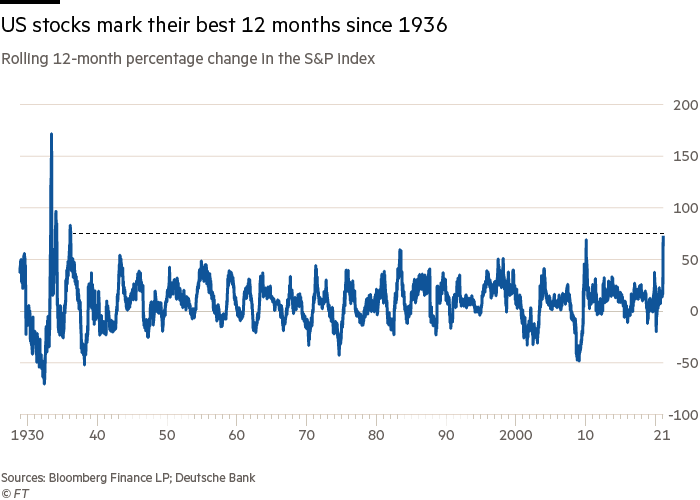

Wall Street stocks in strongest rebound rally since 1936

Simply sign up to the US equities myFT Digest -- delivered directly to your inbox.

Last March was a good time to be a contrarian investor. As the coronavirus pandemic swept into the west and equity and bond markets went into heady tailspins, those who held their nerve and bought into US stocks without selling out later are now sitting on historic gains.

The S&P 500, the broad US equity benchmark that holds the nation’s largest publicly traded companies, rose 74.9 per cent between March 23 last year and the same date in 2021. That, according to strategists at Deutsche Bank, was the index’s most vigorous rise over any 12-month period since 1936.

The gains were kickstarted by a March 23 meeting of the US Federal Reserve, where its policymakers moved to soothe the ructions in financial markets by pledging to buy an unlimited amount of Treasuries and purchase companies’ bonds for the first time in the central bank’s history.

Since then the S&P has been buoyed by President Joe Biden’s $1.9tn fiscal stimulus programme, Treasury secretary Janet Yellen’s pledge to “act big” on the economic recovery and strong expected earnings growth for this year and next.

The average earnings per share of companies listed on the S&P are forecast to rise to $172.44 in 2021 from $122.37 last year, a 40 per cent gain, according to data collected by Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

A rally in shares of information technology companies, including Apple and Microsoft, has been responsible for much of the powerful 12-month gain for the S&P, Silverblatt’s data show. This raises questions over whether they can continue powering the index higher if inflation-adjusted interest rates, which flatter the market valuations of growth companies when they are low, continue to rise as the US economy recovers.

But Maya Bhandari, a multi-asset portfolio manager at Columbia Threadneedle, argues that a rise in these so-called real rates is “baked in” to tech valuations already.

Based on expected profits for the next year, the information technology subsector of the S&P trades at 25 times forecast earnings per share, compared with an average of about 19 over the past 20 years, according to FactSet data.

Meanwhile, Bhandari says, information technology companies’ forecast earnings growth, at 45 per cent between 2020 and 2022, should support tech shares in the months ahead.

“Earnings growth appears to be sufficiently strong to predict a positive total return, even with some derating.”

Comments