Pimco: navigating the end of the bond bull market

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

For many of the most seasoned professionals in the bond market, it feels like the end of an era.

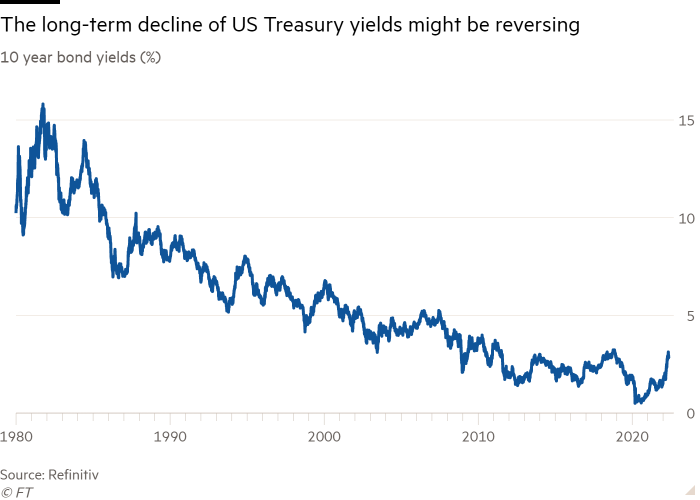

After a boom that has lasted at least three decades, the warning signs are everywhere. The highest levels of inflation in a generation and rising interest rates mean that yields are increasing, so bond investors can no longer assume the value of their holdings will automatically increase year on year.

Investors have pulled a combined $100bn out of US bond mutual funds and exchange traded funds this year, according to the Investment Company Institute. If the trend continues, it would be the first year of negative flows since 2013.

“The long bull market run in bonds has come to an end,” says Scott Minerd, global chief investment officer at Guggenheim Partners, who helps oversee $325bn in assets.

Nowhere are the prospects of a downturn being more closely watched than at Pimco, the California-based group that pioneered active bond trading.

Pimco’s expertise allowed it to profit from decades of falling interest rates and to spin gold from the wreckage left by the 2008 financial crisis. As the world’s largest credit-focused manager, Pimco came to symbolise the bond market boom.

But even before the surge in inflation rattled the bond market, Pimco was already having to swim against two very powerful tides. Watching the rapid expansion of cheap index-tracking funds, even some bond investors have begun to question the fees they pay to active managers such as Pimco.

And the company has had to repair the damage from a spectacular management bust-up. Pimco was founded by legendary bond investor Bill Gross, who spun it out of Pacific Life insurance and ran it for more than four decades. But his investment performance eventually faltered and his hierarchical and confrontational management style drove away talented people.

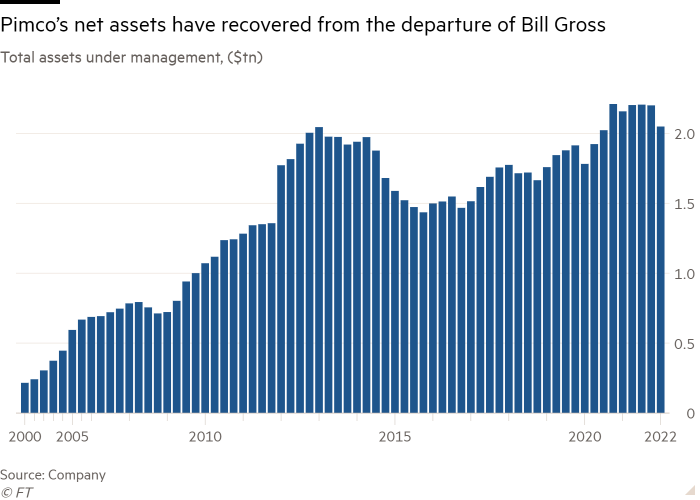

In 2014, Gross’s heir apparent, Mohamed El-Erian (now a Financial Times columnist) unexpectedly resigned and the rest of the senior management had had enough. Threatened with defenestration, Gross decamped overnight to rival Janus Henderson, and more than $100bn in assets left with him.

Since then, Pimco’s chief investment officer Dan Ivascyn, who rose through the ranks, and chief executive Manny Roman, who was recruited from Man Group in 2016, have radically revamped the asset manager while maintaining the focus on credit that made it famous.

Lower key in style, they toned down Pimco’s emphasis on stars, sought to professionalise management and have tried to diversify globally. A failed expansion into equities was pruned back, while resources were ploughed into higher-fee alternative and private credit strategies for big investors who were willing to sacrifice short-term liquidity for better returns. The staff is one-third larger at 3,150-strong, and two-thirds of them have joined Pimco since 2016.

Last year, assets under management finally surpassed their Gross-era peak of $2tn. “Pimco hasn’t been nearly as high profile, but the big picture is that the business is healthy and the investment experience has still been very good,” says Eric Jacobson, a Morningstar strategist.

However, rocky bond markets will test Pimco’s recovery and whether its new culture and more diverse suite of products can thrive in a downturn.

Gross, who retired in 2019 but still trades on his own account, believes the glory days are over for bond managers. “We just rode a wave . . . and we knew how to ride it,” he says. “That was the secret to our success, and I don’t think it’s going to happen again for a long, long time.”

But Roman believes that the turbulence in the markets will actually play to Pimco’s strengths.

“More volatile and more difficult markets are good for us,” Roman says. “The role for fixed income is predictable cash flow and people who are retired want that. I’m remarkably bullish about the role for fixed income going forward.”

Colourful quotes

Back in the early 2010s, Gross and the total return bond fund he personally managed firmly ruled the roost at Pimco. Dubbed the “bond king” by admiring financial journalists who loved his colourful quotes, Gross admits now that he was mercurial and difficult. The five people honoured in the company’s “founders’ room” are all white men and almost everyone worked at its headquarters in the historically white and conservative coastal community of Newport Beach.

Many employees attracted by Pimco’s record of success found Gross’s fondness for vigorous arguments and his need to dominate challenging. “Bill really tried to run an army. There were certain expectations of everyone,” remembers Sonali Pier, who joined in 2013 and last year won a Morningstar “rising talent” award for running one of Pimco’s top-rated funds. Now, “there is some uniformity, what’s the Pimco view or preference or tilt, but there is also some room for freedom of expression.”

To illustrate the shift, she and almost every longtime employee cited the changes Ivascyn made to the way Pimco shares investing ideas. For years, Pimco roughly three times a year has asked every investing professional to put forward their three best ideas and then collated the results into a book that is shared around.

Ivascyn reworked the structure of the book. Rather than being grouped by author, the suggestions are listed without attribution. To find out who proposed a particular strategy, readers have to flip to the end notes.

“The implicit bias [in the old way] was that you would tend to gravitate to the person and the idea based on whether or not you like that person,” says Mohit Mittal, portfolio manager for multi-sector strategies. “Now you cannot really guess who the idea is from unless you like [it] and you have to make an effort to find out whose idea it was. That allows for actively seeking out diverse opinion.”

A strong believer in behavioural economics, Ivascyn has run one of Pimco’s most successful funds since 2007. In meetings, colleagues say he deliberately avoids dominating the conversation, often speaking last after others have expressed their opinions. “My title is group CIO but it’s far different than the previous leadership structure . . . I am part of a team of professionals,” Ivascyn says.

After they pushed out Gross, Pimco and its German owners Allianz deliberately sought an external chief executive who could strengthen the business functions — product introduction, strategy, hiring and the like. Roman has set about changing the culture and making the asset manager attractive to a wider range of employees and investors.

“People have to enjoy coming here. They have to think they’re learning. They have to think that we’re decent human beings and they need to believe in our core values,” Roman says. The workforce is now 37 per cent female and the US workforce is 46 per cent minority, although the share of senior leadership lags well behind. As with much of finance, most minority US employees are of Asian ethnicity rather than black or Latino.

“One of the challenges is that in Newport Beach there is very little diversity,” says Roman. “So we have made strategic decision in terms of having offices where it would be easier to hire more diverse people.” Pimco opened a large office in Austin, Texas, in 2018 and consolidated its emerging markets team in New York.

While many at Pimco applaud Roman and Ivascyn for their efforts, the atmosphere is far from warm and fuzzy. Current and former employees, including some senior executives, describe it as “edgy”, “demanding” and “driven”. Compared with some other traditional asset managers, Pimco is leanly staffed and expects a lot of its professionals, they say, although the hours and demands are not as all consuming as jobs in investment banking.

Pimco’s history as a very white, very male, very confrontational business has left it open to complaints, especially about its past behaviour. A group of 21 past and present female employees wrote to the executive board last year complaining of discriminatory treatment and six women have filed suit alleging that the corporate culture “marginalises, demeans and undervalues women”. The cases are due for trial early next year, and the same lawyer last week sued on behalf of two men from ethnic minority backgrounds.

The firm hired an outside investigator to look at the claims in the letter and is fighting the lawsuits. “It’s deeply concerning for me personally and as a leader as well, that some people feel this way. I think we’ve taken that very, very seriously and wanted to really understand what’s there. It’s been honestly a little bit of a disconnect for me because that has not been my experience,” says Kimberley Stafford, a 22-year Pimco veteran, and one of four women on the 11-member executive committee, although the investment leadership is all male. “The culture has definitely changed,” she says.

A former employee, who spent more than five years at Pimco before leaving for a new opportunity, agrees. “I do think they make a concerted effort to combat the biases that exist in the financial sector. It’s the least ‘boys club’ of the four financial firms I have worked at,” he says.

Follow the index

Over the past decade, some of Pimco’s rivals have grown much faster by emphasising low-fee “passive” funds. These are not only cheaper to run, because they follow indices, but on the equities side have tended to do better over the long run than most stock pickers.

Pimco remains deeply committed to active management. Ivascyn points out some of the investments he considers most promising are not included in the big indices. The group’s size and reputation mean that it gets first pick of large bond and loan sales, creating opportunities for differentiation. Its fees, like those of the rest of the industry, have come down in recent years, but not nearly as far as rivals.

To justify its premium product, Pimco has invested heavily in data and artificial intelligence to provide rigorous analysis of the company’s outcomes and potential biases. In a shift that shows how the industry is changing, it also started using passive management techniques to keep running costs down. At any given time, up to half its assets, those in areas where portfolio managers do not have strong convictions, may track an index, Ivascyn says.

Pimco’s public fixed income funds have typically outperformed the market, even after deducting the higher fees they charge — on average, over the past five years, they beat their category rivals by 0.44 per cent annually, according to Morningstar Direct. The flagship Income Fund does even better, outperforming by an average 1.73 per cent annually since 2014.

As persistently low rates squeezed bond yields in the last decade, Pimco also charged into what the leadership calls “adjacent” products that draw on its expertise in bonds and mortgages. These have included an extensive suite of “alternative” products including direct lending, aircraft leasing, real estate and pop song catalogues.

Aimed at institutions and very wealthy clients, these private funds allowed Pimco and its rivals to offer higher returns and earn bigger fees, boosting overall profit margins. By the end of last year, Pimco was running $144bn in alternatives, including a chunk of real estate assets that it manages for Allianz.

“I would have never come to Pimco in 2014. Like zero chance. Bill Gross was not into alternatives . . . and culturally there were challenges,” says Jamie Weinstein, who joined the company from KKR in 2019 on the alternatives side.

As head of corporate special situations, he is trying to build an alternatives business that leverages Pimco’s enormous presence in the public markets. “We are a major lender or have a relationship with a customer, competitor or supplier of almost everything we look at. That gives us a speed advantage,” he claims. “We can make a call faster. And I think we can make a call that is received on a friendly basis.”

The return of inflation

Pimco’s evolution is being sorely tested in the volatile markets of 2022. Inflation is rising and investors are not confident that central banks will be able to tame it without causing a severe recession. Bonds, once considered a hedge against falling equity markets, no longer look so reliable. The value of both higher-quality “investment-grade” bonds and riskier high-debt have started to drop. Money is flowing out of both mutual funds and ETFs, and Pimco is no exception. Its assets under management dropped 6 per cent in the first quarter, and Morningstar data shows that its funds, on average, have underperformed their peers so far this year.

That threatens to put an end to an extraordinary run that has seen total US bond fund assets, which reflect new money plus investment gains, almost quadruple to $6.4tn since 2007, far outpacing other types of funds.

While some seasoned investors such as Gross and Minerd believe the bond market has lost its verve others are more optimistic: they point out that as bond prices fall, their potential yield rises, making them more attractive to a host of new investors.

“In the short run, there is a lot of pain, bond prices have gone down and people are shocked. But in the big picture, this is the best thing to happen to bonds in a long time,” says Robert Tipp, chief investment strategist for fixed income at PGIM, a rival asset manager. “It should put bonds back on the map for asset allocation.”

In the years since the financial crisis, the big banks have sharply cut back their bond trading, and central banks are now starting to reduce their holdings as well. That means that the big asset managers now play a much more important role in determining where the market will go from here.

“In bonds, the marginal buyer will be the mega-bond funds. Many investors are shell-shocked and they are waiting for a sign. The bond funds will make the calls that matter,” says Steven Major, global head of fixed income research at HSBC. “They represent real money, not fast money.”

Indeed Pimco is already positioning to take advantage. Its managers are holding back on new investments in private debt, where values tend to be stickier, and starting to look at public markets where prices have been falling fast, Ivascyn says.

“We’re not diving into these opportunities, but there’s certainly a lot of relative value,” Ivascyn says. “We’ve had extreme macro uncertainty . . . [and] lots of potential for divergence on a global basis, across countries, across sectors and within sectors. That historically has been a good environment for active management.”

Comments