‘Buy the haystack’ approach still hard to beat

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Interested in ETFs?

Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs.

Vanguard founder Jack Bogle may have recommended that we “buy the haystack”, by holding a passive fund tracking a major stock market index. But some investors in exchange traded funds prefer a more targeted approach.

And, smart beta — which involves tracking indices built around a metric other than a company’s market capitalisation — can offer them a variety of options. From ETFs that buy companies with high dividend yields to those targeting a specific investment factor, such as value or quality, there are many ways to seek an edge.

However, as with any focused investment approach, smart beta can be found wanting in the wrong market conditions. Yield-oriented funds, such as the iShares UK Dividend UCITS ETF (IUKD), have flourished this year, but only after a painful 2020. Smart beta approaches that give equal weighting to every stock, meanwhile, have at times struggled in markets commonly dominated by outperforming large-cap stocks.

Similarly unpredictable outcomes have been generated by factor-based ETFs. The fierce recovery in cyclical stocks that took hold from November last year has seen value funds — focused on stocks that are cheap relative to their fundamental value — surge ahead of their rivals.

In the 11 months since the Covid-19 vaccine breakthrough of November 2020, the iShares Edge MSCI USA Value Factor UCITS ETF (IUVF) has posted a total return of 25 per cent in sterling, putting it five percentage points ahead of an MSCI USA ETF (CU1) offered by the same provider. It is also ahead of funds from the same product range that focus on quality and momentum factors. But, at other times, the value fund has often underperformed.

Further shortcomings have also emerged. The iShares Edge MSCI USA Momentum Factor UCITS ETF (IUMF), which buys shares with an upwards price trend, only rebalances its portfolio every six months. This meant that it missed part of the cyclical rally before belatedly increasing its value exposure in mid-2021.

If individual funds have these shortcomings, is it instead worth mixing and matching? Investors with an enthusiasm for factor investing could attempt to capture a variety of investment styles in a portfolio — something offered by a handful of multi-factor funds. Several options exist: while the iShares funds mentioned have a multi-factor equivalent, JPMorgan and others also offer such products.

Hector McNeil, co-chief executive of ETF provider HANetf, argues that multi-factor products can have a place in portfolios, especially when different investment styles are fighting for dominance. He says: “Ideally, you’d choose a lowly correlated subset that should help during regime changes (when unloved investment styles or parts of the market come into favour and previously dominant parts lag), which are notoriously difficult to predict.”

Briegel Leitao, associate analyst for passive strategies at Morningstar, the data provider, adds that such funds can “potentially extend and be more consistent in their outperformance when one factor picks up the performance of another factor that has perhaps gone out of style”.

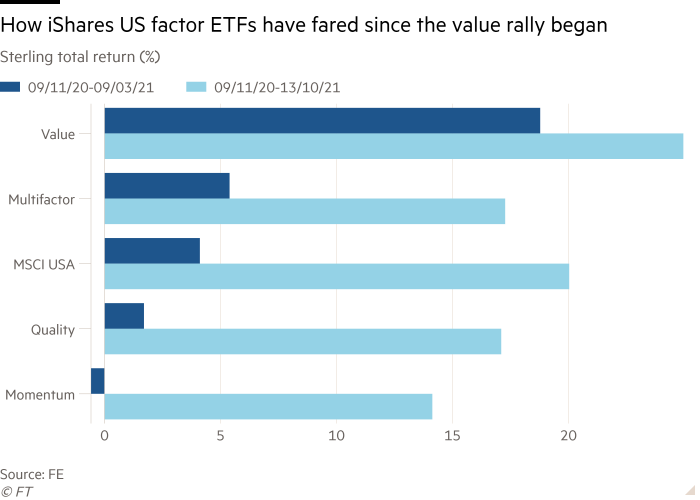

Recent performance of the iShares fund range partly bears this out (see chart). Looking at sterling total returns in the six months from early November 2020, the US value ETF led the pack with an 18.8 per cent return. The US multi-factor fund delivered a return of 5.4 per cent, but outpaced the quality and momentum funds from the same range, also beating a conventional MSCI USA ETF.

A similar pattern can be seen from November 2020 to October 2021: the multi-factor fund comes out slightly ahead of its quality and momentum-oriented peers, but it lags both the MSCI USA ETF and the value fund.

Most of the funds in this product range lack a sufficiently long record for meaningful comparison, though — and history has been unkind to multi-factor funds in other respects. McNeil says they have largely failed to capture the attention of investors, perhaps because they would rather make their own investment style decisions. Tellingly, the iShares US multi-factor fund is much smaller in value than the single-factor offerings in the same range.

There is also a risk of over-diversification. Matt Brennan, head of investment management at AJ Bell, a UK investment platform, says some factors can work against each other, with losses from one offsetting gains from another. Value stocks can do less well if a momentum strategy is performing strongly, for example. “You end up paying a higher fee, but the factors often offset each other,” he warns.

More generally, Brennan remains sceptical about the rationale for following some factors, and says you should only invest if there are sound reasons for outperformance. His choice would be standard ETFs for a broad market exposure, with sector or single-factor funds to add a “tilt”.

True to Bogle’s words, the haystack approach remains hard to beat.

Click here to visit the ETF Hub

Comments