Nimble companies capitalise on ‘last-mover advantage’

Simply sign up to the US & Canadian companies myFT Digest -- delivered directly to your inbox.

Tech group Apple isn’t known for inventing new technologies as much as sensing what is flawed and coming late to market with a reinvented product that bigger incumbents struggle to match.

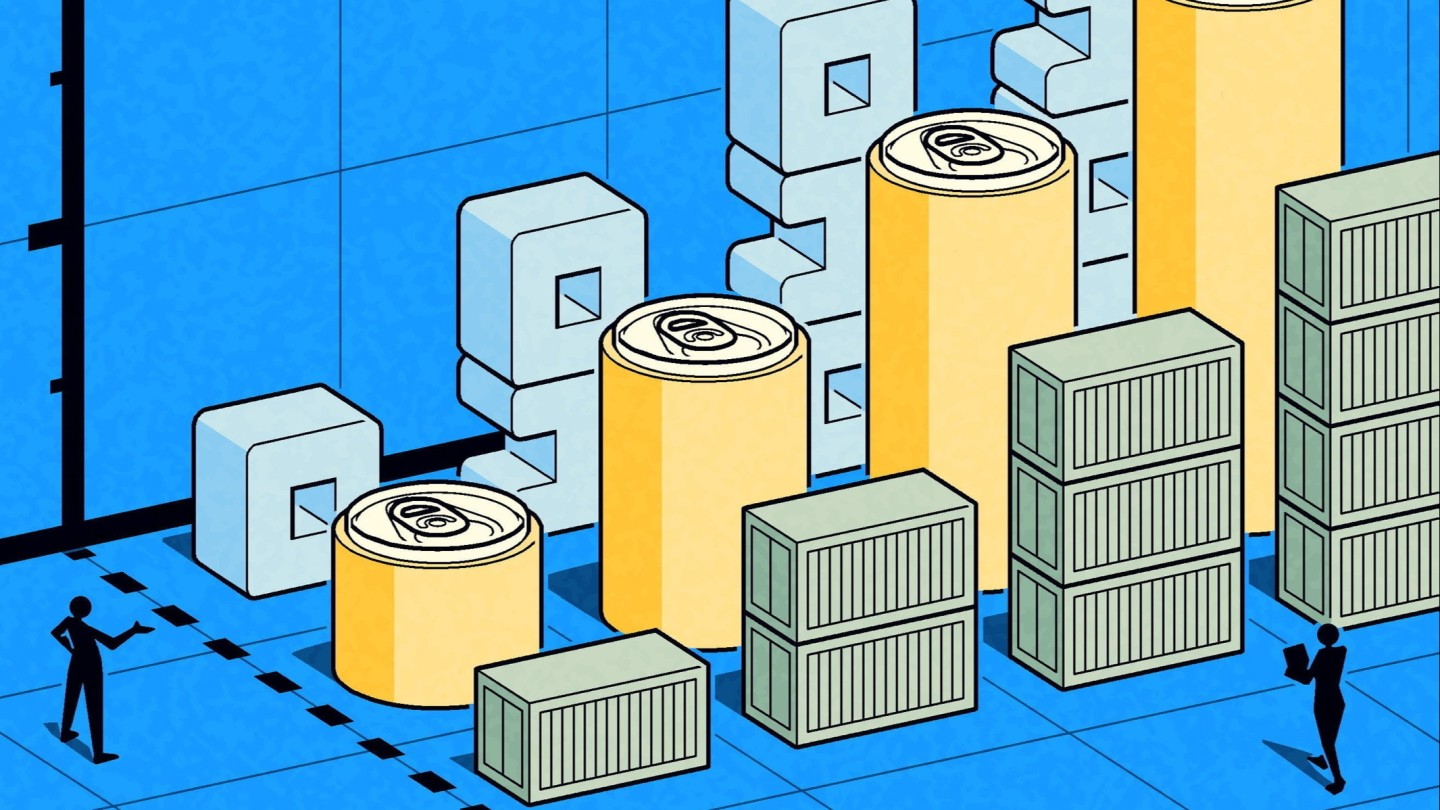

And this so-called ‘last-mover advantage’ is widely seen in the FT-Statista 2023 ranking of The Americas’ Fastest-Growing Companies, which is based on disclosed revenue growth between 2018 and 2021.

The top four companies were all founded after 2013, as were 13 of the top 20, often thriving in mundane, decades-old sectors including furniture moving & storage.

For Bill Shufelt, a former Wall Street trader, the problem he wanted to solve was making non-alcoholic beer tasty and stylish, following decades of neglect. “Non-alcoholic beer has always been in the penalty box,” he points out. “There was always a negative connotation, whether it’s a legal problem, medical issue, or a religious reason. And we wanted to turn that on its head.”

Shufelt and master brewer John Walker co-founded Athletic Brew — fourth on the list — in 2017, in the belief that high-calorie beer was out of sync with the lifestyle of athletes and health-conscious consumers.

Few people believed in its prospects, as non-alcoholic beer has been weighed down with a “Prohibition stigma” going back to the 1920s, he says. But, by reinventing how the beer is made — a whole new process rather than just taking alcohol out of ordinary brew — and then marketing the brand towards ultra-athletes and tech-types tracking their sleep, Athletic Brew has taken 55 per cent of the craft brew, zero alcohol market.

He says their timing was, by luck, perfect. “If we tried to kick off this revolution five years earlier, I don’t think society would be ready,” he says. “Five years later, I think all the big incumbent beer companies would already be so established.”

At the top of this year’s list is CDL 1000, a Chicago-based start-up focused on helping companies get their shipped goods from port to warehouse — an afterthought for many businesses until the pandemic caused global shortages and made supply bottlenecks front-page news.

“When Covid happened, congestion just went through the roof,” says Andrew Sobko, chief executive.

CDL was founded in 2018 on the idea of bringing digital answers to an overlooked, old-school industry. Within months of the pandemic, its client list included Walmart, Target, Home Depot and Panasonic.

Sobko says the biggest lesson he took away from the pandemic was the value of being aggressive and nimble. When the stock market began to crash in March 2020, larger competitors laid off staff, unaware that working-from-home would lead to a boom in ecommerce sales.

CDL pounced. A month before the pandemic, it was struggling to hire. Suddenly, talent pools swelled. “We just basically started hiring some of the most talented people in the industry,” he says. “There was a little bit of skill, a little bit of luck . . . Everything was shutting down and no one knew what was going to happen next.”

Soon, CDL was expanding its offerings into financial services, creating a stickier relationship by processing payments on behalf of clients to pull their inventories on time and avoid delays and penalties. One new electronics client, Sobko recalls, spent more than $147mn last year on these penalties because it was unfamiliar with the arcane processes that govern global ports.

Another logistics company ranked highly is furniture removals service Piece of Cake Moving & Storage. It stands at 14th on the list after revenue grew 43-fold to $39.4mn. “We didn’t do one thing that was revolutionary,” says chief executive Voyo Popovic. Instead, his approach included asking customers just a few important questions upfront, simplifying the scheduling process, and borrowing techniques from hospitality businesses when training staff. A catchy name and 250 bright pink vans also helped. “Thousands of little things [improvements] — that’s the special sauce. We wanted to make the boring, tedious experience of moving a little bit more pleasant.”

The list, of course, was not without providers of new, sophisticated technologies. Revenue at Moderna shot up from $135mn in 2018 to $18.5bn in 2021 thanks to its pioneering work using “messenger RNA” to develop a Covid-19 vaccine. Science writer Michael Specter has compared this revolution in synthetic biology to the progress computers made in the last half-century.

Moderna has the highest revenue among the 200 fastest-growing companies, and half of the top 20 companies are also in life sciences or pharma, riding a wave of innovations spanning bowel control (second ranked Axonics), dialysis (Outset Medical, ranked 10th) and gene analysis (Fulgent Genetics, ranked 12th).

The larger companies on the list were typically well-known brands that thrived owing to some silver lining amid the pandemic.

Revenue at DoorDash grew 17 times to $5bn as restaurants closed and food delivery boomed; at Zoom it grew 12-fold to more than $4bn as remote work forced meetings to go virtual; at digital payments group Block, formerly known as Square, it quintupled to $17.7bn as customers shunned cash; and at Shopify it quadrupled as ecommerce sales ballooned.

US-based companies accounted for all 10 of the top spots, 19 of the top 20, and three-quarters of the entire list. Canada-based groups held one of the top 20 and 15 per cent of the total. Brazil accounted for 6 per cent.

Renen Hallak, chief executive of data storage systems start-up Vast Data — third on the list — also attributes his company’s exponential growth to a “last-mover advantage”.

“We were lucky to start late,” he says, referring to how the company was founded in 2016 and started selling data storage products about 18 months before the pandemic accelerated the need for digital services.

“Our competitors are 20 years old or more — companies like PureStorage, Dell EMC, and NetApp. They started way, way, way before us, but they have built their solutions for a different world. Their systems don’t scale nearly to the level that is required today,” he explains.

Among Vast Data’s clients are the National Institutes of Health, Harvard Medical School, and Nasa. Hallak says the company was able to win those contracts — and be valued at $3.7bn in 2021 — by building on data architectures that didn’t exist a few years prior. “We were able to leverage newer underlying technologies to build a new architecture, which breaks the fundamental storage trade-offs that have existed forever between price and performance and scale,” he says.

Comments