Funds trim negative US stocks bets

Simply sign up to the US equities myFT Digest -- delivered directly to your inbox.

Amateur traders are on the hunt for further opportunities to bulldoze over funds betting against their favoured stocks, ranging from the medical insurer Clover Health to the former smartphone maker BlackBerry.

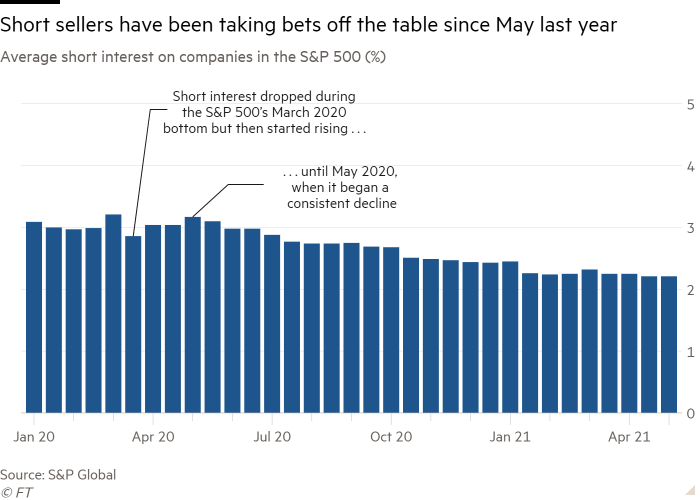

But for those retail traders, repeating the victory of January’s GameStop saga, which punished a clutch of short sellers, may be tricky. In part this is because funds have reeled in their negative bets, as the US economic reopening and persistent monetary stimulus from the Federal Reserve continue to fuel a broad market rally.

“Every business — even if it has a secular challenge — is improving . . . right now,” said Mitch Rubin, chief investment officer at the fund manager RiverPark Capital. “It’s just a very, very difficult environment to short in.”

From the start of the year to the middle of May, the average percentage of S&P 500 companies’ shares that were shorted — sold in anticipation of buying them back cheaper at a later date — has dropped from 2.45 per cent to 2.21 per cent, according to data collected by S&P Global Market Intelligence.

Dramatic scenes earlier this year, when amateur traders organised on online forums to crush the shorts of the hedge fund Melvin Capital by pumping up stock in the video game retailer GameStop, have also left many funds hesitant to pour into some of the most obvious targets.

“We’ve steered clear of anything that could be considered a meme stock,” said Fahmi Quadir, founder of the short-only fund Safkhet Capital. That also means the fund adjusts the size of its positions when short interest on a target becomes “material”, above roughly 30 per cent, she added.

The amount of money that short sellers have placed in their bets against companies in the S&P 500 has come down as well, albeit less sharply than the percentage of float shorted. The total value of short interest in the blue-chip index stood at $525bn as of June 9, down from a high this year at $550bn on April 14.

The stocks with the highest short interest in the index were all in the technology sector, with Tesla, Amazon, Apple and Microsoft leading the way at more than $10bn in short interest on each of their stocks, according to S3. But investors say that following a bumper earnings season for the sector, it is harder to justify those bets.

“I’m not sure you would want to go head first into the shallow end of the pool and short tech at this very moment,” said George Catrambone, head of Americas trading at DWS.

Unhedged — Markets, finance and strong opinion

Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here to get the newsletter sent straight to your inbox every weekday

Comments