Credit Suisse chair re-elected after apology to investors at bank’s final AGM

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Credit Suisse chair Axel Lehmann has apologised to investors for the 167-year-old Swiss bank’s collapse at its final shareholder meeting as an independent business on Tuesday morning.

“It is a sad day. For all of you, and for us,” Lehmann told shareholders at the bank’s first in-person AGM in four years, held at a 15,000-capacity ice hockey stadium in a north Zurich suburb.

“The bitterness, anger and shock of all those who are disappointed, overwhelmed and affected by the developments of the past few weeks is palpable.”

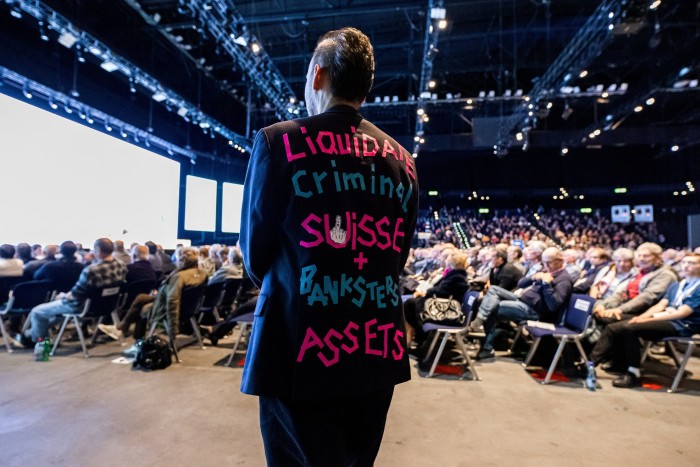

Credit Suisse executives had been braced for protests from Swiss citizens at the meeting after the bank was rescued by its rival UBS two weeks ago in a contentious takeover.

“For that I am truly sorry. I apologise that we were no longer able to stem the loss of trust that had accumulated over the years, and for disappointing you,” Lehmann said.

After Lehmann, who took over as chair a year ago, and chief executive Ulrich Körner’s introductory speeches, attendees were given the opportunity to ask questions and vent their frustration, a process that took several hours. The bank had been expecting up to 2,000 shareholders to attend the meeting.

In a tense series of shareholder votes, Lehmann was re-elected and all seven directors who had not stood down before the AGM had their mandates renewed, but none managed to get more than the 56 per cent support shown to the chair. Christian Gellerstad, who had been on the board for four years, received just 50.05 per cent support.

Proxy advisers had urged shareholders to vote against several members of the board, including Lehmann. Norway’s sovereign wealth fund, a top 10 independent shareholder, said it would vote against the majority of the board, including Lehmann.

The board needed all seven members to be voted through in order to adhere to its own rules after five directors stood down before the AGM began.

Credit Suisse also received a slender majority for its pay policy for the board and executive team, though it narrowly lost a vote on approving the fixed pay policy for the executive board.

At times the meeting turned fractious, with Lehmann asking shareholders to keep their time on the podium to a minimum, but these requests were ignored by some speakers and met with jeers from attendees.

Shareholders asked the board for a range of additional information on the circumstances around its $3.25bn takeover by UBS.

More than three-quarters of Swiss voters want the combined mega bank to be split up by new legislation, according to opinion polls.

“I understand that you feel disappointed, shocked or angry,” Körner told investors at the AGM. “I share the disappointment of you, our shareholders, but I also share the disappointment of all of our employees, our clients, and, ultimately, the general public.”

Körner added: “After 167 years Credit Suisse is giving up its independence.

“A proud and, at times, turbulent company history is drawing to an end and something new is being created.”

Shareholders of both UBS and Credit Suisse were denied a vote on the takeover thanks to emergency measures taken by the Swiss government to rush the deal through.

The first shareholder to speak at the event commented on the strict security measures put in place, which Lehmann said was to ensure attendees were protected.

“I didn’t bring my gun along today, don’t worry,” he told the Credit Suisse board.

“I am wearing my red tie today to represent that I and many other shareholders are seeing red.”

Shareholders also asked the bank to take a range of measures, from ending the financing of a liquefied natural gas project in Texas that has endangered a sacred indigenous burial ground to ceasing its legal action against finance blog Inside Paradeplatz.

Other shareholders proposed hiring a special auditor to assess the events leading up to Credit Suisse’s takeover, while a lawyer from Lausanne put forward a 10-point ethics code for UBS to adopt. Lehmann said he would pass them on to Sergio Ermotti, the incoming chief executive at UBS.

Among the more bizarre incidents of the meeting was a speaker who suggested the Credit Suisse board would have been crucified in medieval times, while another offered the board a bag of empty walnut shells, which he said cost the same as a single Credit Suisse share.

Lehmann said he would accept the gift, though he added that he had his own packet of nuts to keep him going through the meeting.

Comments