Did institutional investors crash the crypto party?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Withnail and I’s drug dealer Danny knew exactly when the 1960s were over. “They’re selling hippie wigs in Woolworths, man. The greatest decade in the history of mankind is over,” he laments in the cult classic.

On Tuesday, Coinbase hailed the “secular tailwind of crypto adoption among institutions”. But in a week of malfunctioning stablecoins, unexpected bankruptcy chatter and widespread carnage, might that statement alone signal that the glory days for digital assets have well and truly passed?

From Morgan Stanley:

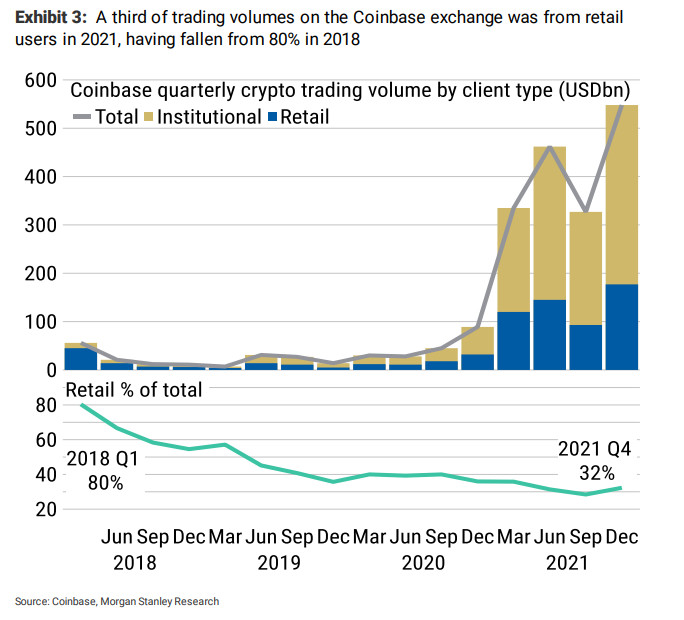

Retail investors are no longer the dominant crypto trader. The largest proportion of daily crypto trading volumes is from crypto institutions, much of which comes from them trading with each other. For example exchanges, custodians, and crypto funds. Retail traders were dominant around four years ago, when bitcoin traded below $10k. We think the increased involvement of institutions, which are sensitive to availability of capital and therefore interest rates, has contributed in part to the high correlation between bitcoin and equities

Chainanalysis very roughly estimates that institutional investors (anyone with more than $10mn to play with) accounted for 44 per cent of total crypto trading at the end of the second quarter of 2021, up from 8 per cent less than a year before.

Analysts at data provider VandaTrack point out that much of that interest centres on Bitcoin and Ethereum:

Client interest [is] concentrated more heavily onto the two main crypto assets, BTC and ETH. This matters because, as more institutions await the first results of the White House executive order on crypto regulation (early June) and the ETH merge to ETH 2.0 (late summer), current price behaviour will continue to be driven by TradFi assets (i.e. Tech). And as moves in rates are driving risky assets behaviour, BTC and ETH will remain strongly correlated, high-beta plays on TradFi in the near-term.

Bitcoin was meant to serve as a hedge against inflation, untethered from central bank policy. Alas, its seepage into the mainstream means it now behaves just like any other risky asset.

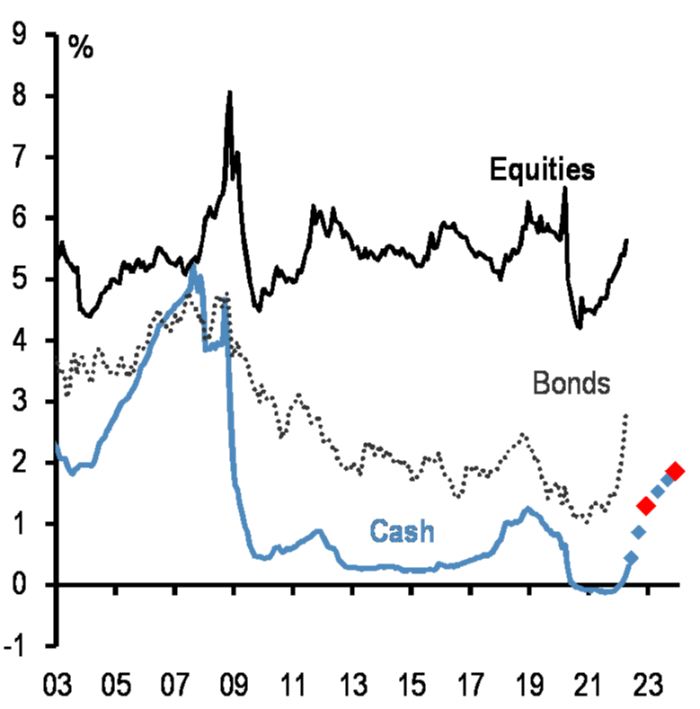

Interestingly, Morgan Stanley reckons that crypto is more sensitive to the money supply than changing interest rates. “Crypto prices rose in 2020 and 2021 due to central banks increasing fiat money supply,” the bank notes. “Now the Fed is tightening, crypto and equity markets are correcting lower.”

Annual growth in global money supply (M2) peaked in February 2021 and bitcoin’s market capitalisation growth peaked a month later in March 2021. The US Federal Reserve confirmed last week it will raise rates further and start to reduce the size of its balance sheet in June, which suggests the times of ample liquidity are truly over.

Speculative risky assets, like cryptocurrencies, have repriced lower as their higher prices (relative to 2019) had been justified by ample USD creation. The correlation between bitcoin and equity indices has remained high and will continue to do so unless bitcoin becomes widely used as a medium of payment - which looks unlikely to happen soon.

The section in bold implies that cryptocurrencies - and equities - might have further to fall once the Fed starts trimming its $9tn bond portfolio in June.

Analysts at JPMorgan estimated last week that bond yields have a further 200 basis points to rise before the equity risk premium declines to pre-Lehman crisis norms.

Bitcoin may be up at pixel time, but that doesn’t mean a floor has been established. Camberwell carrot, anyone?

Comments