Wall Street braces itself for tax rises from Biden’s new stimulus plan

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

No sooner had President Joe Biden’s $1.9tn stimulus package passed than attention turned to his next big spending bill for infrastructure — and the tax rises that are likely to pay for it.

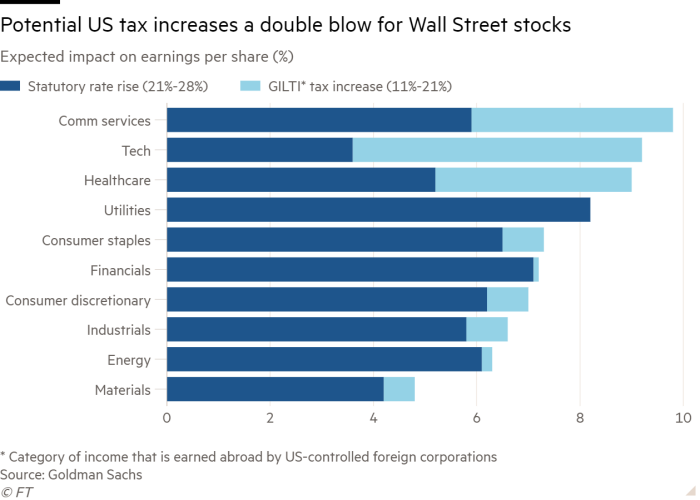

For equity markets, the corporate tax increases proposed by Democrats to fund the $2tn package could get quite costly quickly, according to analysts’ projections. Goldman Sachs calculated that Biden’s tax plan would knock 9 per cent off earnings per share for companies in the S&P 500 next year.

Under Biden’s plans, laid out last week, the US corporate tax rate would rise from 21 per cent to 28 per cent, a sharp reversal from the cuts rolled out during Donald Trump’s presidency. The proposal would also add a global minimum tax of 21 per cent, determined on a country-by-country basis, to target tax havens.

Communication services and information technology are likely to be among the biggest losers from the tax package, given the sectors’ exposure to higher taxes on foreign dealings. Goldman expects both to take about a 10 per cent hit on earnings next year owing to the jump in corporate and global tax rates alone. The bank’s estimates were based on a plan set forth during the presidential campaign, which included similar tax increases.

For tech groups in particular, higher taxes are another blow for a sector that, until recently, underpinned an unprecedented rally on Wall Street. Savita Subramanian, head of US equity & quantitative strategy at Bank of America, said tech shares have come under pressure this year from rising borrowing costs, which decrease the value of future cash flows that are heavily baked into the valuations of the sector’s high flyers.

“That suggests to me that these are areas of the markets that are more at risk than they have been for a while,” Subramanian noted.

So far, however, markets do not seem to have pencilled in tax rises, said Mike Mullaney, director of global markets research at Boston Partners.

“Taxes are going to go up,” Mullaney said. “We just don’t know the extent of what they’re going to look like yet.”

Comments