‘What just happened?’ ask bruised tech investors

Simply sign up to the US equities myFT Digest -- delivered directly to your inbox.

On Friday, the Financial Times unmasked SoftBank, the Japanese investment group, as the “Nasdaq whale” whose options trading helped stoke an eye-popping rally in tech stocks before a vicious market correction this week.

Now, with the air suddenly coming out of inflated valuations, investors are urgently trying to understand how activity in derivatives markets sent Apple, Tesla and a host of hot stocks to record highs — and what might happen next.

So what are options?

Equity options provide investors with the right to buy or sell a stock in the future at a fixed price somewhere above or below where it is currently trading.

They serve an important purpose of hedging investment portfolios against losses, but they also have a long history of fanning big gains and losses for speculators.

A call option — the right to buy a stock — becomes profitable if the share price rises beyond the agreed level. A put option — the right to sell a stock at a given price — can be valuable in the event of a sharp fall in prices.

Buyers of options have to pay a little money for the contract, but not much relative to the money that can be made or saved if the underlying shares move sharply.

How has options market activity diverged from usual patterns?

Investors with equity portfolios most often like to own puts as insurance to guard against a big drop in the broader market.

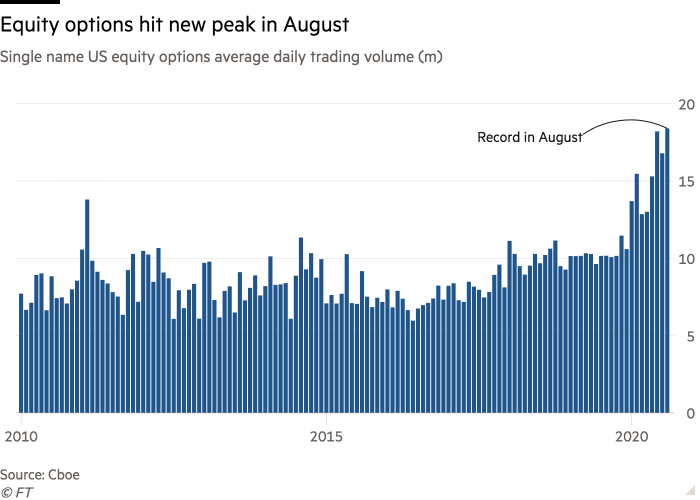

But in the past few months, this has been flipped on its head for mega-cap tech stocks and there has been rampant buying of call options — particularly on Apple and Tesla.

It has looked to some veterans like a speculative mania. Investors betting that tech stocks will increase further in value have far outweighed those buying options that protect their holdings from lower share prices. The put to call ratio in Apple stock on Monday was the lowest in at least 10 years, according to Bloomberg data; the ratio for Tesla last month set a four-year low.

The action “is a function of options buyers outnumbering options sellers, which has been especially prominent in the top tech names”, said David Silber, head of institutional equity derivatives for Citadel Securities.

Who has been driving the option activity?

A combination of retail investors and large funds have jumped on the tech call option bandwagon. A major institutional buyer, nicknamed the “Nasdaq whale” by traders and identified now as Masayoshi Son’s SoftBank, has dominated the buying of calls, attracting plenty of other players along for the ride.

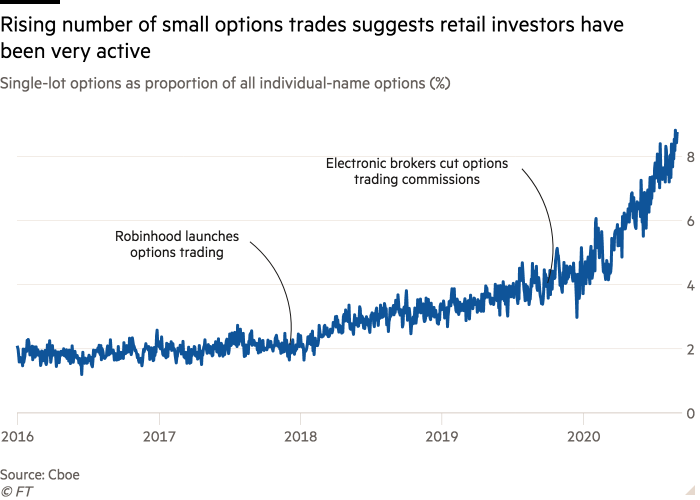

Funds already sitting on big gains have been happy to recycle a little of their profit to further leverage their portfolios and aggressively buy calls. Retail investors, trading on online platforms such as Robinhood — free of commissions — have also embraced options trading in record numbers and chased big tech names.

“The apparent increase in small retail investors and the apparent rise in option related trading . . . have contributed to the speculative nature of the market in recent weeks,” said Chris Iggo, chief investment officer for core investments at Axa Investment Advisers.

What does such one-sided activity mean for the broader market?

The scale of call buying has triggered a number of market dislocations and led traders to see a feedback loop that pushed tech stocks dangerously high.

Connecting the activity in the options market with the stock market itself are the dealers who sell options. These dealers — which include big banks such as Goldman Sachs, JPMorgan and Morgan Stanley, and market makers like Citadel Securities — would be exposed to losses on call options if share prices spike and they have not hedged their exposure.

To hedge that risk, dealers can purchase the underlying stock, so they also get a piece of any share price spike. Their buying, in turn, pushes up the underlying stock, creating a self-fulfilling run that helped to push Tesla and Apple to all-time highs this week.

On the eve of Thursday’s sell-off, options markets were predicting increased volatility, including particularly wild swings in Nasdaq shares relative to the rest of the stock market. Normally, such measures of volatility are slumbering when markets are going up. The divergence was a stark warning for equity bulls.

What goes up can come down

Crowded trades become very dangerous when juiced by the power of options activity and a tipping point was reached this week. Prices in call options for the likes of Tesla and Apple have swung sharply and triggered sharp drops not just for these stocks but across the sector — which in turn has knocked broader benchmarks such as the S&P 500, where tech stocks have come to dominate.

With selling pressure picking up on Friday, the Nasdaq 100’s gain from its low in March was cut to about 62 per cent versus a peak of 78 per cent at the close on Wednesday.

Given the scale of options activity, it may take some time for the market to stabilise. That suggests a period of elevated volatility and further downside for tech shares, but it also sets the stage for volatility traders to step up and help calm down the market once the dust settles.

Equity investors, meanwhile, are likely to buy a dip in prices given ultra-low interest rates on bonds have made stocks more attractive and revenues of big tech companies have proven insulated from the downturn this year, compared to other industries.

The main takeaway is that options trading will remain a key part of the picture. “The dynamics in the options market are certainly becoming a bigger part of the equity market,” said Citadel’s Mr Silber.

Comments