Sustainable funds face threat from tech sector turmoil

Simply sign up to the ESG investing myFT Digest -- delivered directly to your inbox.

Environmental, social and governance-focused funds face a more uncertain outlook in 2022, as pressures mount from research costs and hits to the big growth stocks that have helped power the investments’ outperformance.

ESG inflows boomed throughout 2021, even as they slowed in pace towards the end of the year, with global sustainable fund assets doubling in the six months to September 2021 to reach $3.9tn, according to data provider Morningstar.

But the breakneck expansion of the ESG sector could stall if performance starts to approach or underperform benchmarks, after years of high-flying returns driven by powerful rallies in growth stocks.

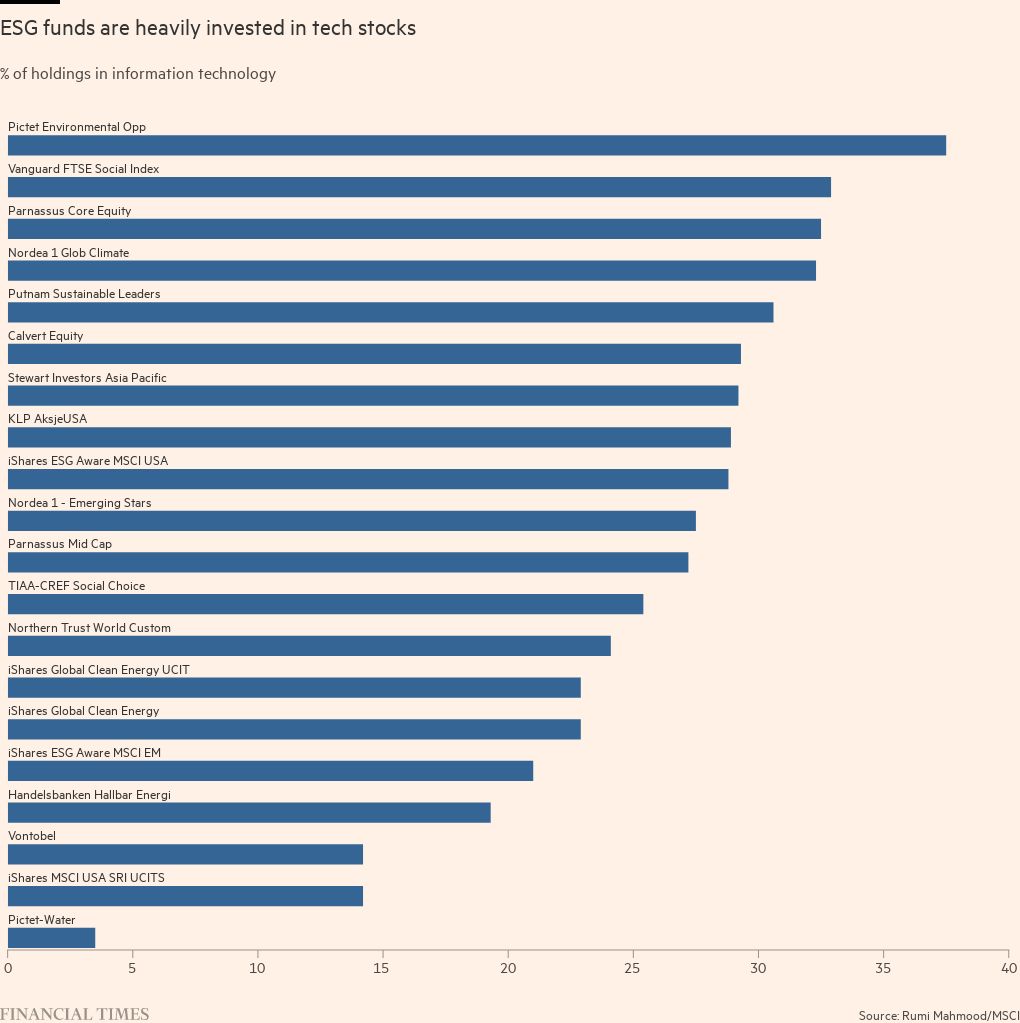

At the end of December, the top stocks held across the world’s 20 largest ESG funds, which together manage about $340bn in assets, were technology giants Microsoft, Google’s parent company Alphabet and Apple, according to Rumi Mahmood, vice-president of ESG research at MSCI.

Yet while tech shares have been big winners during the pandemic, they have taken a hit since the turn of the year — fuelling speculation that a more sustained rotation towards value strategies is in the offing as the US Federal Reserve starts to withdraw Covid-era monetary stimulus.

“I think it’s going to be an important test for the industry. I’m not convinced that 100 per cent of people who are buying sustainable funds are doing so purely for environmental and ethical reasons. Many are in it as ‘tourists’ because these just happened to be the best performing funds,” said David McCann, equity analyst at Numis.

The tech-focused Nasdaq Composite has had its worst start to the year in half a decade, briefly dropping into correction territory after the Fed adopted a more hawkish tone earlier this month before recovering to trade down 4.8 per cent since January 1. The current fall may turn out to be a blip, but a sustained shift in the market could be painful for ESG funds that have bet heavily on them.

“Certain names are at the top: Microsoft, big tech, big healthcare . . . these have been trading high and are the names these funds are most overweight. If we rotate and rates rise, they will be all beaten up. Banks and resources could fare better, and those are generally underweighted by ESG funds,” said Tom Mills, equity research analyst at Jefferies.

Shares in some more specialist ESG focused companies are down since the start of the year on worries this could soon materialise. London-based Impax’s share price has fallen 15 per cent since the start of January, while Liontrust is down by about 14 per cent.

ESG fund managers argue that sustainability has now become so baked in to investment strategies across the board that a significant reversal is unlikely. For many investors, certain energy and resource companies are now uninvestable, no matter how well their stocks do, fund managers say.

And while interest rate rises discount shareholders’ future returns on speculative tech companies, the investing audience for some of those companies has also exploded.

“We’ve seen more and more of the broader market coming around to the idea that they need a net zero target and therefore need to buy clean energy in order to fuel their growth, so the addressable market for these companies has grown very rapidly,” said Amanda O’Toole, who runs a cleantech thematic fund at Axa Investment Managers.

Much store has been placed in the ability of cutting-edge technology to address sustainability issues. But fund managers are also looking for ESG prospects among more traditional companies.

“ESG and climate investing isn’t all about highly priced concept stocks. We have climate plays in every sector of the market,” said Simon Webber, fund manager at Schroders, who thinks companies such as homebuilder Kingfisher, insurer Munich Re and carmaker BMW will be big winners in the climate transition.

If there is a shakeout in sustainability investing’s fortunes, “there have been a lot of new entrants to the climate and ESG fund management business and we’ll find out, just like with companies, who is good at what they do,” Webber added.

Sustainable investing is also subject to mounting research costs that are expected to reach $1.3bn globally in 2022, straining already thin investment house margins and potentially endangering sustainable strategies if a market correction takes hold.

In Europe, research budgets at asset management houses have more than halved between 2016 and 2022, according to estimates from Frost Consulting, since the companies started financing them out of their own budgets instead of through investor fees under Mifid II reforms.

At the same time, the costs of running ESG strategies have ballooned as funds have launched and grown, and may eclipse overall research budgets by 2024.

“Ironically, European asset managers are less resilient and less sustainable than they were [at the onset of the financial crisis],” said Neil Scarth, of Frost Consulting. “One reason is that in 2008 asset owners rather than asset managers were paying that huge research bill, and that has now evolved to be a significant ESG cost that didn’t [previously] exist for many managers.”

ESG strategies have substantial overheads because of high data and specialised research costs, and the need to hire stewardship departments to engage with companies multiple times per year on sustainability targets.

“We are talking to some senior managers at investment firms who are starting to re-examine the relationship between ESG revenues and costs, in an environment where none of these additional costs are met by asset owners,” Scarth said.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

Comments