Billions flow to nascent US battery sector with push from climate law

Simply sign up to the Electric vehicles myFT Digest -- delivered directly to your inbox.

For much of the past century, a small corner of North Carolina supplied the vast majority of the world’s lithium before cheaper competition from abroad took away its crown.

Investment is now flowing back into the region. Chemicals group Livent this week completed an expansion of a lithium hydroxide refinery in Bessemer City, North Carolina. The project increased US production capacity for first time in more than a decade of the compound used in lithium-ion batteries that power electric vehicles.

Lithium is not the only part of the battery supply chain on the receiving end of an impending influx of investment. As the US looks to build an EV ecosystem from the ground up and dislodge control of the market from China, money is pouring into everything from graphite plants and cobalt refineries to battery gigafactories.

Companies are positioning themselves to supply an EV market set to boom, with US sales predicted to more than double to almost 2.5mn vehicles by 2025, according to consultancy Rho Motion. President Joe Biden wants half of all vehicle sales in the US to be electric by 2030.

“You don’t need to be brave or ambitious to say: ‘We will play a role in that future growth’,” said Paul Graves, chief executive of Livent.

Biden has thrown the weight of the government behind the buildout of the US battery supply chain as he looks to achieve a triple goal of combating climate change, boosting manufacturing jobs and reducing reliance on China, which dominates the market.

In August he signed the country’s biggest-ever piece of climate legislation. The Inflation Reduction Act will provide lucrative tax incentives to companies that develop mines, processing facilities, battery plants and EV factories in the US.

The law has turbocharged interest in US battery supplies, with companies committing about $13.5bn worth of investments since it was enacted compared to $7.5bn in the three months before, according to Benchmark Mineral Intelligence. Analysts at Cowen estimate more than $91bn will be pumped into the country’s battery industry in the coming decade as a result of the legislation.

“Whereas people were considering domestic manufacturing for a variety of reasons before, the credits now make it a potentially more attractive place than any other,” said Sarah Morgan, co-head of the M&A and capital markets practice at law firm Vinson and Elkins.

The government has also taken other steps to foster EV battery development. Under the Bipartisan Infrastructure Law, which passed last year, the US handed out $2.8bn of grants to about 20 companies to support construction of everything from lithium refineries to graphite production plants. The government projects this will draw total investment of $9bn when combined with private sector funds.

Among the recipients were chemicals groups Solvay and Orbia, which plan to construct a $850mn polyvinylidene fluoride plant in Georgia by 2026. The material will be used as a lithium-ion binder and separator coating in batteries, giving the US another link in the complex EV supply chain.

“The time has come for the US,” Solvay chief executive Ilham Kadri told the Financial Times. She added that the US has been far more aggressive than Europe in supporting a local battery supply chain. “Geopolitically, the difference is they support manufacturing and localising it.”

Biden has framed his green push as a way of tackling climate change, creating domestic jobs and also competing with China, the dominant player in the global battery supply chain today.

China is home to more than half of the world’s lithium, cobalt and graphite refining capacity. In battery parts, it has 75 per cent of cathode capacity, 85 per cent of anode capacity and 73 per cent of cell manufacturing capacity, according to analysts at Cowen.

“By undercutting US manufacturers with their unfair subsidies and trade practices, China seized a significant portion of the market,” Biden said last month. “Today, we’re stepping up to take it back [with] bold goals and actions to make sure we’re back in the game in a big way.”

To reduce US dependency on China for cobalt, project developer EVelution Energy is building a $150-200mn refinery in Arizona that can meet 40 per cent of the needs of domestic EV production by 2027 and will be supplied with feedstock by global commodity trading house Trafigura.

Socrates Economou, head of nickel and cobalt trading at Trafigura, said that the $7.5bn of funding in the Inflation Reduction Act for tax credits, equivalent to 1mn EVs at the full subsidy of $7,500 a car, sends a powerful message to auto companies and their suppliers — but any tangible impact would take time.

“As an initial statement, the IRA underlines what America’s target is. It will reward supply or refined product that doesn’t pass through Russia or China. We will see much more refining capacity coming online in the West but it can’t happen within two or three years.”

The law’s raw material and component domestic sourcing rules have sparked trade tensions with ally South Korea as well as the EU, which has argued that the tax credits violate World Trade Organization rules.

Some argue the sheer force of demand would have drawn money to the sector even without government support. “A lot of the investment decisions were made four years ago,” said Graves at Livent. “I think they predate efforts by the US government to get involved.”

The US is forecast to have around 920 gigawatt hours of annual battery manufacturing capacity by 2031, the year the IRA tax credits are set to expire, according to Cowen. European gigafactories are on track for a total capacity of 1,186 GWh by that time. But China is still set to dominate the space, with 5,153 GWh of capacity.

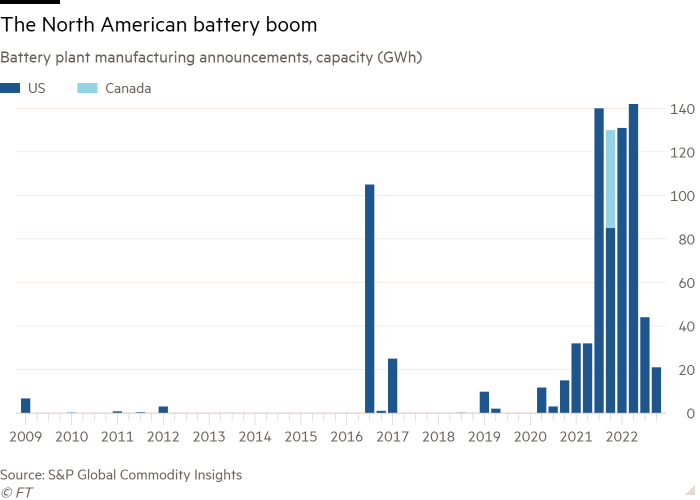

There has been 338 GWh of new US battery manufacturing capacity announced this year alone, according to data from S&P Global Commodity Insights, more than the past four years combined.

By passing the IRA and infrastructure act, “the Biden administration has basically seized the bull by the horns”, said Sanjiv Malhotra, chief executive of Sparkz, which is building a battery plant in rural West Virginia that will hire coal miners displaced as use of the fossil fuel declines.

“There is a race going on in terms of electric mobility . . . and if the US is to have a leadership position, it only has the next three to five years to establish it. If we are going to continue to depend on China for batteries, I think they basically can kiss it goodbye.”

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

Comments