FTX Ventures buys 30% stake in Scaramucci’s SkyBridge Capital

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

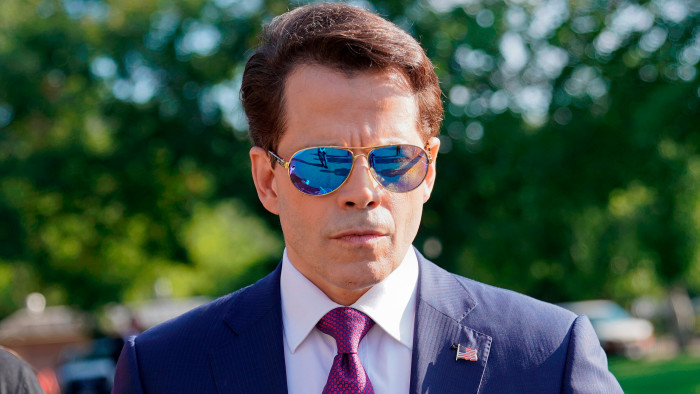

FTX Ventures, the investment firm led by billionaire Sam Bankman-Fried, will buy a 30 per cent stake in the fund of ex-Trump aide Anthony Scaramucci, as he continues his mission to try to bolster the struggling cryptocurrency market.

The financial terms of the deal have not been disclosed but Scaramucci’s SkyBridge Capital said it would use $40mn of the proceeds to buy cryptocurrencies, which it has agreed to hold as a long-term investment.

With the deal, Bankman-Fried will again step in as a financial backstop for companies afflicted by the crash in crypto markets.

SkyBridge has historically invested in hedge funds but Scaramucci, who briefly served as White House communications director under Donald Trump and later became a critic of the former president, has pivoted its business towards cryptocurrencies.

Recent upheaval in the crypto market, which included several businesses filing for bankruptcy and caused cryptocurrency prices to sink, has affected SkyBridge’s performance and prompted the firm to suspend redemptions in one of its funds. However, Scaramucci has remained optimistic about crypto’s prospects and encouraged investors to “stay disciplined” in an interview with CNBC.

News of the deal comes days ahead of Scaramucci’s annual Salt conference in New York City, for which Bankman-Fried is a sponsor and speaker. The two men earlier this year also founded and co-hosted Crypto Bahamas, a digital assets conference.

Bankman-Fried’s largest business, the FTX exchange, derives much of its revenue from trading fees and depends heavily on the health of the crypto market. The crash in token prices, which have fallen about 70 per cent from their peak last autumn, has provided dealmaking opportunities for stronger companies.

FTX extended a bailout to crypto lender BlockFi in July after the company suffered losses on its exposure to bankrupt crypto hedge fund Three Arrows Capital.

FTX also offered a $400mn credit facility to BlockFi in the deal, which included an option to buy the company for up to $240mn.

Bankman-Fried has also offered bailout loans to lender Voyager Digital, which later went bankrupt after the 30-year-old billionaire declined to provide additional support.

FTX held meetings about an emergency loan with Celsius, another major casualty of the crypto crash, but refused to extend a lifeline before the New Jersey-based lender suspended customer withdrawals and filed for bankruptcy.

Earlier this week, FTX announced a partnership with video game retailer GameStop to help the company, which was at the centre of the meme stock trading frenzy last year, with its push into the digital asset business.

Scaramucci previously likened Bankman-Fried’s interventions to the Gilded Age financier John Pierpont Morgan propping up the US banking system.

“Sam Bankman-Fried is the new John Pierpont Morgan — he is bailing out cryptocurrency markets the way the original J P Morgan did after the crisis of 1907,” he said in a June interview with Bloomberg.

Comments