High costs and renewables challenge the case for nuclear power

Simply sign up to the Energy sector myFT Digest -- delivered directly to your inbox.

The island of Anglesey, off the north-west coast of Wales, is famous for ancient sites and prehistoric ruins. If all goes to plan over the next few months, the island will make history again — this time as the scene of the next stage in the revival of the UK nuclear industry.

Britain has announced an outline agreement with Hitachi of Japan to build two reactors on the site. If a final deal is struck next year, the plant could be producing electricity by the mid-2020s.

The development, called Wylfa Newydd, would be only the second nuclear plant built in Britain for decades. Together with Hinkley Point C, the £20bn plant under construction in Somerset, in the south-west, by EDF of France, it would generate much-needed low-carbon electricity. They will help ensure the UK’s energy security as coal-fired power stations and ageing nuclear reactors close.

Their fate is also a wider test of the nuclear industry’s ability to compete at a time of rapid change in energy. The nuclear industry has been under threat since the disaster at the Fukushima plant in Japan in 2011 revived concerns about safety and prompted several developed countries, notably Germany, to phase out nuclear power.

The biggest danger to the industry however is that of spiralling costs. Given cheap and plentiful gas and the rise of renewable power whose costs are falling, many industry observers wonder how nuclear power can compete.

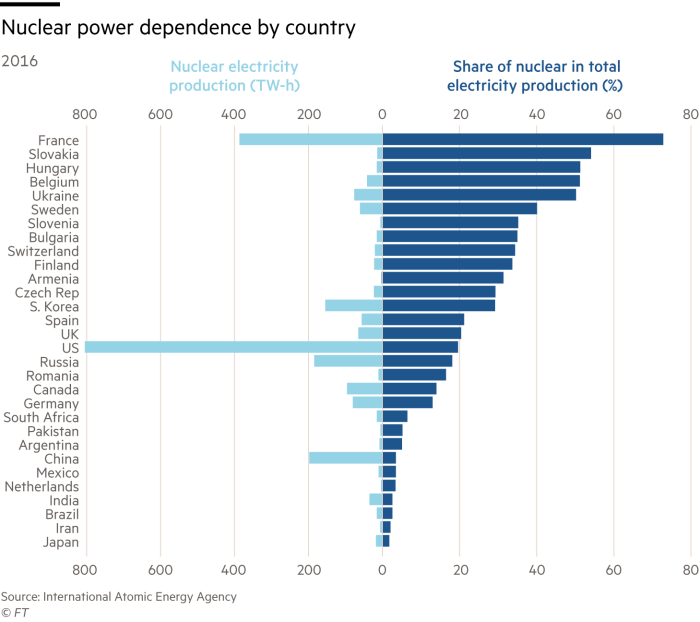

“We’ve seen a substantive decline in the share of nuclear of total electricity generation worldwide,” says Paul Dorfman, of the Energy Institute at University College London. “Increasing nuclear costs along with the technological advances and the plummeting price of renewables are the key dynamics, and there’s a clear trend emerging.”

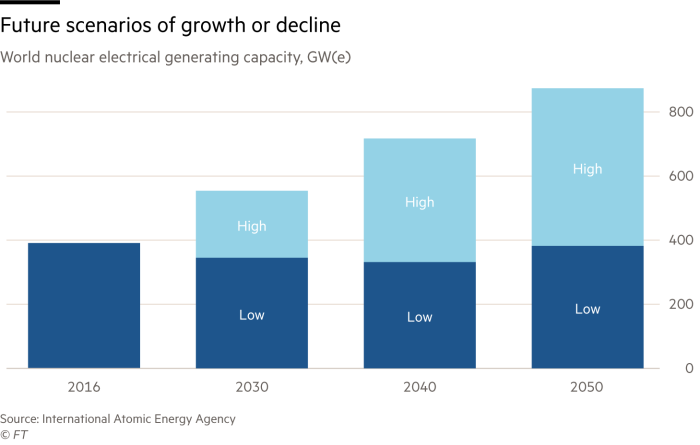

Since the 1950s, when the world’s first commercial nuclear power stations started operating, atomic power has increased its share of generating power. At the end of 2016, the 449 reactors in operation had a global generating capacity of 392GW, according to the International Atomic Energy Agency, the UN watchdog.

Yet as competition from gas, wind and solar has grown, nuclear’s share of global electricity generation has declined to 11 per cent from a peak of 17 per cent in the mid-1990s. In its Energy Outlook report published in February, BP forecast that renewable energy would be the fastest-growing source of energy by 2040.

The UK is one of the few developed countries planning further nuclear power plants. Russia has started building Turkey’s first new reactor as the country tries to reduce its reliance on energy imports. However, the majority of plants are being built in developing nations where energy demand is rising such as in China, India and some Middle East countries. Ten reactors were started up in 2016, of which half were in China where the government regards nuclear as a source of reliable low-carbon electricity as its economy shifts away from coal.

Rising costs remain the big challenge. A recent analysis of the history of reactors published in the journal Energy Policy concluded the following: nuclear power projects are more expensive than in the early 1980s; nuclear construction lead times have increased two-fold in the past 50 years; and the increase in complexity and risks of nuclear projects results in high financial costs.

“Nuclear projects are actually becoming more complex to carry out, inducing delays and higher costs,” says the study’s lead author, Joana Portugal Pereira, from the Centre for Environmental Policy at Imperial College London. “Safety and regulatory considerations play heavily into this, particularly in the wake of Fukushima.”

In western Europe, apart from Hinkley Point C, just two other plants are under construction: at Flamanville in France; and at Olkiluoto in Finland. Both involve the European Pressurized Reactor technology that will be used at Hinkley Point and both are running years late and over budget. In the US, the first two nuclear projects under way for the past 30 years are similarly over budget.

With the UK among the few western nations making a commitment to new reactors, the world is watching to see whether they can be competitive. The government’s decision to guarantee EDF a minimum price for electricity from Hinkley Point C of £92.50/MWh — linked to inflation and almost double the current wholesale price — has attracted severe criticism.

In the case of Wylfa Newydd, the government will consider attaching taxpayer funds to the construction of the site, but with the ambition of achieving a strike price for the electricity that will be about £15/MWh cheaper than for Hinkley.

Supporters of renewables point out that at about £77.50/MWh, this price is still higher than the £57.50/MWh allocated for UK offshore wind contracts last September. However, others point out the cost of new reactors will drop if identical units are built and if the technology designs are completed before construction begins. Some commentators argue that nuclear can still play a role in the future energy mix because it offers large-scale reliable power.

Simon Virley, partner and head of energy and natural resources at consultancy KPMG, argues that nuclear “can play an important role in providing the volume of low-carbon electricity we might need if we see widespread electrification of transport and heating — so long as the costs come down”.

Explore the rest of our stories on Energy Producers

- Solar and wind power surge marks production shift

- Big Oil harnesses power of data analysis to ensure survival

- Natural gas vies for role in low-carbon economy

- Coal fades in developed world but is far from dead in Asia

- Opinion: Forecasters have an awful record in predicting energy markets

Comments