Seven & i chief faces restructuring reality

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When Ryuichi Isaka took over as chief executive of Seven & i in May and promised a revival plan in 100 days, he appeared to be in a sweet spot, having won the backing of US activist Daniel Loeb and survived a nasty boardroom spat.

But five months on, Mr Isaka faces the difficult task of delivering the turnround of a sprawling conglomerate that has pursued an expansion policy in a shrinking and ageing market.

“It is true that our merger and acquisition strategy has not delivered the sufficient returns for our investors,” Mr Isaka said in his first strategy briefing on Thursday.

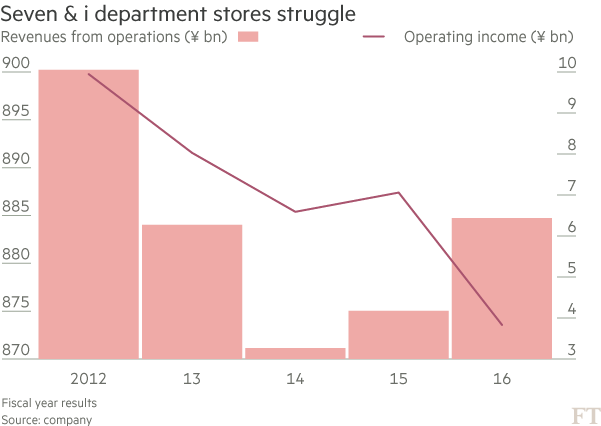

As part of his plan, the retailer behind the 7-Eleven convenience store chain, said it would divest some of its struggling department stores in the western part of Japan to rival H20 Retailing and focus its resources in the main Tokyo area. By overhauling its businesses, the group aims to increase operating profit more than one-quarter to ¥450bn ($4.3bn) by the 2019-20 fiscal year.

“I had expected more closure of stores, but this H20 deal is a well-considered move that may have a more immediate impact to plug losses at department stores,” said Naoki Fujiwara, fund manager at Shinkin Asset Management. “But there are still so many more challenges.”

The landscape for Japan’s retail industry has darkened over the past five months as consumer spending has failed to pick up and spending by Chinese tourists has slowed.

Department store sales across the country have fallen for six straight months. Among the main department store operators, J. Front Retailing cut its net profit target 9 per cent this week while rival Isetan Mitsukoshi promised to close two more domestic stores last month. Japanese retail group Aeon also reported a loss for the fiscal first half.

Seven & i’s previous management, including Toshifumi Suzuki, the 83-year-old chairman who had overseen the group for nearly 25 years, had already announced plans to close 40 unprofitable Ito-Yokado supermarket stores over the next five years and two department stores.

But investors including Mr Loeb, who disclosed his stake in the retailer last year, had criticised the measures as insufficient. They want to break the company of its habit of shielding underperforming businesses, including the struggling Ito-Yokado supermarket stores, which have also been a drag on the company’s earnings. Analysts say Mr Suzuki had resisted a drastic overhaul of the business despite repeated promises of closure of struggling branches.

The activist investors have pinned their hopes on Mr Isaka, the former president of its core 7-Eleven Japan unit, the division that has long been the steady engine of growth for Seven & i, accounting for 88 per cent of its operating profit in the first six months of the current fiscal year.

He, in turn, has promised a more open corporate culture where problems can be laid out in the open. This was seen as a sharp change from Mr Suzuki, a charismatic but dogmatic leader who had almost single-handedly built the world’s biggest convenience store chain.

Mr Suzuki’s abrupt resignation in April came after he failed to win the board’s backing to remove Mr Isaka. The decision was touted as a boost for Prime Minister Shinzo Abe’s campaign to improve corporate governance. The ousting attempt by Mr Suzuki came under fire from the group’s founding family members and external directors, who had backed Mr Isaka because of his role in strengthening the convenience store operations.

Ahead of the announcement, Yoshiyuki Namiki, and SMBC Nikko analyst, suggested investors would be convinced of real change if Mr Isaka outlined plans not only to shutter Ito-Yokado stores but also to carry out plans to offer early retirement to reduce personnel costs. Such steps were not announced on Thursday.

Once the problematic businesses are addressed, Mr Isaka faces a stickier challenge: charting a strategy to maintain the convenience store units in a shrinking home market. The group also needs to capture overseas growth particularly in the US.

In the past fiscal year, the operating profit for its 7-Eleven business grew 30 per cent year-on-year in local currency terms, while profits for Japanese operations grew 5 per cent.

“For its convenience store business, no one is yet sure of how Seven & i will build a new business model to overcome market saturation so that’s where Mr Isaka comes into play,” Mr Namiki said.

Comments