Credit crisis led to a bonfire of the acronyms

Simply sign up to the Capital markets myFT Digest -- delivered directly to your inbox.

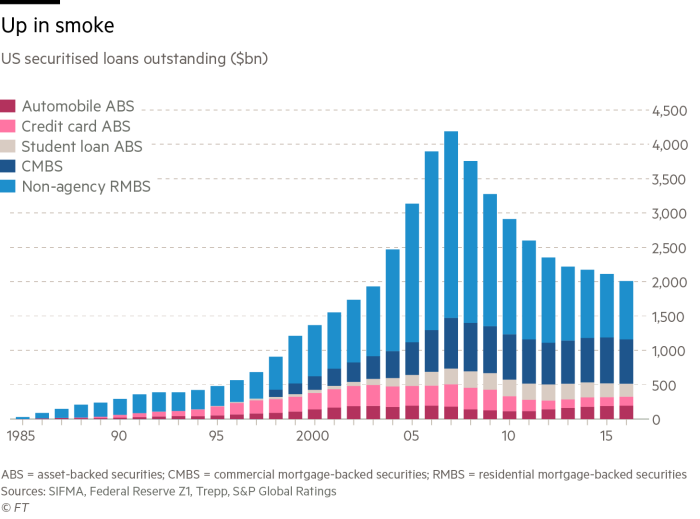

At the heart of the crisis was a collection of obscure acronyms which turned out to be WMD, weapons of mass financial destruction. Everyday loans, for cars, houses or office buildings, were rolled up into bundles which were then sliced into asset backed securities, or ABS.

The technique powered a surge in easy lending, particularly residential mortgage-backed securities (RMBS) which led to the housing boom and bust. In the decade since, the share of loans being securitised has dwindled.

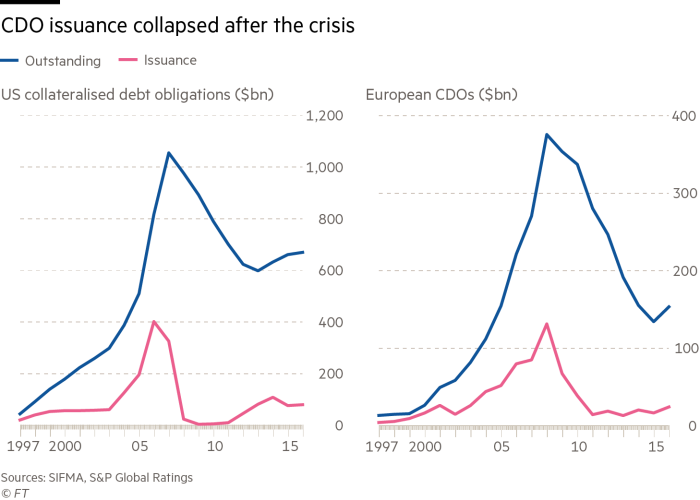

Collateralised debt obligations took the securitisation a step further, packaging and slicing up existing ABS to create even more fragile structures. Of the CDOs rated by Standard & Poor’s, 70 per cent defaulted, for instance by missing an interest payment.

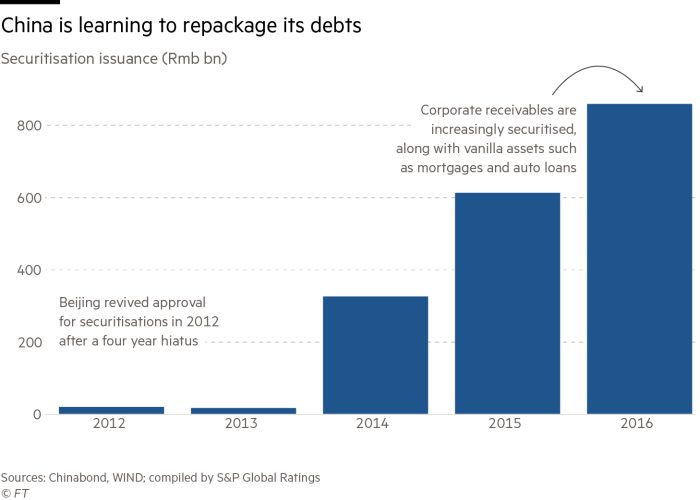

There is one place in the world, however, where use of securitisation is rapidly growing.

Comments