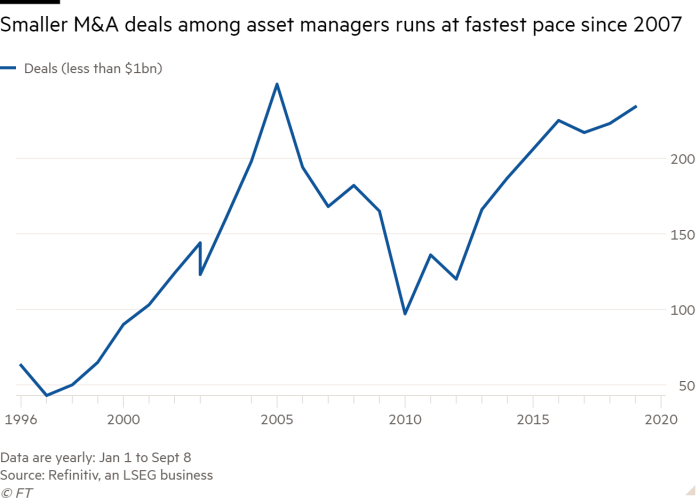

Hunt for small asset management deals hottest since 2007

Simply sign up to the Fund management myFT Digest -- delivered directly to your inbox.

Smaller deals between asset managers are running at the hottest pace in almost 15 years as businesses hunt for tactical acquisitions instead of bigger, riskier purchases — many of which have failed in one of the world’s most fragmented sectors.

The first nine months of this year have seen more deals worth less than $1bn between asset managers than at any point since 2007, according to data from Refinitiv. Those deals, which are meant to boost operating performance rather than reshape companies, are also up 5 per cent over the same period last year.

“We expect the trend of tactical, smaller M&A transactions will continue as asset managers look for ways to enhance their growth prospects,” said Michael Cyprys, analyst at Morgan Stanley.

Cyprys added that instead of trying to absorb a big rival, asset managers will look to buy in new products and new ways of reaching clients.

“While scale continues to be an important element of success in this sector, ultimately it is about having the right solutions,” said Janis Vitols, head of asset management investment banking at Bank of America.

Vitols added that several large asset managers have also been loath to buy in skills and departments they already possess, risking culture clashes and creating problems that consume huge amounts of management time.

Intense competition for new investors and a steady decline in fees have long driven bouts of deal activity across the sector. The asset management industry is dominated by a select group of titans, led by BlackRock, Vanguard and Fidelity. At the other end of the scale are smaller boutiques that prosper by targeting specific sectors.

In the middle sit a swath of asset managers that have to decide whether to seek scale through a big transformative deal or expand into new areas with a more tactical approach.

Asset managers have increasingly sought technology and new areas of growth to offset declining fees and cater to a retail investor boom. Hot areas include private markets for debt and real estate, and products that reference environment, social and corporate governance metrics. Another key trend is growing investor demand for greater customisation of portfolios and use of models to help them choose a mixture of equities and bonds.

“M&A activity has picked up and a number of deals this year have been focused on expanding the operating capabilities of asset managers,” said Jeff Stakel, a principal at Casey Quirk, a Deloitte-owned global asset management strategy consultant.

Stakel said the current push for mergers and acquisitions included extending geographic reach for asset managers, and bolt-on transitions through financial technology groups and boutiques that can augment and improve existing business models.

Among fintech-oriented deals in recent months, JPMorgan Chase bought OpenInvest, which helps financial advisers build ESG portfolios, and Campbell Global, a forest management and timberland investment company. In June JPMorgan also bought Nutmeg, a UK digital adviser, that valued the platform at £700m. Vanguard recently bought Just Invest, a small wealth manager that focuses on direct indexing which provides customised portfolios and is expected to grow rapidly in the next few years.

However, some larger deals have also cropped up. Earlier this year Wells Fargo sold its asset management arm in a $2.1bn transaction to private equity groups GTCR and Reverence Capital. Bank of Montreal sold its foreign asset management business in April to Ameriprise.

Comments