Investors in UK government bonds suffer worst quarter for two decades

Simply sign up to the Sovereign bonds myFT Digest -- delivered directly to your inbox.

Holders of UK government bonds are suffering the worst quarter in at least two decades as Britain’s economic prospects brighten, setting a contrast with the eurozone where a more sputtering recovery from the coronavirus crisis is helping haven assets hold their value.

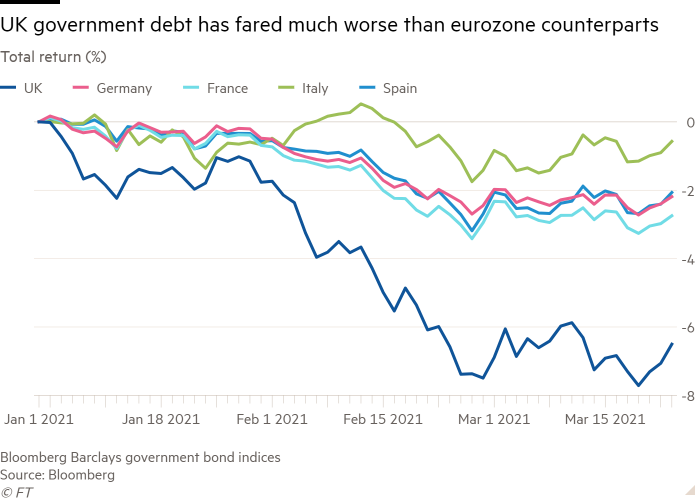

Global bond markets have struggled broadly in the first three months of 2021, with US Treasuries at the centre of the market storm. But the selling has also been severe in UK debt, which has tumbled 6.5 per cent on a total return basis, on track for the worst performance on records stretching to 2000, according to a Bloomberg Barclays index.

Debts issued by Germany, France, Italy and Spain — the biggest eurozone economies — have fared better, with losses ranging from 0.5 per cent to 3 per cent.

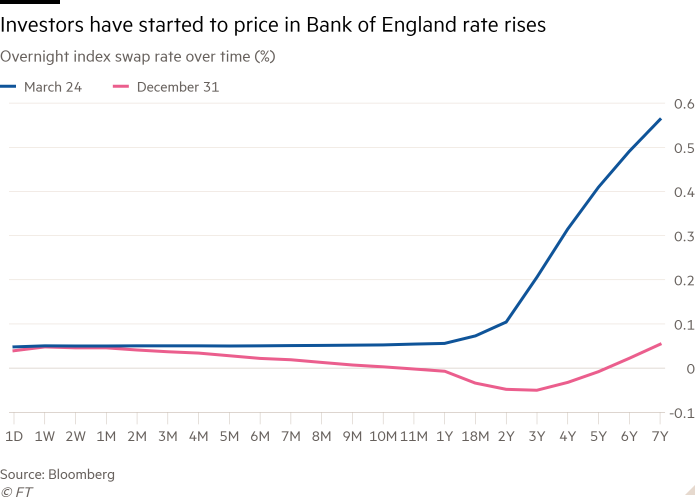

The drop in the price of UK debt has come as the swift rollout of coronavirus vaccines has given investors more confidence in the route to economic recovery. Traders have unwound expectations that the Bank of England will need to cut its main policy rate below zero and the narrative has shifted to focus on when policymakers will need to raise rates from historic lows if more rapid growth leads to stronger inflation.

It marks a stark contrast to last year, when the debt of many countries rose in tandem as central banks around the world flooded the market with unprecedented stimulus measures at the height of the pandemic.

“The gilt strength of 2020 is over. This is the market to be short as a global investor,” said Theo Chapsalis, head of UK rates strategy at NatWest Markets, referring to betting against the debt. “We have a strong backdrop for a correction in gilts yields and for gilts to underperform [German] Bunds.”

Analysts are expecting a further spell of poor performance for gilts as the reflation trade led by US bonds has further to run, while Europe faces a different trajectory on the back of economic uncertainty and more central bank intervention.

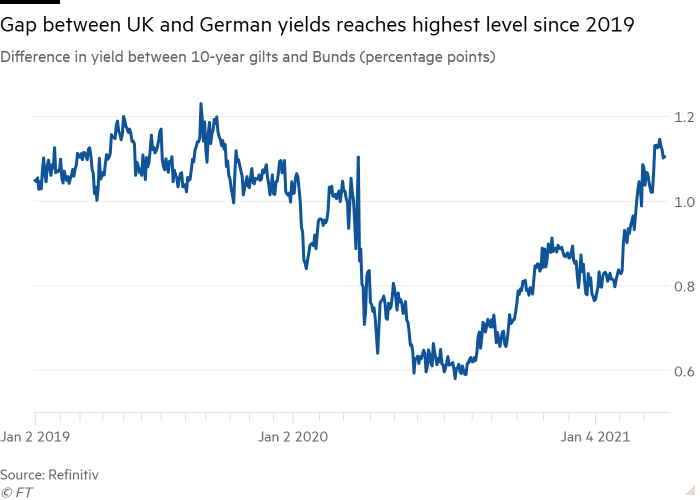

The benchmark 10-year gilt yield has increased 0.56 percentage points this quarter to 0.76 per cent, the flip side of sliding prices. This has pushed the gap between yields on gilts and Bunds to the widest since the autumn of 2019 at about 1.1 percentage points.

German Bunds and other eurozone bonds have been bolstered by the European Central Bank, which stepped up this month to support the eurozone debt market in an attempt to ward off a rise in borrowing costs against the backdrop of a slower recovery in Europe.

Facing the darker outlook, the ECB quickened its bond purchases to hold down the rise in yields, which the central bank’s president Christine Lagarde said could “translate into a premature tightening of financing conditions for all sectors of the economy”.

The BoE meanwhile followed in the footsteps of the US Federal Reserve, keeping its policy levers unmoved and upgrading its growth forecasts. Andrew Bailey, BoE governor, said last week that the rise in gilt yields is consistent with the “change in the economic outlook”.

Demand for gilts has weakened since January as investors concluded that negative rates are not on the cards for the UK, and reckoned with a flood of debt supply from heavy government borrowing. The resolution of the Brexit process removed another support for gilts from investors looking for a safeguard against uncertainty.

“Safe-haven demand is easing out of gilts before it is easing out of some eurozone markets,” said John Wraith, head of UK rates strategy at UBS.

Some investors expect reflation to play out differently in the EU where the economic prospects are more uncertain. Several countries including France, Italy and Germany have recently had to tighten lockdown rules to contain a third wave of infections and the EU has suffered from vaccination delays.

“Europe is already on a different path,” said Frédérique Carrier, head of investment strategy at RBC Wealth Management. The EU’s fiscal stimulus is smaller in relation to its economy than the UK, she added, and will be a “slow drip” over five years beginning later this year.

A rocky period for gilts is likely to be a more supportive for sterling and other UK assets, if the economic recovery keeps up with expectations. “There’s a lot of rebound left in the UK economy which equates to higher sterling and higher yields,” said Jim Caron, portfolio manager at Morgan Stanley Investment Management.

But investors may be too caught up in the enthusiasm around stronger economic prospects, said Mike Riddell, a portfolio manager at Allianz Global Investors. He points to a sharp rise in market-based inflation expectations as an indication that investors are pricing in a high level of optimism about growth.

The rosy economic picture is vulnerable to shocks, which could come from snags in the vaccination programme, new Covid-19 variants or a subpar global growth, analysts have noted.

“I would say we are priced for something close to a best-case scenario over the coming months,” Wraith said.

Comments