China GDP grows 6.7% in second quarter on boost from infrastructure

Simply sign up to the Property sector myFT Digest -- delivered directly to your inbox.

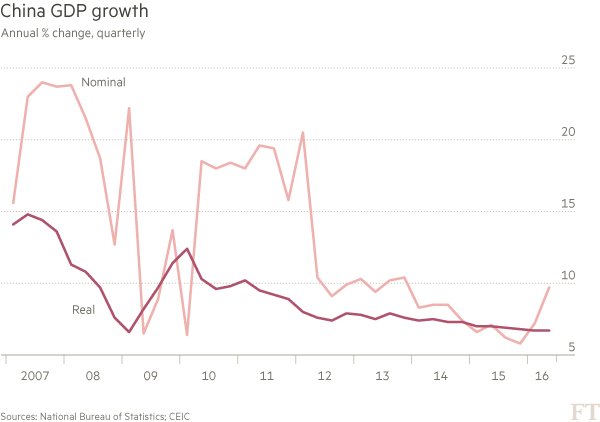

China’s economy grew 6.7 per cent in the second quarter, unchanged from the previous three-month period, as a buoyant property market and government stimulus boosted demand for factory output.

The latest quarterly real growth figure is slightly ahead of the 6.6 per cent pace that economists expected, according to a Reuters poll. China’s legislature approved a full-year growth target of 6.5 to 7 per cent for 2016. China’s economy grew 6.9 per cent in 2015.

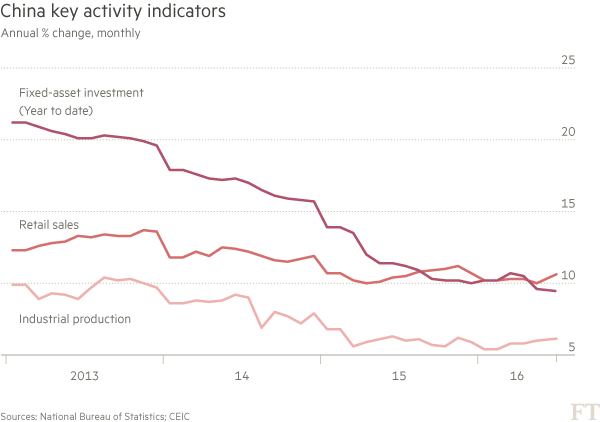

Yet downward pressure on the economy remains significant. Fixed-asset investment — which includes both infrastructure and manufacturing investment — grew at 9 per cent, its slowest pace since 2000 in the first six months and down from 9.6 per cent in the year to May.

“Growth has stabilised, and we also see that the structure is improving. Investment growth is coming down, which is a correction for the over-investment of the past seven years,” said Zhu Haibin, chief China economist at JPMorgan in Hong Kong. “But investment growth is much stronger in new sectors such as high tech and infrastructure. In the overcapacity sectors like steel and coal mining, we see negative growth.”

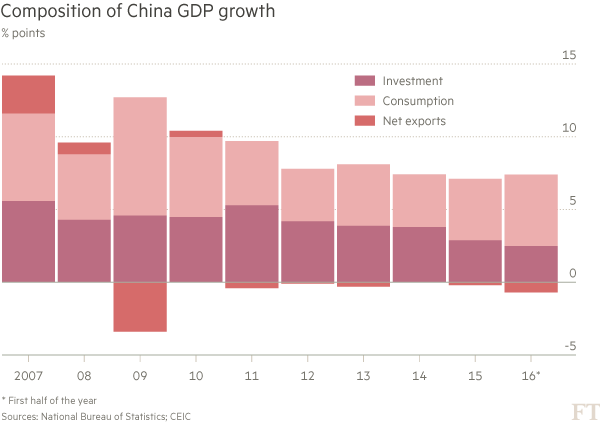

China’s economy is in the midst of a wrenching transition from a growth model based on construction and heavy industry towards greater reliance on consumption and services.

In a sign of progress towards rebalancing, investment contributed only 2.5 percentage points to GDP growth in the first half, down from 2.9 points last year, while the consumption contribution rose from 4.2 points to 4.9 points. Net exports subtracted 0.7 points.

Monthly data also showed good news for consumption. Retail sales grew 10.6 per cent in June from a year earlier, the fastest pace since December and ahead of expectations of 10 per cent. The figures will help allay concerns the investment slowdown will spread to consumption through declining growth in household income.

But China’s industrial economy continues to suffer from rampant overcapacity and deflation. Mining grew 0.1 per cent in the first half, while electricity, heat and water production grew 2.6 per cent.

Facing a bleak demand outlook, privately owned manufacturers have cut spending on new factories, contributing to the sharp slowdown in fixed investment. But a surge in infrastructure investment by state-owned enterprises has taken up the slack, supporting demand for commodities such as steel, copper and cement.

“The most important data point in today’s release is private investment, which accounts for 62 per cent of total investment but continues to see zero growth in June.” Larry Hu, China economist at Macquarie Securities. “Whether private investment can turn round in the coming months is the key to the Chinese economy in the second half.”

An acceleration in real estate investment helped stabilise overall investment in the second quarter, but there are signs that the property rally is starting to fade. Property sales, construction starts, and investment all slowed in June after rising in April and May.

Separate data from the central bank on Friday showed that Chinese banks issued Rmb1.3tn in new loans in June, a sign that policymakers continue to prioritise short-term support for growth over tackling China’s debt load. New credit from all sources totalled is 10.8 per cent ahead of last year’s pace through the first six months of the year. The International Monetary Fund warned last month that China’s corporate debt was a “serious and growing problem that must be addressed immediately”.

Global investors remain broadly pessimistic about China, but fear of a hard landing and spillovers to the global economy have eased since falls in China’s stock market and currency sent global markets into a tailspin in January.

The renminbi weakened 3 per cent in the second quarter, its second-worst three-month run to date. But unlike in January, investors have reacted with indifference. China’s main stock index on Friday traded within half a percentage points of the three-month high touched on Wednesday.

“The second quarter data are another sign that the global financial turmoil emanating from China in early 2016 was a false alarm, and that the ‘stopped clock’ forecasts of doom from congenital pessimists are, at least for now, incorrect.” Bill Adams, senior international economist at PNC Financial Services, wrote on Friday.

Twitter: @gabewildau

Comments