What happened to the ‘too big to fail’ banks?

Simply sign up to the US & Canadian companies myFT Digest -- delivered directly to your inbox.

One of the lessons of the crisis that began in 2007 was that banks proved “too big to fail”. Fears of systemic collapse pushed governments into bailing out hundreds of financial institutions around the world. So it is ironic that the world’s biggest banks have got bigger, not smaller, in the decade since.

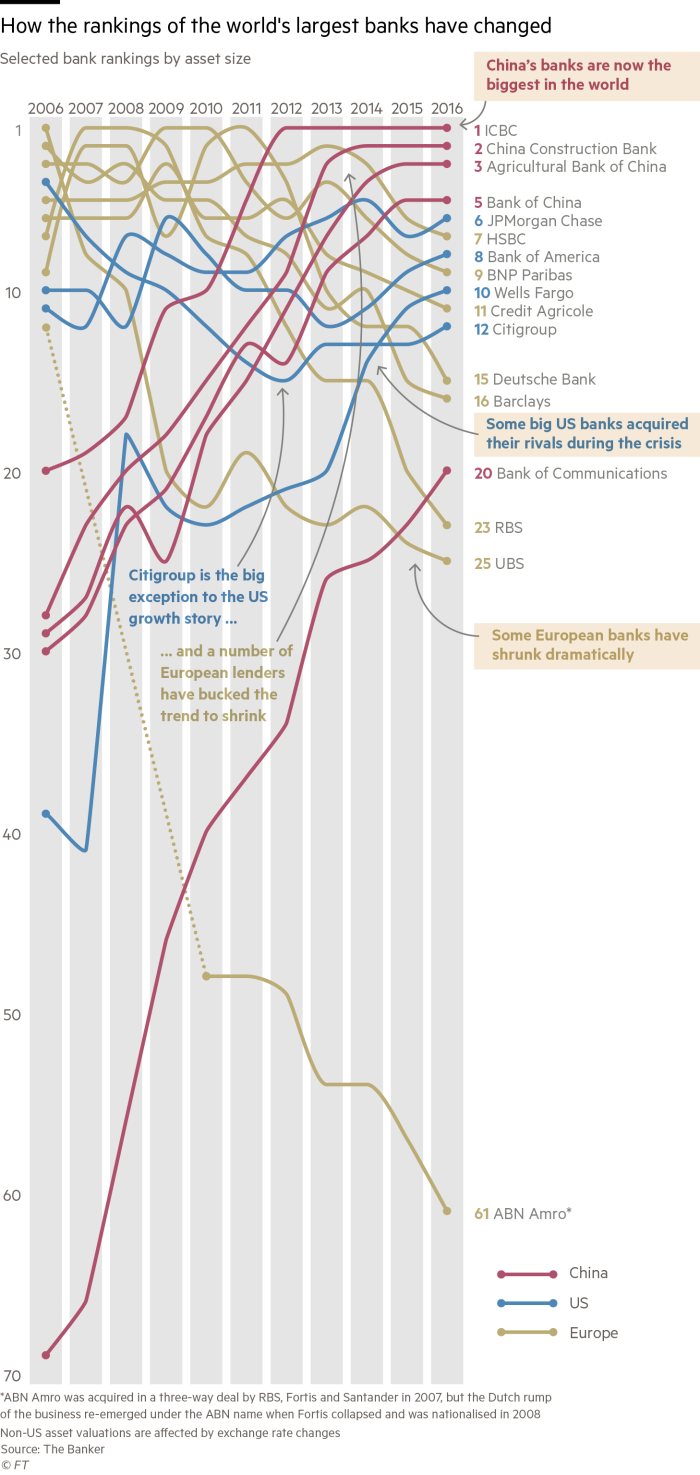

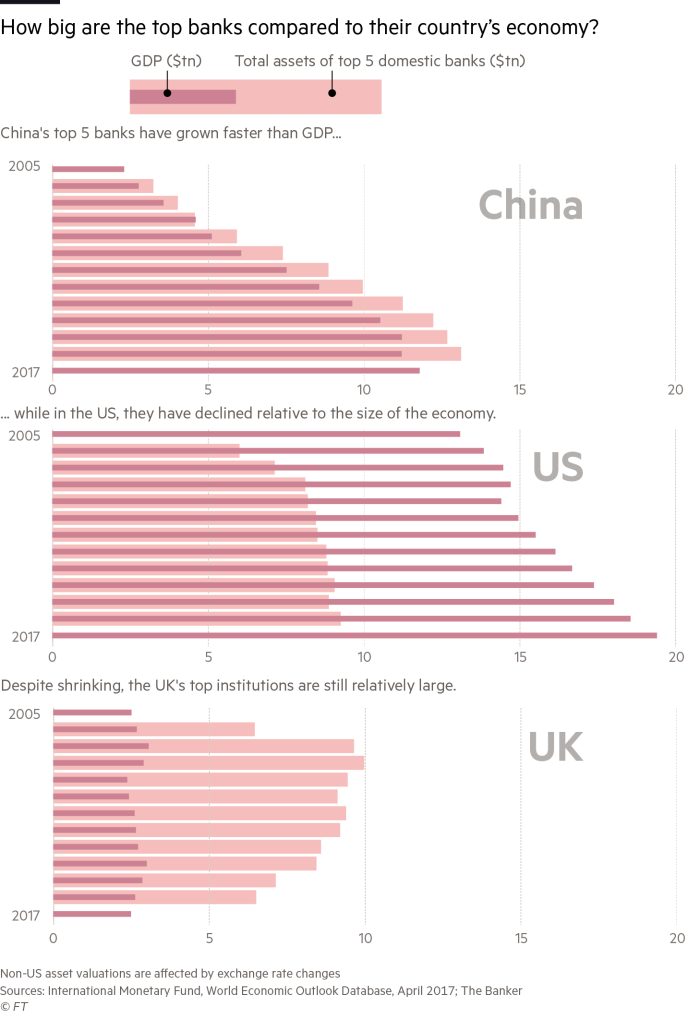

That is true of US institutions, such as JPMorgan Chase and Bank of America which grew in large part because of their rescue of troubled rivals. Many of Europe’s banks have shrunk dramatically — including Barclays and Royal Bank of Scotland, which both held the title of world’s biggest bank in the mid-2000s — but there are some surprising exceptions, such as troubled German lender Deutsche Bank.

Meanwhile, in emerging markets, notably China, balance sheets have ballooned. Measured by total assets, China’s four big banks are now among the top five in the world.

Are the largest banks still “too big to fail” after the regulatory reforms of the past decade? Share your thoughts in the comments below.

Comments