Flows into ETFs treble in March as investors seek safety

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Flows into exchange traded funds almost trebled to $62.1bn last month, with the bulk heading into safe assets like government debt as investors sought shelter from the recent banking crisis.

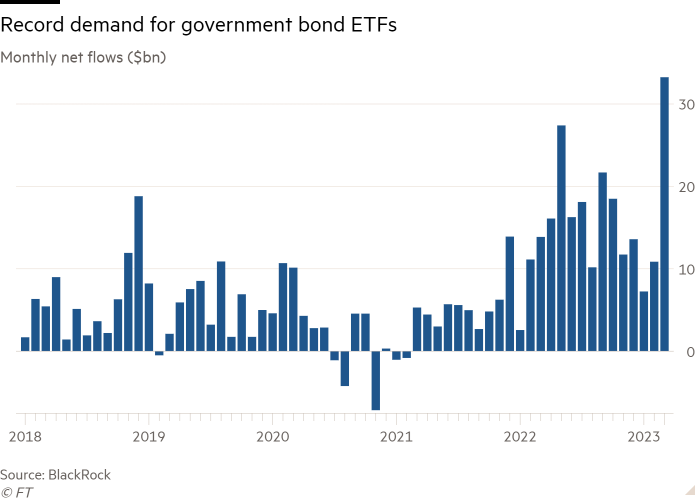

Developed market government bond ETFs soaked up a record $33.2bn of the money, eclipsing the previous monthly peak of $27.4bn set in May 2022, according to data from BlackRock.

Exchange traded products investing in gold vacuumed up a further $1.7bn, the highest tally since April 2022 and partially reversing the $25.5bn of net outflows gold funds have suffered in the interim.

Even equities’ more defensive sectors such as technology were in vogue, while more cyclical energy ETFs were out of favour, alongside risky high-yields bond funds.

“In March, while net inflows to ETFs were strong, nearly all of the money US ETFs gathered were in fixed income ETFs led by Treasury products as investors sought safety amid the banking crisis and the uncertainty of the Federal Reserve’s next move,” said Todd Rosenbluth, head of research at consultancy VettaFi.

Total net inflows were markedly higher than February’s meagre $23.3bn, yet Karim Chedid, head of investment strategy for BlackRock’s iShares arm in the Emea region, said that although “we have seen a pick-up in flows, [investors are] positioning for a more defensive investment environment”.

Chedid argued there was also a “strong long duration play across equities, fixed income and commodities”, driven by expectations of a pivot in US monetary policy, with the market pricing in an 80 per cent probability of one final 0.25 percentage point interest rate rise in May, but the growing likelihood of two rate cuts in the second half of the year.

In fixed income, this duration strategy was evidenced by the $28.6bn of net inflows into US Treasury bond ETFs being divided almost equally between those focused at the short end, middle and long end of the yield curve “as opposed to crowding only at the front end”, Chedid said, signifying a “huge comeback” for the asset class.

This divergence was shown by iShares’ 7-10 Year Treasury ETF (IEF) gathering $6.1bn in March, while at the other end of the maturity scale SPDR’s Bloomberg 1-3 Month T-Bill ETF (BIL) sucked in $3.8bn according to VettaFi data. The iShares US Treasury Bond ETF (GOVT), with an effective duration of 6.3 years, was just behind at $3.7bn.

Havens like sovereign bonds and high-quality stocks were the ETF categories with the biggest first-quarter inflows alongside actively-managed ETFs, said Aniket Ullal, head of ETF data and analytics at CFRA Research.

With money market funds seeing a $463bn jump in assets in the US alone in the first quarter amid a surge in inflows, Ullal added “these trends appear to reflect a more cautious investing environment among fund investors,” precipitated by the collapse of two regional US banks and Switzerland’s Credit Suisse.

Outflows from riskier fixed income funds slowed, however. In March developed market investment-grade and high-yield bond ETFs saw aggregate outflows of $0.9bn, a far cry from the $8.3bn of selling witnessed in February, the second-largest exodus on record.

The bulk of the improvement was, however, accounted for by the Schwab 5-10 Year Corporate Bond ETF (SCHI), which saw its assets surge from $345mn at the end of February to $5bn by the end of March, seemingly due to its inclusion in some of Charles Schwab’s model portfolios.

Net buying of equity ETFs rose to $24.3bn in March, from $9.4bn in February. Chedid said there was a “defensive tilt” to equity inflows.

Technology — a sector where valuations are heavily dependent on future interest rate and inflation expectations — led the way, with IT ETFs taking in a net $3.2bn, following three outflow months in the previous four.

ETFs investing in financial stocks saw their second straight month of inflows, gathering $1.6bn, despite the ructions in the sector.

Latest news on ETFs

Visit the ETF Hub to find out more and to explore our in-depth data and comparison tools helping you to understand everything from performance to ESG ratings

“In spite of the banking crisis, investors turned to bank ETFs with KRE [the SPDR S&P Regional Banking ETF] and XLF [the Financial Select Sector SPDR Fund] having net inflows for March,” said Rosenbluth, although he added that ETF shares “are often created to support shorting purposes”, meaning an increase in issuance is not necessarily indicative of rising demand to hold the underlying assets.

Nevertheless Chedid believed the recent fall in sector valuations might be seen as an “attractive entry point, if you don’t believe the developments in the sector are going to lead to systemic problems”.

Chedid said the renewed demand for gold ETPs could signal investors “positioning for a slowdown in the economy”, but could alternatively be a long duration trade predicated on expectations for lower interest rates, which reduce the opportunity cost of holding non-yielding assets.

However, he feared that some investors could end up getting their fingers burnt given BlackRock’s less optimistic house view on the scope for Fed rate cuts than the market at large.

“The market is pricing multiple rate cuts by the Fed before the end of the year. We don’t think that will happen,” he said. “We are probably close to the peak in the cycle, however, not to the extent that the market is pricing.”

Comments