‘Crash-protection mode’ helps managed futures ETFs crush rivals

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

With equities, bonds and real estate all underwater this year, most exchange traded fund investors are nursing sharp losses.

One small corner of the ETF world has delivered decent returns, though, despite — or maybe because of — the red ink elsewhere.

Managed futures funds take both long and short positions in futures contracts linked to equities, bonds, commodities and currencies, potentially allowing them to make money even when markets fall — as long as there is a clear trend for them to follow.

And this year there certainly has been with the iMGP DBi Managed Futures Strategy ETF (DBMF), by far the largest such fund with assets of $925mn, currently having short exposure to virtually every asset it tracks.

“Managed futures funds are in crash protection mode — as bearishly positioned as any time during the past decade and a half. They’re betting the chaos continues,” said Andrew Beer, co-manager of the fund.

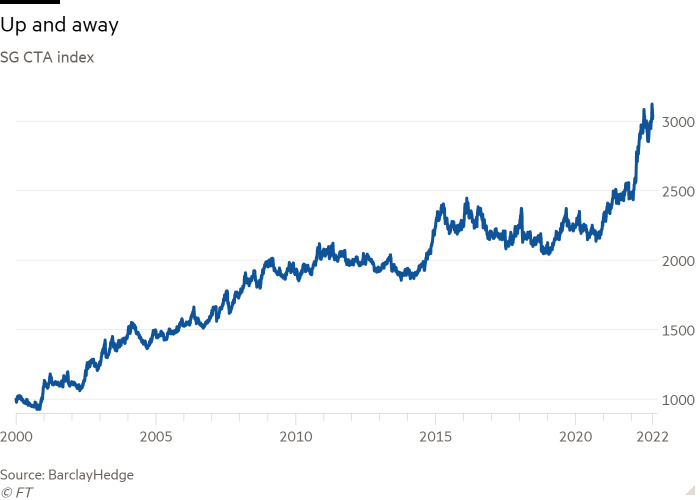

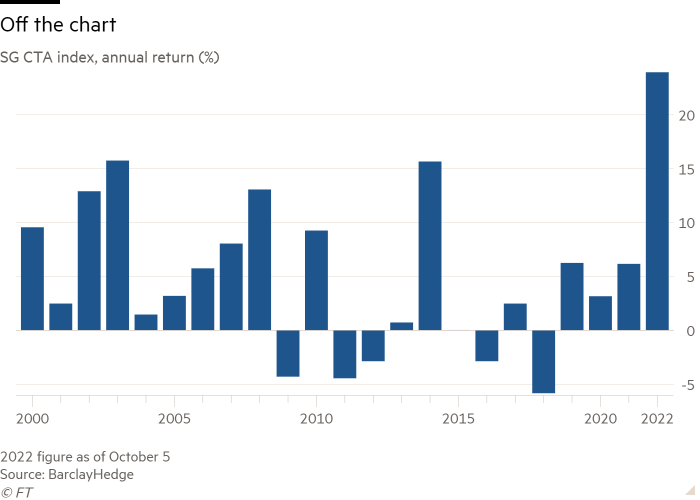

So far this year DBMF is up 30.3 per cent, broadly in line with the 24 per cent gain of the Société Générale CTA index, which tracks the performance of trend-following “quant” hedge funds known as commodity trading advisers.

In such a difficult year for markets — just 6 per cent of the 2,754 ETFs listed in the US have delivered positive returns so far this year according to Aniket Ullal, head of ETF data and analytics at CFRA Research — these gains have fuelled inflows. A lot of inflows: DBMF began the year with just $60mn to its name.

“[Managed futures ETFs] are crushing it this year,” said Todd Rosenbluth, head of research at VettaFi. “They are doing what they intended to do, which is to perform differently to the broad market and to offer an alternative to traditional equity and bond ETFs.”

The strategy has been particularly in vogue this year because bonds, the traditional counterweight to equities in a broad-based portfolio, have also plunged.

“There is a case that you need to diversify your diversifier,” said Bryan Armour, director of passive strategies research, North America, at Morningstar.

“A lot of people use bonds to step up when stocks are down, but it’s not always going to work, as 2022 has shown. The more uncorrelated assets you can hold the better.”

DBMF is typical of ETFs in the sector in that it is attempting to replicate the average return of 20 CTAs run by houses such as Man Group’s AHL unit, AQR Capital Management and CFM — but with a lower minimum investment, “lower fees [85 basis points], better liquidity and maybe better downside risk”, said Beer.

“We have outperformed all 20 [underlying CTAs] on a net of fees basis,” he added. “We outperform in the smartest and most old-fashioned way: we are cheaper.”

Beer analyses daily performance data for the 20 funds. This is compared to the performance of a portfolio of the 10 large futures contracts that Beer said “make a difference” such as gold, crude oil, the yen, the euro, two and 10-year Treasuries and the S&P 500.

DBMF’s algorithm then attempts to determine the CTAs’ positioning in the 10 key contracts and replicate it, rebalancing weekly.

“It’s returns-based style analysis,” he said. “We pick up their big shifts in the portfolio. Managed futures is a shockingly simple strategy,” while being a little late is not too important as “nobody is front-running the 10-year Treasury [contract], it’s so liquid.”

Managed futures funds have been out of favour for much of the post-global financial crisis period as equities and bonds rose largely in unison, obviating the need for a more complex, diversified approach.

Despite this, the approach still has its supporters.

Armour analysed the period from 2000 to August of this year. He found that a 60/20/10/10 portfolio of equities, bonds, managed futures and gold beat a traditional 60/40 equity/bond portfolio by 52 basis points a year annualised, as well as outperforming on a risk-adjusted basis, even factoring in the higher fees levied by managed futures vehicles. The maximum drawdown was also lower.

“Portfolios that diversify beyond bonds don’t completely protect investors from bear markets, but they can turn into winning strategies over the long haul,” Armour said. “Dry spells should run shorter and shallower when diversifying diversifiers, which should pay off in the long run.”

Rosenbluth largely agreed, but with a caveat. “There is a role for these products within a portfolio during volatile markets, but it should be a slice of a satellite portion. If we get a recovery in traditional markets this strategy is likely to lag behind,” he said.

As for now, DBMF is positioned at extreme bearish levels, akin to the depths of the global financial crisis.

Earlier in the year long crude oil was a moneymaker, but the fund now has a solitary long position, in S&P 500 futures, worth just 1.5 per cent of the portfolio. It is swimming in a sea of shorts, particularly in US Treasury bonds and bills, the euro, yen and developed market equities outside the US.

Unlike a more evangelical investor such as Ark Invest’s Cathie Wood, Beer said the quant funds he endeavoured to mimic were not wedded to their positions, however, and could change them in a flash.

“They believe we are in the middle of a colossal regime change [the rising dollar], but when it stops working they are going to get out,” he said. “They are not Cathie Wood. They are cold and dispassionate.”

Click here to visit the ETF Hub

Comments