Europe’s energy crisis gives boost to green hydrogen

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Is it finally lift-off for green hydrogen?

The combustible gas plays a vital role in a wide range of industrial processes. Most dramatically deployed as a rocket fuel, hydrogen is more typically used to produce ammonia, a crucial ingredient in fertiliser, and to remove sulphur in oil refining. Around 80 per cent of the gas produced is used in this way. Other applications include manufacturing plastics, explosives, textiles, pesticides and dyes.

But current production of the gas is also almost entirely dependent on fossil fuels. The Paris-based International Energy Agency calculates that it accounts for 6 per cent of global natural gas and 2 per cent of global coal consumption.

As a result, the IEA says, hydrogen production pumps out about 830mn tonnes of carbon dioxide per year — equivalent to the CO₂ emissions of the UK and Indonesia combined.

However, many governments and policymakers are now putting their faith in hydrogen to help them achieve net zero greenhouse gas emissions by 2050 — believing the way it is produced and deployed can be transformed. If they are right, hydrogen could play an essential role in decarbonising manufacturing and displacing fossil fuels in transport and power generation.

Ambitions for transforming hydrogen into a clean fuel and chemical stock will depend on the rapid building out of electrolysers, though. They separate water — a compound of hydrogen and oxygen — into its constituent elements. And ensuring that the electrical power used in the separation is derived from renewable sources, rather than fossil fuels, will be essential to adopting truly “green” hydrogen.

The financial commitment required to achieve this is “enormous”, according to Kofi Mbuk, senior cleantech analyst at London-based think-tank Carbon Tracker. But recent geopolitical events have helped heighten interest in alternatives to fossil fuels.

“There has been a dramatic change in the price of [conventional] hydrogen sparked by the invasion of Ukraine by Russia,” says Mbuk. Whatever the outcome of the conflict, he adds, the result will be greater interest in expanding renewable energy sources, including green hydrogen.

He calculates that roughly $73bn has been committed globally to produce green hydrogen since the start of the conflict. At current prices, hydrogen derived from clean power sources will be cheaper to produce in Europe than hydrogen from more polluting alternatives, he argues.

In the US, President Joe Biden’s Inflation Reduction Act, passed in August, also provides billions of dollars to expand green hydrogen production, boosting its economic competitiveness against natural gas.

The legislation provides a long-term subsidy that will drive down supply costs compared with “grey” hydrogen derived from natural gas, meaning “investors could generate very healthy returns and rapidly scale up production in the US market”, Mbuk says.

Plug Power, a US supplier of green hydrogen, is among those looking to take advantage of an anticipated turn in the market. Days after the signing of the legislation, it announced a supply deal with Amazon from 2025, aimed at helping the US retailing giant hit its net zero carbon commitments by 2040.

It is also planning to build an electrolyser and liquefaction plant in Belgium, as part of a deal struck in June with the regional Flanders government. This will be capable of supplying 12,500 tonnes a year of liquid and gaseous green hydrogen to the European market by 2025,

At the time, Andy Marsh, Plug chief executive, said: “The energy crisis in Europe resulting from geopolitical risks has accelerated the demand for green hydrogen development projects.”

EU policymakers are keen to make Europe a hub for green hydrogen technology and production. In May, the trading bloc declared its ambition to produce 10mn tonnes and import a further 10mn tonnes of renewable hydrogen each year by 2030.

Then, in September, Ursula von der Leyen, president of the European Commission, unveiled plans for a European Hydrogen Bank that could deliver a further €3bn in development funds to the sector.

“Hydrogen can be a game changer for Europe,” she said. “It is key in diversifying our energy sources . . . We need to bring this niche market to scale.”

A particular EU focus will be to accelerate the uptake of green hydrogen and ammonia in hard-to-decarbonise sectors, such as heavy transport and energy-intensive manufacturing.

Mbuk welcomes these commitments but notes that work needs to be done to ensure the electricity supplied for electrolysing water is genuinely derived from renewable or low-carbon sources.

Locating electrolysers next to wind turbines or solar arrays makes sense for some projects — particularly where there is a suitable customer nearby. If this is not possible, contracts will need to guarantee that renewable electricity is used in production. Otherwise, the result can be “yellow” hydrogen, which still depends in part on the burning of fossil fuels.

Green hydrogen could also have an important part to play in storing intermittent renewable energy as battery technology develops. But Mbuk argues that it may not be an appropriate energy source if direct electrical power is available. In particular, inefficiencies of electrolysation and concerns over its use in water-stressed environments could limit its growth.

Up to 35 per cent of energy can be lost in the electrolysing process. “It makes no sense to use hydrogen to produce electricity when you don’t have to,” he says.

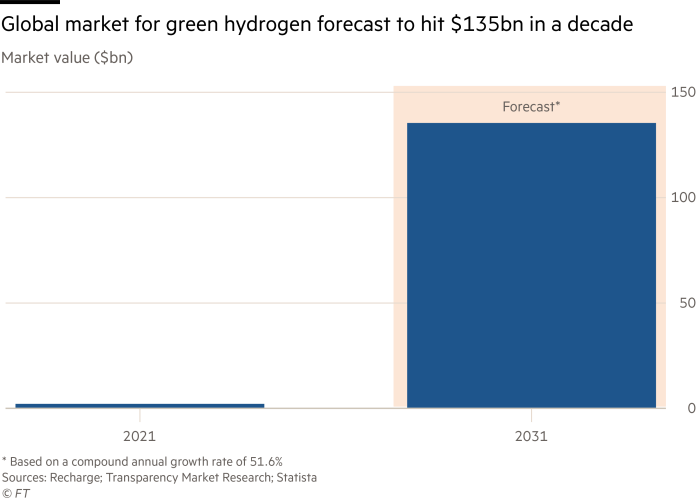

Progress in expanding green hydrogen production capacity has been slow to date, the IEA reports.

Less than 1mn tonnes of low-emission hydrogen was produced in 2021. That is about 1 per cent of world demand, which rebounded to 94mn tonnes following recovery from the Covid-19 pandemic. Most of this low-carbon hydrogen was “blue” — derived from fossil fuels but abated by carbon capture, utilisation and storage, rather than from electrolysers powered by renewable energy.

However, an IEA report in September suggested that, based on current trends and scaling up of manufacture, the cost of electrolysers could fall by 70 per cent compared with today. That, combined with cheaper renewable energy, could fire up demand for green hydrogen.

It also predicted that, based on all projects in the pipeline, by 2030 the production of low-emission hydrogen could expand to reach 16mn-24mn tonnes per year, with some 9mn-14mn tonnes of this based on electrolysis.

That would not be enough to overturn hydrogen’s status as a significant source of greenhouse gas emissions by the turn of the decade. But it would at least reduce its carbon footprint by a meaningful fraction.

The colours of the hydrogen rainbow

Green hydrogen Made by using clean electricity from renewable energy sources to electrolyse water (H₂O), separating the hydrogen atoms from the oxygen they are coupled to. Currently expensive but costs are falling.

Blue hydrogen Produced using natural gas but with carbon emissions being captured and stored or reused. Negligible amounts in production because of a lack of carbon capture projects.

Grey hydrogen The most common form of hydrogen production, it involves reacting natural gas with steam — so called steam methane reformation — but without capturing the resulting carbon emissions. Costs have risen this year following global disruption to natural gas supplies.

Brown hydrogen The cheapest way to make hydrogen but also the most environmentally damaging because of the use of thermal coal in the production process.

Pink/purple hydrogen Made using nuclear energy to power the electrolysis.

Turquoise hydrogen Uses a process called methane pyrolysis to produce hydrogen and solid carbon. Not proven at scale. Concerns around methane leakage.

Yellow hydrogen Made from a mixture of renewable energy and fossil fuels.

Comments