ETFs: why tracking difference usually matters more than tracking error

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Most exchange traded funds are passive vehicles that seek to track the performance of their chosen benchmark. That benchmark could be anything from a well-known index, such as the S&P 500, to a specially constructed index of securities, such as clean energy stocks.

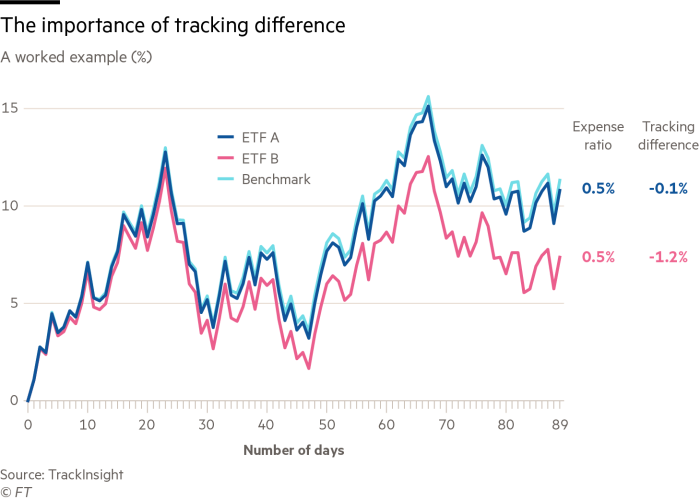

ETF providers often talk about historical index returns when promoting their products. In reality, investors should not expect to enjoy the same returns as the index because of a variety of factors including the fund’s total expense ratio (TER), trade execution costs, management fees, cash drag, foreign exchange rate volatility and rebalancing costs.

An ETF usually trails its benchmark index, but can be in positive territory if it outperforms its index as a result of revenue from stock lending, for example.

It is important to look at tracking difference because it might eat into potential returns even more than fees as demonstrated in the chart below.

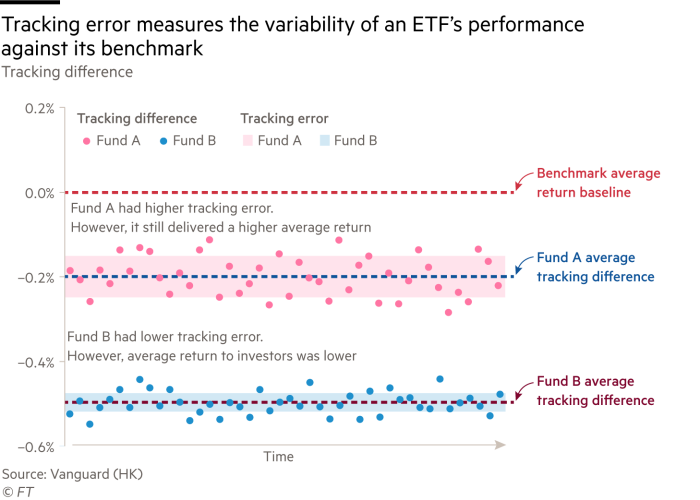

However, funds also publish a separate metric that represents another factor that investors should consider: tracking error.

Tracking error gives a clue to the volatility of returns by measuring the consistency of a portfolio’s tracking difference over time. It is calculated by using the annualised standard deviation of the difference in the portfolio and the benchmark returns.

There are a variety of risk factors that can lead to a higher tracking error including fees, which can have an impact on returns, rebalancing costs and cash drag — the uninvested cash left over in a portfolio at the end of the day’s operations.

If you need to decide which is more important, think about your investment time horizon. If this a long-term investment, then tracking difference is likely to be more important than tracking error as you try to compare funds. If you anticipate needing access to your invested capital in the near term or you do not plan to hold your investment for the long term, tracking error could become more relevant.

In general, the closer to zero for both indicators, the better a passive ETF has replicated its underlying index.

However, for most passive ETF investors tracking difference is likely to be the most important metric and is frequently used by ETF data providers as an important criterion for ranking funds.

“It’s the quickest way to check if a manager is delivering,” said Michael John Lytle, chief executive of Tabula, an ETF provider, when interviewed earlier this year on how investors should go about conducting their own due diligence. He added that tracking error was relatively unimportant for the long-term investor.

Both criteria are among a much longer list of checks that investors should be making at least once a year, he advised.

Comments