Asset managers take aim at ‘unstable’ EU green fund rules

Simply sign up to the ESG investing myFT Digest -- delivered directly to your inbox.

Asset managers are complaining that new EU rules to classify sustainable investments are unworkable, prompting the European Commission to consider junking a key part of its flagship initiative for the €282bn market.

The tightening of EU criteria for the greenest category of investment has led asset managers including BNP Paribas, BlackRock, Amundi and Pictet to remove the label from €175bn (£154bn) of funds in just over three months to January, reducing the size of the market by nearly 40 per cent.

Several people familiar with discussions between EU officials and industry say the commission is now debating whether to scrap the category altogether, to quell fears of greenwashing and address the frustration of the market.

“They are considering getting rid of Article 9 entirely,” said a person in the talks with the commission, referring to the legislative name for the greenest category of investment. The person added that legal constraints meant Brussels could not give a “satisfactory answer” to questions by Esma, the EU’s securities regulator, about the uproar among investors.

While the commission cannot rewrite the underlying law itself, it could propose legislation for the EU to adopt after next year’s parliamentary elections.

The rules were first set out by the EU’s 2021 Sustainable Finance Disclosure Regulation, which asset managers rely on to identify their most environmentally friendly products, since broader bloc-wide rules on a new “taxonomy” of green investments are not yet fully implemented.

The EU and UK still lack official guidance about using ESG labels for funds.

Jean-Jacques Barbéris, director of ESG at Amundi, the largest European fund manager, said the bloc’s definition of “sustainable” was “highly unstable”. “There are [funds] that are super demanding on the one side and others that are a little ‘yoo-hoo, party time’ on the other . . . and everything in between,” he added.

Some buyers of Amundi funds have already told financial advisers to stop buying green investments because of confusion about what counts as sustainable, Barbéris added.

At present, the bloc’s definition refers to investments that contribute to an environmental or social objective, and “do no significant harm” to such goals.

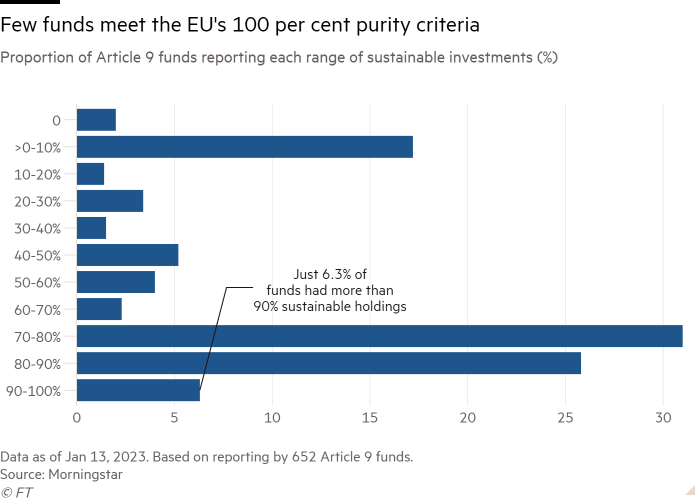

But the commission clarified its rules in January to require the greenest funds to hold 100 per cent “sustainable” investments — leading to the rebranding of asset managers’ funds. It could make this definition even more restrictive in a further clarification due next month.

Philippe Zaouati, chief executive of the French asset manager Mirova, added that he would have to ditch his group’s use of the Article 9 label entirely if Brussels opts for the strictest legal interpretation of “sustainability” because none of the firm’s funds would qualify.

Asset managers have felt compelled to relabel more funds and shuffle holdings in recent months, and to change the proportion of each fund they describe as “sustainable” in submissions to the EU.

Brussels’ reluctance to strictly define the word sustainable has created an atmosphere of “confusion and uproar”, the head of responsible investments at Nordea Asset Management, Eric Pederson, said. “Asset managers and the regulator and law firms [are] starting to get jittery and feeling unsure,” he added.

Industry players fear the situation could lead to mis-selling accusations against fund managers. The French financial regulator, the AMF, called on EU regulators last month to reform its disclosure rules to bring in clearer minimum standards and ensure Article 9 funds cannot include fossil fuel companies.

“Philosophically, it’s not easy”, said Hortense Bioy, head of sustainability research at Morningstar. “The EU’s end goal is to redirect capital towards sustainable activities, while combating greenwashing. But if the result is too complicated and everyone is confused, it might dampen appetite for these investments and defeat the whole point.”

The European Commission did not immediately respond to a request for comment.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

Comments