Opposition shadows Cerberus windfall from Albertsons supermarket deal

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Broadening scrutiny of a US supermarket megamerger is standing in the way of billions in additional profits from what has already been a highly lucrative investment for a group led by Cerberus Capital Management.

The Cerberus group has earned $4bn from its stakes in Albertsons, the supermarket chain that last month agreed to sell itself to rival Kroger. Completing the $24.6bn sale would yield another $12bn in cash payouts, according to Financial Times calculations.

The deal to create a nationwide chain of nearly 5,000 stores is now encountering pushback from labour unions and some national and state politicians who warn it will lead to higher grocery prices, closed stores and job cuts.

Last week a Washington state court blocked a $4bn special dividend to Albertsons shareholders including Cerberus, at least until a court hearing scheduled for Thursday.

“Paying out $4bn before regulators can do their job and review the proposed merger will weaken Albertsons’ ability to continue business operations and compete,” said Bob Ferguson, the Washington state attorney-general.

If the dividend is allowed and the deal does close, it will cap an extraordinarily rich investment for New York-based Cerberus, a low-profile private equity group founded by billionaire Stephen Feinberg.

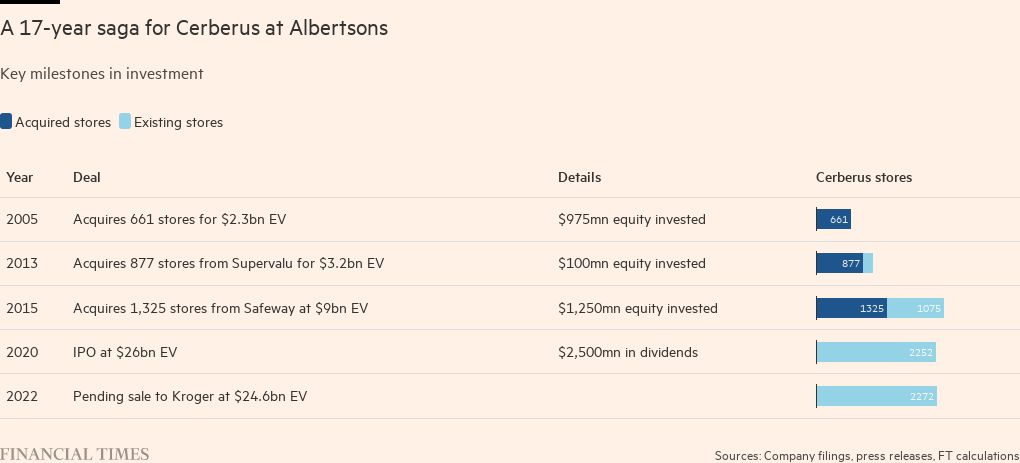

Cerberus, which specialises in distressed assets, made its first transaction involving Albertsons in 2005 alongside a group of specialist property buyout groups. Cerberus remains the retailer’s largest shareholder with a 28 per cent stake.

The Cerberus group bought 655 stores being cast off by Supervalu, a food wholesaler that was buying Albertsons at the time. It contributed $350mn for the stores and paid a separate $625mn as compensation for assuming certain liabilities.

The investor group quickly earned four times its original equity investment through dividends and sales of assets. The divestitures included more than 400 stores sold to rival chains such as Publix, according to a person familiar with Cerberus’s returns.

Cerberus deepened its involvement with Albertsons in 2013 when Supervalu, struggling under the debt it took on to fund the earlier transaction, was forced to sell most of its stores. Cerberus, by then an experienced supermarket operator, quickly pounced. It purchased 877 stores for just $100mn in cash along with the assumption of $3.2bn of liabilities.

The group took its biggest swing in 2015 when Albertsons swallowed supermarket chain Safeway and its 1,325 stores for nearly $10bn. Cerberus only needed to contribute $1.25bn in equity to the highly leveraged deal, financing the rest with debt. Albertsons ultimately squeezed out $1bn of annual cost savings, a figure well ahead of what it had initially estimated.

Cash also flowed in from Albertsons’ property portfolio as the company sold stores to investors who then leased them back. In December 2017, for example, Albertsons-Safeway sold the real estate for 71 of its stores for $720mn to an affiliate of another private equity firm, Fortress Investment Group.

“Real estate played a major part,” said an investor in the sale-leaseback deal. “Early on, it gave us a lot of cash. Then it gave us a financing base whenever we needed it . . . It gave us great downside protection. We always knew we could access it if we needed it.”

One of the investors in the Cerberus group is Kimco Realty. The publicly listed group has disclosed that up to 2017 it invested roughly $200mn in various Albertsons deals and had received cash distributions of $300mn. Since the Albertsons sale to Kroger was announced in mid-October, Kimco liquidated a quarter of its shareholding for another $300mn. Its remaining stake in Albertsons will be cashed out at roughly $1bn should the Kroger deal close.

The ballooning size of the Albertsons business has complicated Cerberus’s ability to cleanly exit its investment. The investor group had in 2018 tried to list Albertsons through a reverse merger with Rite Aid, the pharmacy chain, but the deal collapsed when Rite Aid shareholders objected. Albertsons finally listed its shares in 2020.

That initial public offering proved to be another gusher of cash, giving the Cerberus group $800mn. Albertsons additionally funded a $1.75bn dividend to the group by selling convertible preferred stock to Apollo Global Management that was secured by a portfolio of stores.

“Cerberus’s investment in Albertsons is an example of how private equity can generate superb returns by building and transforming businesses,” said Gustavo Schwed, a former executive at Providence Equity and now at New York University. “Through a patient strategy of store expansion, acquisitions and the prudent use of leverage, Cerberus, together with management, has created one of the largest grocery chains in the US.”

Others question how Cerberus made its fortune. “The Albertsons deal is among Cerberus’s most outrageous stunts — all under the guise of legality and legitimate shareholder value maximisation. Cerberus will get the lion’s share. Others, the scraps. Workers and communities, who knows?” said Rosemary Batt, a professor at Cornell University who is a critic of the private equity industry.

The $12bn the Cerberus group would be paid out of the Kroger deal includes its share of the special dividend held up by the Washington state court. The total interim payouts earned since 2005 are $4bn, according to FT calculations.

The full $16bn sum would constitute a return of seven times on $2.3bn invested over 16 years.

While the Washington state case is pending, a federal judge in Washington, DC on Tuesday separately declined to grant a temporary restraining order halting the special dividend that had been requested by the District of Columbia and two states. Albertsons has called the Washington state case “meritless”.

Apart from court disputes over the dividend, members of Congress are asking regulators to block the Kroger combination. The deal “could exacerbate existing antitrust, labour, and price-gouging issues in the grocery sector and further raise prices for vulnerable Americans”, US senators Bernie Sanders and Elizabeth Warren wrote in a letter to the US Federal Trade Commission.

“The transaction is certain to receive close and prolonged scrutiny by the FTC and a variety of state antitrust authorities,” said William Kovacic, a law professor at George Washington University.

Albertsons has insisted Americans will be better off if the deal is finished and that unlike grocery rivals Amazon and Walmart, Kroger will have a unionised labour force. Cerberus and Albertsons declined to comment for this article.

The grocery chain has maintained that it has primarily spent yearly cash flow cutting debt from its balance sheet. As such, Albertsons has said it will still have $500mn in cash and $2.5bn of borrowing capacity after the dividend is paid with manageable debt ratios.

If the deal closes as planned, Albertsons shareholders would also receive shares in a new spun-off company of roughly 300 stores to be divested to ease competition concerns. Industry insiders said that Cerberus, after profiting from Albertsons, could use these properties as building blocks for another grocery empire.

Comments