Joe Biden’s $1.9tn package is a risky experiment

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

How much fiscal stimulus is too much? The debate on this question among economists who support the goals of Joe Biden’s US administration has become fierce. That is no bad thing: policy should be debated. In this crisis, as during the 2008 financial crisis, one has to evaluate the risks of doing too little against those of doing too much.

But one thing is clear: the fact that too little stimulus was delivered in 2009 does not mean that far more than that must be right today. Policy must be judged by its suitability in current circumstances while recognising the uncertainties and balance of risks.

I have no objection in principle to huge fiscal spending. Indeed, in January 2009, I argued that the US should run a fiscal deficit of 10 per cent of gross domestic product until the damaged balance sheets of the private sector were healed. Shortly thereafter, I argued that we had to learn from Japan if we were to understand the dangers then confronting western economies. I have also recognised from the start that a pandemic is an emergency, rather like a war. Policy did indeed need to go on a war footing.

Nevertheless, it is vital to recognise what makes a pandemic different from a financial crisis or a war. Unlike a financial crisis, Covid-19 will not necessarily create an overhang of bad private debt likely to suppress demand indefinitely. Instead, the balance sheets of people who have earned well and spent little have actually improved. Again unlike a war, the pandemic does not destroy physical capital. There is a good chance therefore that economies will recover really strongly, once fear of the disease has waned. If so, the dominant part of the planned fiscal policy response should aim not so much at short-term relief as at “building back better”, by promoting a sustained increase in public and private investment.

This is the context in which the debate on the Biden administration’s $1.9tn fiscal package needs to be understood. It is not a philosophical debate, but one over the size, timing and nature of the package. The protagonist has been Larry Summers, former US Treasury secretary and chief economic adviser to Barack Obama, supported by Olivier Blanchard, former chief economist of the IMF. Both are Keynesians and supporters of the Biden administration. Summers even developed the “secular stagnation” theory, which justifies reliance on fiscal policy.

Summers recently questioned the wisdom of the package in the Washington Post. He argued that stimulus equal to 13 per cent of GDP (the $900bn that has already been enacted plus the $1.9tn) “was very large, especially in an economy with extraordinarily loose financial conditions, reasonably rapid growth forecasts, still unmet public spending needs and a very big overhang of private saving. Budget deficits in 2021 on the proposed plans will quickly be approaching the record World War II levels as a share of the economy.”

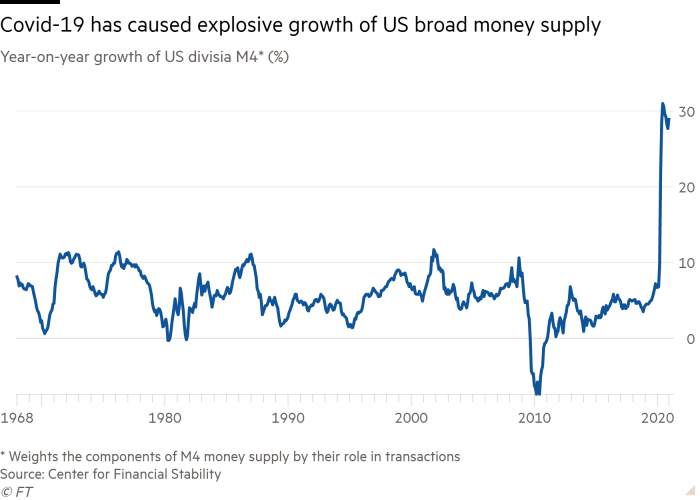

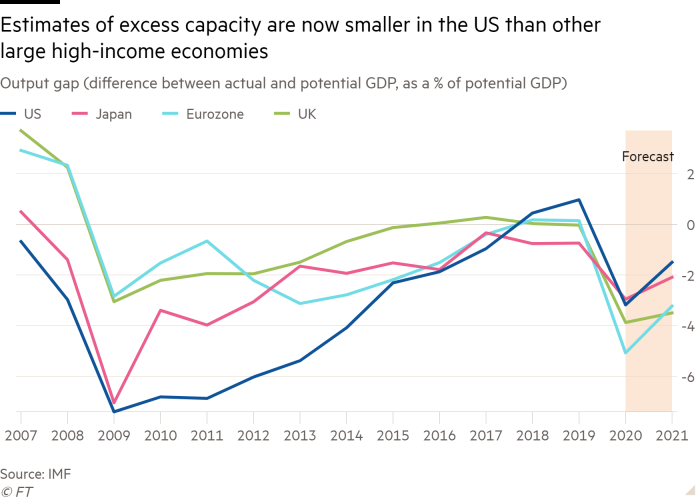

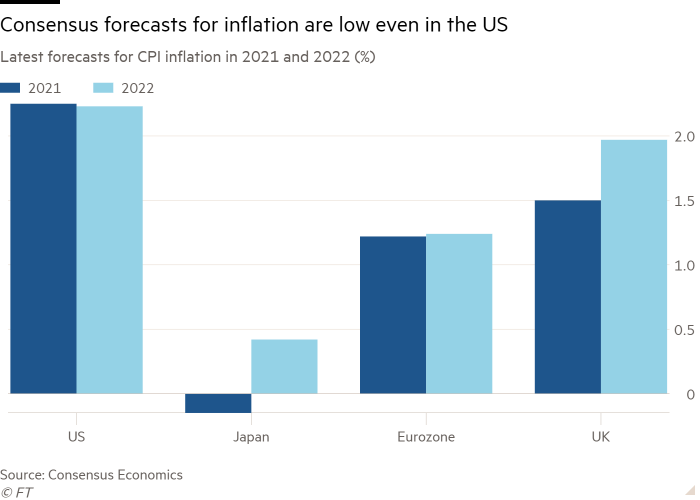

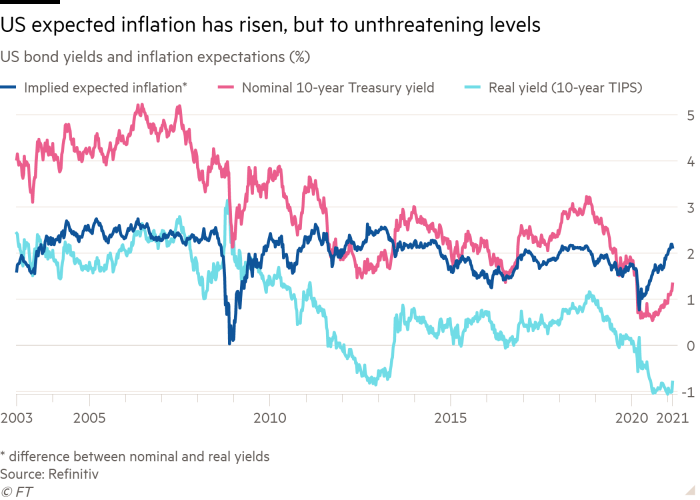

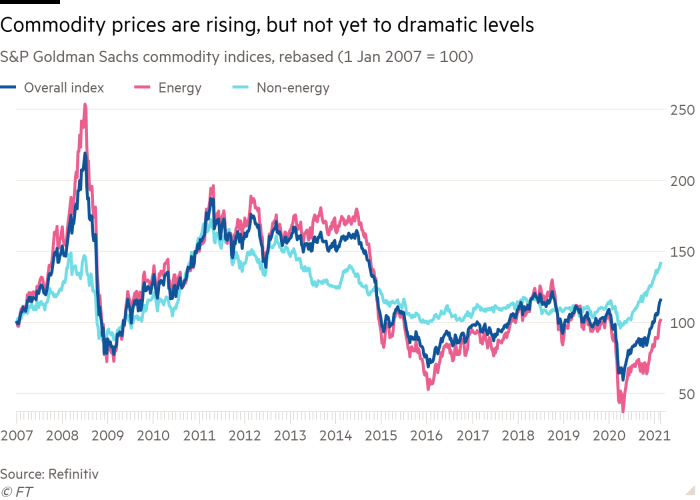

This is undoubtedly a reasonable concern. The growth of the broad money supply is extraordinary. The IMF forecasts only a modest gap between actual and potential GDP in the US in 2021. It is quite possible that monetary and fiscal expansion on this scale will hugely overheat the US economy. Against this, we see no significant resurgence in inflation expectations, while excess capacity is likely to endure in the world economy as a whole.

Some analysts seem to view a big upsurge in inflation as inconceivable, because it has not happened for a long time. This is a bad argument. Many once thought a global financial crisis was inconceivable because it had not happened for a long time. In the 1960s many thought the inflationary upsurge of the 1970s similarly inconceivable.

Many seem to believe nowadays that lower unemployment will not raise inflation. But at some point excess demand is sure to raise prices and wages. At that time, inflation expectations will start shifting permanently upward. The 1970s and 1980s taught us that bringing them down again is very costly, not just economically, but to the credibility of government.

These concerns should not be taken as an argument against any further US fiscal package. But if Biden could ignore political timing, it would make more sense to go for a smaller support package now and propose a huge medium-term investment programme later on. In the meantime, he would see how the recovery went before proposing another short-term support programme. But the administration’s view clearly is that it has a window of opportunity to alter people’s lives and so must “act big” now, and not later on. It also clearly believes the balance of peril lies far more on the side of doing too little than on that of doing too much. One must hope the judgment it is making in promoting this huge package proves correct.

What is clear is that a big package will be even more important to the eurozone, where the economic impact of Covid-19 on GDP was worse than in the US and the recovery seems sure to be weaker. Nor is this an argument against shifting the balance of stimulus from monetary to fiscal policy. Such a shift is desirable, given how aggressive monetary policy tends to promote excessive risk-taking in finance.

If enacted, the $1.9tn package will be a risky experiment. It might be no bad thing if it ended up somewhat smaller than now proposed. Whatever is decided, one point is clear. The success of the package is of immense importance. Proving that an active government can deliver good things to the public is essential for the health of American democracy. I pray that the Biden administration’s gamble succeeds.

Comments