst, a prolonged depression as new virus outbreaks bring economies to a halt again. But the signs of a shift in consumer attitudes to cars could protect them from the worst of the economic fallout.

“There is something almost you could call revenge buying,” Volvo chief executive Hakan Samuelsson told the FT’s recent Global Boardroom conference. “People are really tired of sitting at home locked in and they really want to go out and buy.”

Private transport revival

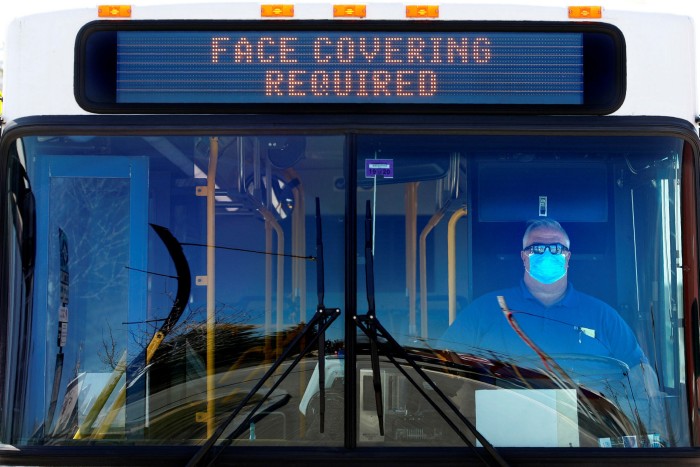

Marketing executives have leapt into action to capitalise on anxiety about using public transport. A recent newspaper advert in Germany from a dealer showed a huge face mask draped across the front of a VW Tiguan, each ear loop stretched over a wing mirror. “Safety first,” read the bolded white lettering underneath.

Where engine power or comfort once drove sales, health concerns are now at the wheel. Ford in China used the lockdown to re-engineer the air filtering systems on its vehicles. While not claiming to prevent the virus, it offers greater protection from smog and other airborne particles wafting into the car. Once dealerships reopened, the brand sold 40,000 upgrades almost instantly, including significant numbers of retrofits.

The big question is whether the pace of the Chinese rebound can be replicated in Europe and North America. Despite precipitous sales falls in April when dealerships and factories were shut, there is some evidence of bottled-up demand among car buyers.

In the UK, interest in car buying has surged since Boris Johnson announced in early May a slight easing in lockdown rules. Anyone returning to work was urged by the prime minister to “avoid public transport as much as possible” — a phrase that was catnip to dealers who had been forced to close showrooms eight weeks earlier.

Traffic on Auto Trader, the UK online car marketplace, peaked on the day of the speech at more than 1m views, the highest since the lockdown began in March.

At Citygate Automotive, which operates 13 showrooms across west London and Berkshire, what started as a trickle of orders in the hours after the speech has risen to a torrent. “The world has woken up in dramatic fashion,” says chief executive Jonathan Smith.

By the end of this week, the company expects to have returned to pre-lockdown order levels, before it has reopened even a single showroom, albeit mostly for used cars.

Robert Forrester, who runs the listed Vertu Motors dealer group with close to 100 sites across England, has tracked orders throughout the downturn. “We are increasingly back in business and, armed with a face mask made by my mum, I can’t wait,” he says on Twitter.

A recent survey by Auto Trader found that more than half of UK driving licence holders without a car are considering buying one in order to avoid using public transport after the coronavirus lockdown ends.

A similar pattern is emerging in the US. A fifth of 3,000 residents polled in mid-March by Cars.com, a Chicago company that sells subscriptions to US dealerships to list their inventory online, said they were considering buying a car because of Covid-19.

About 43 per cent of respondents said they had stopped using public transport, almost the same percentage as those hailing fewer ride-shares.

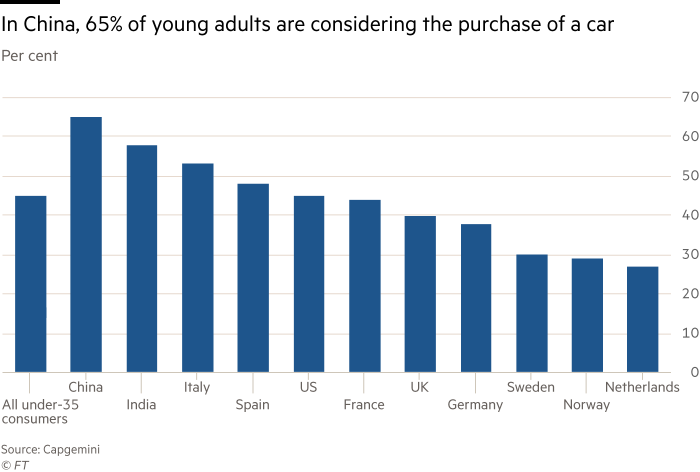

“The pandemic has the potential to reverse long-term trends of non-ownership among younger consumers, 35 per cent of whom say they’re looking at buying a vehicle,” says Markus Winkler, head of automotive at the consultancy Capgemini.

Although auto companies now have the opportunity to create a new base of loyal customers, he says they will need to take a new approach. “Almost 80 per cent of 25- to 35-year-olds have never owned a car, so traditional messages based on intricate knowledge of other products on the market won’t necessarily work,” he adds.

In the US, seven times more people searched for the term “is it a good time to buy a car?” between March 15 and 21 than during the same week a year earlier, even as stay-at-home orders forced dealerships to close their doors.

The lockdown has also failed to deter the most dogged buyers. Jordan Jeong and his fiancée added a second car because of the pandemic, signing the paperwork at their apartment after the dealership delivered the car, while the sales representative stood six feet away.

“It was almost too easy,” he says, given the price tag. “The biggest piece of anxiety with getting a car sight-unseen is: ‘Am I getting ripped off?’”

In the short term, the move has been transformational. His hour-and-a-quarter subway ride from their Brooklyn home to the hospital where he is an emergency room doctor has shrunk to a half-hour drive. “It has been surreal driving through New York City with no traffic whatsoever,” he says.

Subscriptions and sharing

Where people are unable to buy cars — even cheaper models or used cars — they are using other services to get access to private vehicles.

Zipcar, the sharing service owned by rental group Avis, saw a rise in demand in cities across the US after launching a dedicated feature that offers exclusive vehicle use for several days at a time.

“In the past Zipcar has not served as an option for the suburb to city commute,” Zipcar president Tracey Zhen told the FT. “We anticipate more people may want exclusive access to a vehicle for short-term use, which we’re ready to provide.”

In Japan, concerns about public transport have sparked interest in car subscriptions — a relatively new trend that had gained little traction before the outbreak. Idom, one of the country’s largest used car dealers, launched a $280 monthly subscription service from February and orders have doubled in just two months.

Demand has been particularly strong from medical professionals and women requiring daily transport to grocery stores and schools. Before the pandemic, 70 per cent of its subscription users were male.

Naoki Yamahata, manager in charge of Idom’s subscription service, says financial hurdles to owning a car remain high in Japan. “People are seeking a service that allows them to partially own a car without the actual risk of owning an asset and that demand has been fuelled by coronavirus,” says Mr Yamahata. “Subscription service fills the needs that fall between car ownership and car rental or sharing.”

In the past three weeks, German start-up Cluno says it has seen a 53 per cent rise in subscriptions to its service. “Despite massive economic uncertainty among many customers, we have returned to a pre-corona level and the trend is strongly upward.”

Yet as more people return to work, and the roads clog up again, the appeal of sitting in traffic may wane. Cities have spent years dissuading motorists, introducing charging schemes for entering city centres and repurposing road space as cycle lanes. “In big cities, the private car is really not a very practical concept,” says Mr Samuelsson.

This week London restored the congestion charge for driving in the centre of the city, announced an increase in the fee and unveiled plans to make some central thoroughfares car-free.

Volkswagen global sales chief Christian Dahlheim says the push towards cars is “probably not” a long-term shift. “Obviously, it’s unthinkable that we replace public transport by individual transport in all major cities,” he says. “But we believe it might drive demand in the shorter term.”

While the surge of inner-city interest may be shortlived, other changes will be permanent. One of those is the shift to online buying.

When Ms Coleman bought her family Honda in New York, she did so without visiting a forecourt, or taking a test drive. Instead, a sales representative previewed the car in a FaceTime call.

“I anticipate that [virtual marketing] is here to stay,” says the dealership’s general manager, Brian Benstock.

A year ago, online transactions accounted for 7 per cent of sales, he says. Now that it is up to 100 per cent, Mr Benstock says he expects interest to remain high even after New York eases its lockdown.

“The toothpaste is out of the tube,” he says. “It’s just easier.”

In China, many of Volkswagen’s 2,000 dealerships have taken to live-streaming from showrooms on platforms such as TikTok or Kuaishou, after the company trained more than 70,000 people to communicate online in February.

“Car salespeople are becoming entertainers,” says Michael Mayer, VW’s head of sales in the country, adding that even customers who bought cars online wanted some form of human interaction at the end of the process.

Blue-sky thinking

One of the biggest issues about the coronavirus crisis for the industry will be its impact on demand for electric vehicles. Encouraged by the cleaner air evident in the lockdown, the treacle-like shift towards battery cars may pick up pace.

“There are a lot of people who are a lot happier that the air is clear and the skies are blue,” says Doug Parr, chief scientist at Greenpeace UK. “There is a very broad sentiment that we want to do something a bit different when we recover.”

Mr Samuelsson at Volvo believes electrification will go faster. “I think it would be naive to believe our customers come back into a showroom asking for diesel cars,” he says.

Even though electric cars remain more expensive to purchase, BMW chief executive Oliver Zipse believes that consumers will be won over by the low running costs, despite lower petrol prices.

“Even today, in many cases, electrified vehicles already offer a total cost of ownership advantage, which is increasingly perceived by customers,” he says.

In the current environment, the industry will take any relief it can. Global sales are now expected to fall by a fifth this year, according to estimates that still forecast a recovery in large markets in the coming months.

Carmakers were facing a testing year in 2020 even before the pandemic, with softer demand in China and strict carbon dioxide emission rules in Europe forcing them to sell electric cars on wafer-thin margins and fewer of the profitable sports utility vehicles.

The immediate challenge for industry executives is convincing consumers to make what is often their second-biggest purchase in the midst of a deep recession. To do so, they are rolling out schemes used in the aftermath of the previous financial crisis, including unemployment insurance, which would protect new car owners against being unable to meet repayments.

The industry is torn, however, over whether government incentives to buy cars should be focused on pushing the appeal of electric cars, or simply aiming to rebuild volume across the sector.

Mr Samuelsson says it “would be a waste of money” to incentivise the purchase of “old world” cars. “They should use the money to promote new technology as they were planning to do before.”

“To incentivise the purchase of a car or truck, that is always short-term,” says Daimler board member Martin Daum. Instead, governments have “a unique opportunity to support the build-up of the infrastructure”, such as charging points.

Whether from reluctant public transport converts or avid petrolheads itching to snap up the latest model, the industry will be grateful for a recovery of any shape after a disastrous start to the year.

“I really hope that this will be the case because anything else would, of course, be a disaster for our business”, says Mr Samuelsson. “If this triggers a year of recession or something, then you have to redraw everything.”

Letter in response to this article:

The pandemic leaves car lovers at a crossroads / From Walter Weis, Forest Hills, NY, US

Comments