LNG tankers idle off Europe’s coast as traders wait for gas price rise

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

More than 30 tankers holding liquefied natural gas are floating just off Europe’s shoreline as energy traders bet the autumn price reprieve prompted by robust supplies and warm weather will prove to be fleeting.

The ships, which are hauling $2bn combined worth of LNG, are idling or sailing slowly around north-west Europe and the Iberian peninsula, according to shipping analytics company Vortexa. The number of LNG vessels on European waters has doubled in the past two months.

The traders who control the tankers are holding out for higher prices in the coming months, when temperatures cool over the winter and the glut of natural gas in Europe’s storage now begins to be drawn down. Another 30 vessels are on their way, currently crossing the Atlantic and expected to join the queue ahead of the winter, Vortexa data show.

The queue has come as European countries have filled their storage tanks to near their limits ahead of the winter. This has been achieved through voracious purchases of LNG to substitute for Russian gas that has been cut off in retaliation for western sanctions.

Higher than usual temperatures for this time of year have also reduced heating demand, helping keep storage sites full and prices falling. As of end of October, European storage sites were at 94 per cent capacity, with Belgium reaching 100 per cent, France 99 per cent, and Germany 98 per cent, according to Gas Infrastructure Europe.

It mirrors a similar situation in the oil industry during the height of the coronavirus crisis, when a glut of crude had led traders to park their oil on ships as floating storage, waiting for prices to rise again.

Similar actions have been seen in the LNG market before, one trader said, including in September last year when the price of European natural gas started to rise rapidly.

With gas storage capacities full, “LNG vessels have been queued up outside European LNG receiving terminals, chasing what they expected to be the premium market for this LNG,” said Felix Booth, head of LNG at Vortexa, adding that it will probably take another month for the cargoes to find a terminal to offload.

“For now these vessels have incentive to hold positions” in anticipation of higher prices as the weather gets colder, he said.

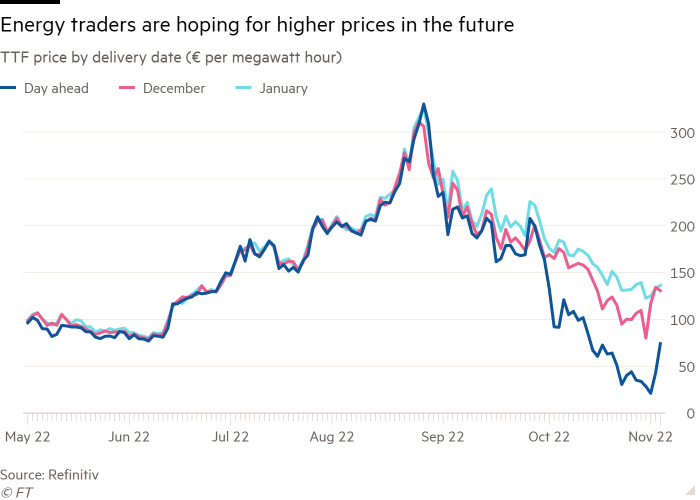

Dutch TTF gas futures, the benchmark European contract, have plummeted in recent months with milder than usual weather and the mostly full European storage weighing on prices. TTF contracts for delivery in November, which recently expired, were trading below €85 per megawatt hour ($24.2 per metric million British thermal unit), some 70 per cent lower than the peak in late August.

But the market is now in a situation known in the industry as “contango”, in which prices for delivery in the future are trading higher than for immediate delivery. TTF contracts for delivery in December are roughly 30 per cent higher than the level the November contract closed at, and January some 35 per cent higher, incentivising traders holding cargoes to deliver as late as possible.

The hold up of cargoes has led to a scarcity in available vessels, leading to higher freight prices that has made LNG further out of reach for Asian buyers, which have been competing with Europe for cargoes throughout the year.

The freight cost from the US Gulf Coast to north-east Asia was assessed at $478,000 a day and to north-west Europe at $468,000 a day at October 31, according to data provider Argus Media. Both are record highs and twice the price compared to a year ago.

Asia’s benchmark LNG price has often traded above the European price in recent weeks, which would be an incentive for traders to send their cargoes to Asia, but the tight LNG freight market has meant “few firms are even able to secure the additional shipping capacity to sell US or west African cargoes into north-east Asia instead of Europe, irrespective of the spread between European and north-east Asian delivered LNG prices,” said Samuel Good, head of LNG pricing at Argus Media.

“Firms have been seeking to push cargoes that would have been delivered to Europe in late November into early December” given the higher prices, and because fewer charter days are needed for trading into Europe compared to sending it to Asia, traders are finding it “easier to sort” cargoes by keeping them on European waters, he added.

Comments