AMC: equity raises and value traps

Simply sign up to the US equities myFT Digest -- delivered directly to your inbox.

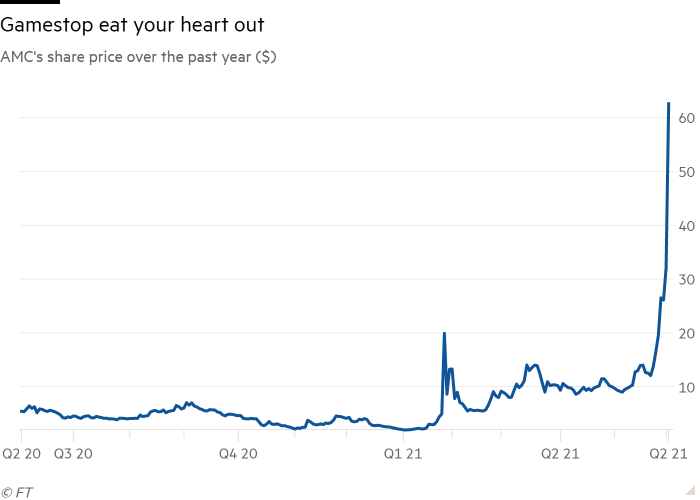

Usually, you’d go to the cinema to experience drama. But, at the moment, you’re arguably better off just watching the stock of stricken cinema chain AMC Entertainment.

After a meteoric rise this year propelled by retail investors, on Tuesday the company sold 8.5m shares at $27.12 to Mudrick Capital Management, raising a touch under $231m in the process. The stock, as it had done most of the year, went up. Then Mudrick turned around and proceeded to sell its entire position, reportedly telling its clients it was “overvalued” (you don’t say). Stock went up again. By Wednesday’s close, it was up another 96 per cent to $62.55. Taking it firmly into the 30-bagger territory so far this year.

So AMC has done the only rational thing for a theatre chain trading at 10 times forward revenues, and 57 times its pre-pandemic ebitda, and has announced it is raising more cash on Thursday.

Here’s the related prospectus, which gives the bookrunners -- B. Riley Securities and Citigroup Global Markets -- the right to sell another 11.5m shares into the market. If all the shares are sold (and why wouldn’t they be given the stock’s clear popularity), AMC’s total share count would be 513,330,240, according to the document. Just so you get a sense of the capital markets activity this year at the company, that share count is over four times where it was at 2020’s year-end.

As you might not quite expect in the world of upside-down markets, the share price is down 2 per cent in pre-market trading, to $61.30 on the news. Despite the line in the prospectus that . . .

...our current market prices reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals, and we do not know how long these dynamics will last.

Hmmm.

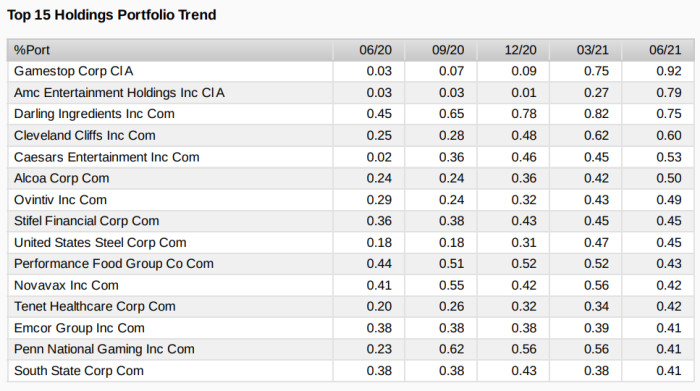

One funny wrinkle in the great 2021 retail investing saga is the effect the rapidly increasing market capitalisation of these companies is having on index funds and ETFs.

Our favourite so far? Well the composition of the iShares Russell 2000 Value ETF has particularly tickled us. Ostensibly designed to give investors “exposure to small public U.S. companies that are thought to be undervalued by the market relative to comparable companies” in the classic value investor style, its two largest holdings are currently AMC and Gamestop.

Indeed, according to FactSet data, Gamestop now makes up 0.92 per cent of the ETF, up from just 0.03 per cent in June 2020, while AMC is now 0.78 per cent of the fund:

We’re not sure about you, but it seems unlikely to us that investors in this particular ETF imagine they’re buying companies trading at software-esque multiples of revenues that still have a decent chance of going the way of the Dodo.

Value investing deity Ben Graham must be spinning in his grave.

Comments